Tech Earnings • Hotel Dividends • Builders Bounce

- U.S. equity markets snapped a two-day rally Tuesday as investors parsed a busy slate of corporate earnings reports highlighted by another wave of announced layoffs across mega-cap technology firms.

- Pausing after a two-day rally of nearly 3%, the S&P 500 slipped 0.3% today while the tech-heavy Nasdaq 100 declined 0.2%. The Dow gained for a third session however, advancing 104 points.

- Real estate equities were among the leaders today as benchmark interest rates declined back to the cusp of four-month-lows. The Equity REIT Index gained 0.2% but Mortgage REITs slipped 0.5%.

- Southerly Hotels (SOHO) surged more than 25% today after it reinstated its preferred distributions on its three preferred issues which had been suspended since early 2020. SOHO was the only REIT that had not yet reinstated its preferred distributions after pandemic-related cuts.

- DR Horton (DHI) - the nation's largest homebuilder - gained 2% after reporting better-than-expected earnings results and noting that it has seen a pickup in sales activity in early 2023 as mortgage rates moderate from their multi-decade high peaks last November.

Income Builder Daily Recap

U.S. equity markets snapped a two-day rally Tuesday as investors parsed a busy slate of corporate earnings reports highlighted by another wave of announced layoffs across mega-cap technology firms. Pausing after a two-day rally of nearly 3%, the S&P 500 slipped 0.3% today while the tech-heavy Nasdaq 100 declined 0.2%. The Dow gained for a third-session however, advancing 104 points. Real estate equities were among the leaders today as benchmark interest rates declined back to the cusp of four-month lows. The Equity REIT Index gained 0.2% today with 13-of-18 property sectors in positive territory while the Mortgage REIT Index slipped 0.5%.

Homebuilders and the broader Hoya Capital Housing Index were also upside standouts today following better-than-expected results from DR Horton - the nation's largest homebuilder. Bonds caught a bid today after several days of selling pressure. The 10-Year Treasury Yield dipped 6 basis points to close at 3.47% - near the lowest levels since last September. Crude Oil futures dipped about 2% today while the US Dollar Index finished flat following PMI data from S&P Global showing that the U.S. manufacturing and services sectors remained in contraction-territory in early January. Six of the eleven GICS equity sectors finished higher on the day with Industrials (XLI) and Utilities (XLU) stocks leading to the upside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Hotels: Southerly Hotels (SOHO) surged more than 25% today after it reinstated its preferred distributions on its three preferred issues which had been suspended since early 2020. SOHO noted that it intends to pay the accrued dividends through "periodic announcement of special dividends, as warranted by market conditions and the Company’s profitability.” Yesterday we published Hotel REITs: Dividends Are Back on the Income Builder Marketplace which noted that the U.S. hotel industry delivered surprisingly solid operating performance in the back-half of 2022 despite a myriad of headwinds. Within the Hotel REIT sector, we continue to favor the higher-margin limited-service segment but are also beginning to see value in select full-service names with a Sunbelt focus along with compelling higher-yielding opportunities in hotel REIT preferred stocks, which we discussed in the full report here.

Homebuilders: DR Horton (DHI) - the nation's largest homebuilder - gained 2% after reporting better-than-expected earnings results and noting that it has seen a pickup in sales activity in early 2023 as mortgage rates moderate from their multi-decade high peaks last November. Positively, DHI's cancellation rate declined to 27% from 32% in the prior quarter while the builder delivered 17,340 during the quarter - above the upper end of its guidance range of 16,500 - buoyed by incentive offers and reductions in home prices "where necessary to optimize returns." Housing data over the past several weeks has shown early hints of a demand recovery. The Mortgage Bankers Associated reported this week that mortgage applications surged 27.9% from the prior week while Redfin reported last week that its Homebuyer Demand Index increased 6% over the past month. Google searches for “homes for sale” were up nearly 50% from their November low.

Net Lease: Spirit Realty (SRC) - which we own in the REIT Focused Income Portfolio - advanced 0.5% today after Fitch Ratings affirmed its credit ratings at “BBB” with a stable outlook. Getty Realty (GTY) gained 1% today after it announced the issuance of $125 million of senior unsecured 10-year notes priced at a fixed rate of 3.65% - a rate well below current market interest rates that was based on guarantee agreements entered into in February 2022. Proceeds from the issuance were used to prepay in full the company’s $75 million 5.35% Series B senior unsecured notes due June 2, 2023.

While the REIT earnings calendar doesn't get busy until early February, we'll see a trickle of reports starting this week with office REIT SL Green (SLG) and cell tower REIT Crown Castle (CCI) on Wednesday along with timber REIT Weyerhaeuser (WY) on Thursday. We'll publish our Earnings Preview report later this week which will discuss the major themes we're watching over the next six weeks of REIT earnings reports.

Additional Headlines from The Daily REITBeat on Income Builder

- Terreno (TRNO) announced that it has executed a lease for 192,000 sf in Northern NJ with a transportation and logistics services provider which will commence April 1, 2023 and will expire November 2028 as the Company executed an early termination agreement with an existing tenant in the 192,000 sf space effective March 31, 2022

- Outfront (OUT) announced that Providence Equity Partners acquired a multi-decade lease for nine marquee billboards at Two Times Square and 1600 Broadway from Universal Branding Group.

- Wolfe Research initiates AIRC with an Outperform rating

- BA/ML upgrades HASI to Neutral from Underperform

- Scotiabank downgrades KRC to Sector Perform from Outperform

- Yesterday, Morningstar upgraded EXR and PSA to Buy from Hold

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong start to 2023 with residential mREITs advancing 0.5% today while commercial mREITs gained 0.7%. On a quiet day of newsflow, Western Asset (WMC) and NexPoint Real Estate (NREF) led the gains on the upside while Angel Oak (AOMR) and Blackstone Mortgage (BXMT) lagged on the downside. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS. AGNC Investment (AGNC) and Dynex Capital (DX) kick off mREIT earnings season at the end of the month on January 30th.

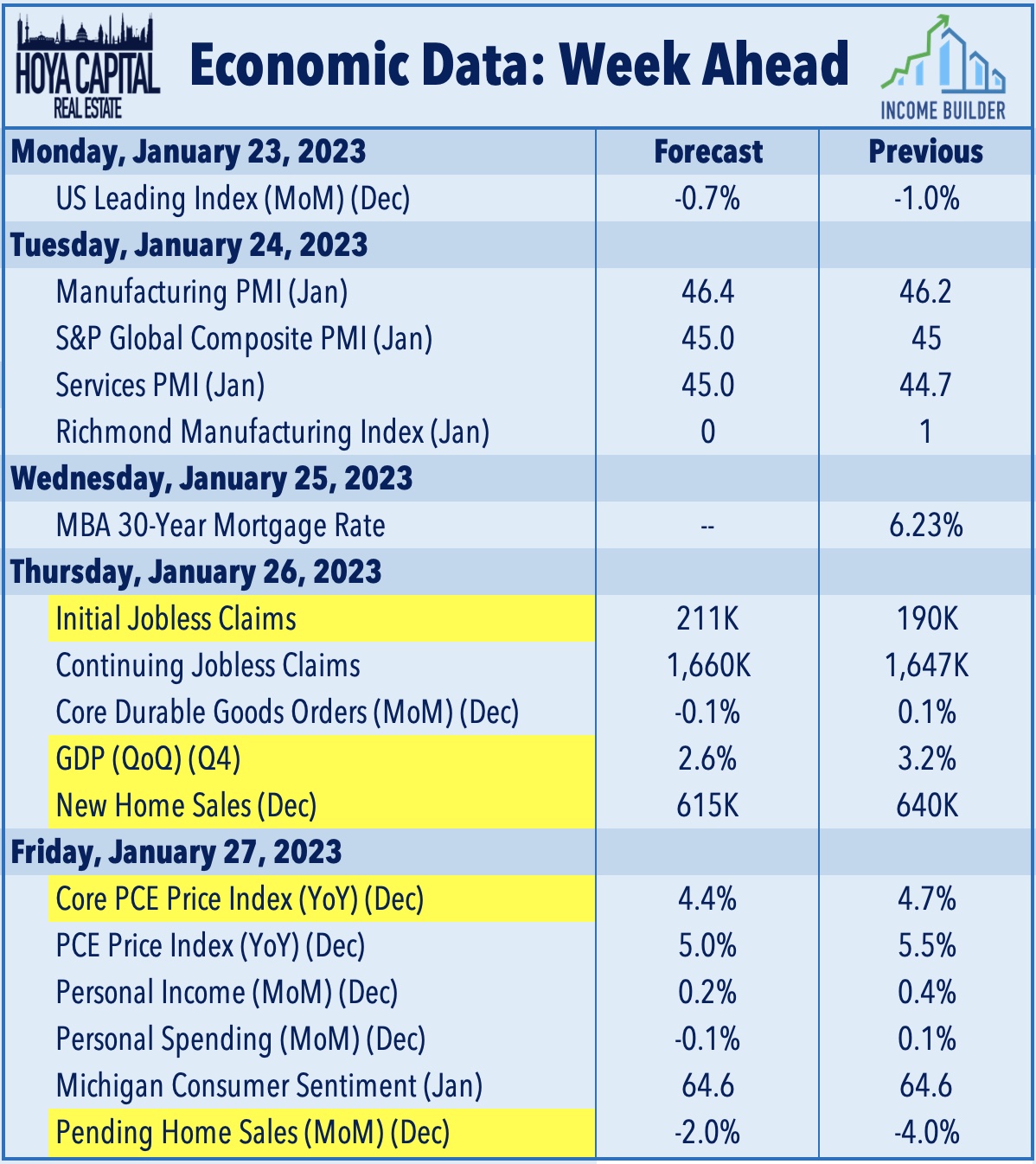

Economic Data This Week

It'll be another jam-packed week of housing data, inflation reports, and corporate earnings results in the week ahead. The main event of the week comes on Thursday with fourth-quarter Gross Domestic Product data which is expected to show that the U.S. economy expanded at a modest 2.6% annualized rate. The Atlanta Fed's GDPNow model forecasts growth of 3.5% from the prior quarter as the significant drag from residential fixed investment is expected to be offset by a boost from improved personal consumption and higher net exports. On Thursday and Friday, we'll see New Home Sales and Pending Home Sales data for December which are expected to echo the continued slowdown seen in Existing Sales and Housing Starts data this past week. Also on Friday, we'll see another critical inflation report with the Core PCE Index - the Fed's preferred gauge of inflation - which has been one of the early indicators showing signs of peaking price pressures in recent months.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.