A January To Remember • Jobs Week • Earnings Ahead

Summary

- U.S. equity markets posted broad-based gains Monday - but still ended a historically volatile January with its worst performance since March 2020 -ahead of a busy week of employment data.

- Posting its 10th straight session with intra-day moves of over 1%, the S&P 500 rallied 1.8% today while the tech-heavy Nasdaq 100 gained more than 3% for a second-straight session.

- Real estate equities were broadly higher as well with the Equity REIT Index finishing higher by 1.3% with 18-of-19 property sectors in positive-territory while the Mortgage REIT Index rallied nearly 3%.

- Healthcare REIT Diversified Healthcare (DHC) rallied 5% after announcing that it entered into a $703M joint-venture for 10 properties in DHC's Office Portfolio segment with two global institutional investors.

- Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets posted broad-based gains Monday - but still ended a historically volatile January with its worst performance since March 2020 -ahead of a busy week of employment data and earnings report. Posting its 10th straight session with intra-day moves of over 1%, the S&P 500 rallied 1.8% today while the tech-heavy Nasdaq 100 gained more than 3% for a second-straight session while Mid-Caps and Small-Caps each gained 2%. Real estate equities were broadly higher as well with the Equity REIT Index finishing higher by 1.3% with 18-of-19 property sectors in positive territory while the Mortgage REIT Index rallied nearly 3%.

As discussed in our Real Estate Weekly Outlook, the start of corporate earnings season has partially eased recent investor jitters about rising interest rates, geopolitical tensions, and persistent inflation. For the month, ten of the eleven GICS equity sectors finished lower with Consumer Discretionary (XLY) and Real Estate (XLRE) dragging on the downside while Energy (XLE) delivered gains of nearly 20% on the month. Homebuilders and the broader Hoya Capital Housing Index were among the upside standouts today ahead of a busy week of earnings reports from residential REITs and homebuilders.

Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 200k in January following the second-straight month of weaker-than-expected employment growth of 199k in December and for the unemployment rate to remain at 3.9%. We'll also see Construction Spending and JOLTs Job Openings data on Tuesday, and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Equity REIT Daily Recap

Last week, we published REIT Earnings Preview: Dividend Hikes And 2022 Outlook. Real estate earnings season kicks off this week, and REITs enter fourth-quarter earnings season at an interesting crossroads, having been the best-performing asset class of 2021, but also one of the weakest through the first three weeks of 2022. REIT property-level fundamentals remain on an upward trajectory and we expect another strong quarter from residential REITs, in particular, as recent data indicates that rents continue to soar by double-digit rates. We'll see more than a dozen reports this coming week including results this afternoon from PotlatchDeltic (PCH) and Kilroy (KRC).

Billboard: Today, we published Billboard REITs: Under-The-Radar Inflation Hedge as an exclusive report for Income Builder members. In your face, but still under the radar? Billboard REITs own a commanding share of the nation's 500,000 outdoor advertising displays - a surprisingly resilient business with strong inflation-hedging attributes. Unlike other increasingly-cluttered digital formats, there's "only one channel" on the highway. These REITs are well-positioned to capture the steadily rising share of marketing spending towards Out-of-Home ("OOH") advertising displays. We discuss our updated outlook and how we're allocating to the sector in our report linked here.

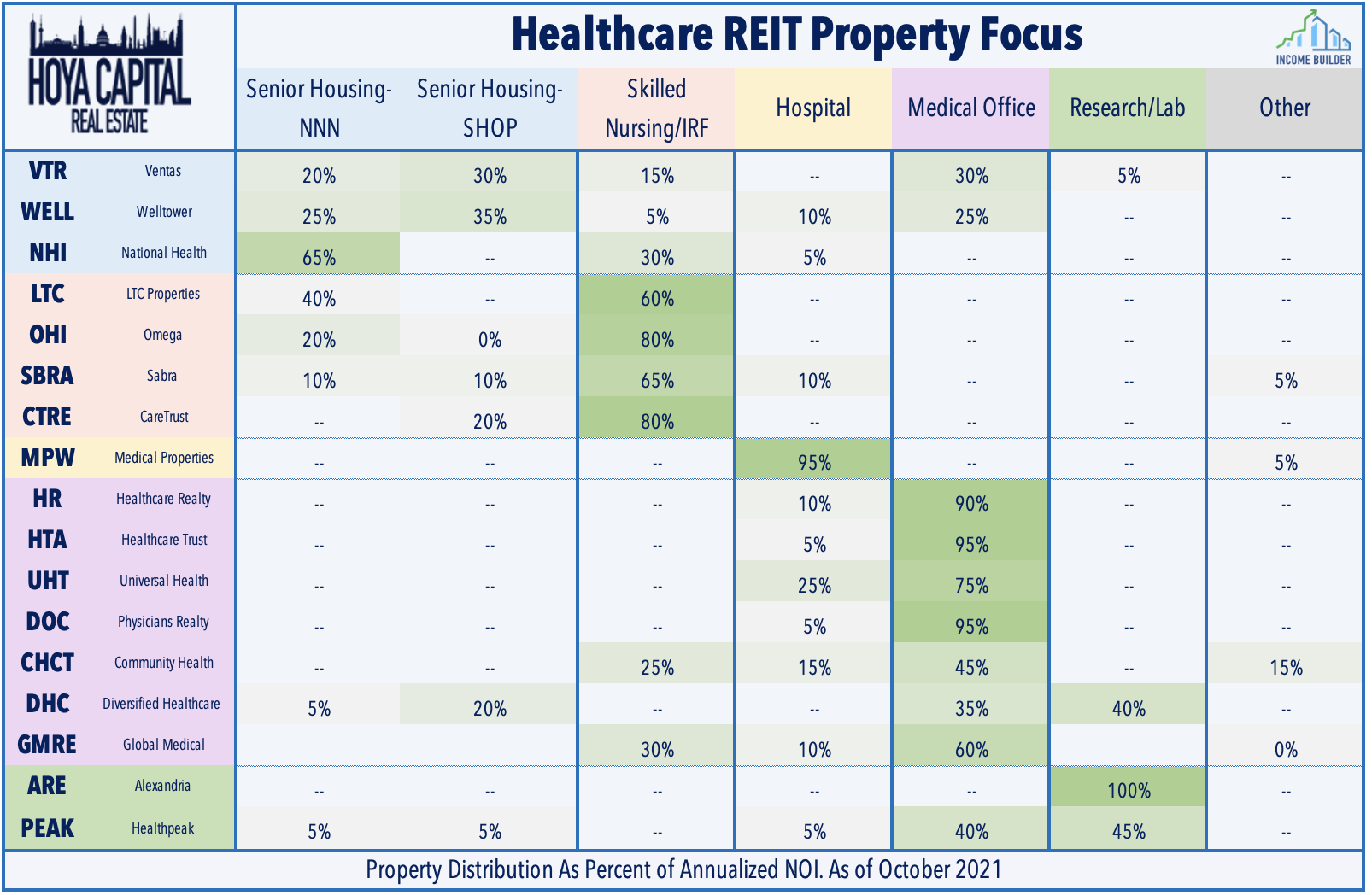

Healthcare: Diversified Healthcare (DHC) rallied 5% after announcing that it entered into a $703M joint-venture for 10 properties in DHC's Office Portfolio segment with two global institutional investors. The ten property portfolio is being sold at roughly $660/sq. foot or a 4.98% capitalization rate based on FY21 cash NOI. The investors acquired a 41% and 39% equity interest in the joint venture for an investment of ~$100.7M and $95.8M, respectively; DHC retained a 20% equity interest in the JV. The transaction is expected to result in a gain on sale of roughly $320M.

Industrial: LXP Industrial Trust (LXP) gained 3% today after it received a $16/share cash offer from activist investor Land & Buildings, which represented a rather modest 11% premium to LXP’s most recent closing price of $14.41. LXP announced that its Board will review the letter to determine the course of action that it believes is in the best interests of LXP’s shareholders. Income Builder contributor Philip Eric Jones published a report last night: LXP Industrial: New Name, New Portfolio, Uncertain Future.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential and commercial mREITs each rallied 2.3% today. Leading the gains today were Hannon Armstrong (HASI), AG Mortgage (MITT), and Arlington Asset (AAIC). Last Friday, we published Mortgage REITs: High Yield Opportunities & Risks which discussed our updated sector outlook and previewed the upcoming mREIT earnings season which kicks off with results from AGNC Mortgage (AGNC) this afternoon.

We're excited to announce the launch of our new investment research service on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.