Deep Inversion • Strong Jobs Data • Data Center Deal?

- U.S. equity markets finished little-changed Wednesday as traders parsed a second day of Congressional testimony from Fed Chair Powell and another slate of stronger-than-expected employment data.

- Trimming its week-to-date declines to 1.3%, the S&P 500 advanced 0.1% today while the tech-heavy Nasdaq 100 gained 0.5%. The Dow slipped 58 points.

- Real estate equities and other yield-sensitive segments rebounded after a rough start to the week, with the Equity REIT Index gaining 1.2% today with 16-of-18 property sectors in positive territory.

- Bond markets repeated the performance patterns seen on Tuesday, with the 10-Year Treasury Yield holding steady at 3.98%, but shorter-term rates marched higher, with the 2-Year Treasury Yield closing at 5.07% - representing the deepest yield curve inversion since 1981.

- DigitalBridge (DBRG) rallied more than 6% following reports that the company is considering a sale of its minority stake in Vantage Data Centers - one of the largest data centers operators.

Income Builder Daily Recap

U.S. equity markets finished little-changed Wednesday as traders parsed a second day of Congressional testimony from Fed Chair Powell and another slate of stronger-than-expected employment data. Trimming its week-to-date declines to 1.3%, the S&P 500 advanced 0.1% today while the tech-heavy Nasdaq 100 gained 0.5%. The Dow slipped 58 points. Real estate equities and other yield-sensitive segments rebounded after a rough start to the week with the Equity REIT Index gaining 1.2% today with 16-of-18 property sectors in positive territory, but the Mortgage REIT Index declined 0.4%. Homebuilders and the broader Hoya Capital Housing Index were among the leaders on data showing that mortgage applications rebounded last week despite an increase in mortgage rates to the highest level since last November.

Bond markets repeated the performance patterns seen on Tuesday with the 10-Year Treasury Yield holding steady at 3.98%, but shorter-term rates marched higher with the 2-Year Treasury Yield closing at 5.07% - representing the deepest curve inversion since 1981. Ahead of the BLS nonfarm payroll report on Friday, a pair of employment reports continued a months-long trend of stronger-than-expected readings. ADP Research reported that private payrolls rose 242,000 last month - above the median estimate of 200,000. The Labor Department, meanwhile, reported that there were 10.8 million job openings in January - down from 11.2 million a month earlier, but well above the median estimate of 10.5 million. Underscoring the labor market tightness that has been a concern of Fed officials, the ratio of openings to unemployed people remained historically elevated at 1.9x in January - significantly above the 1.2x level in late 2019 before the pandemic.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

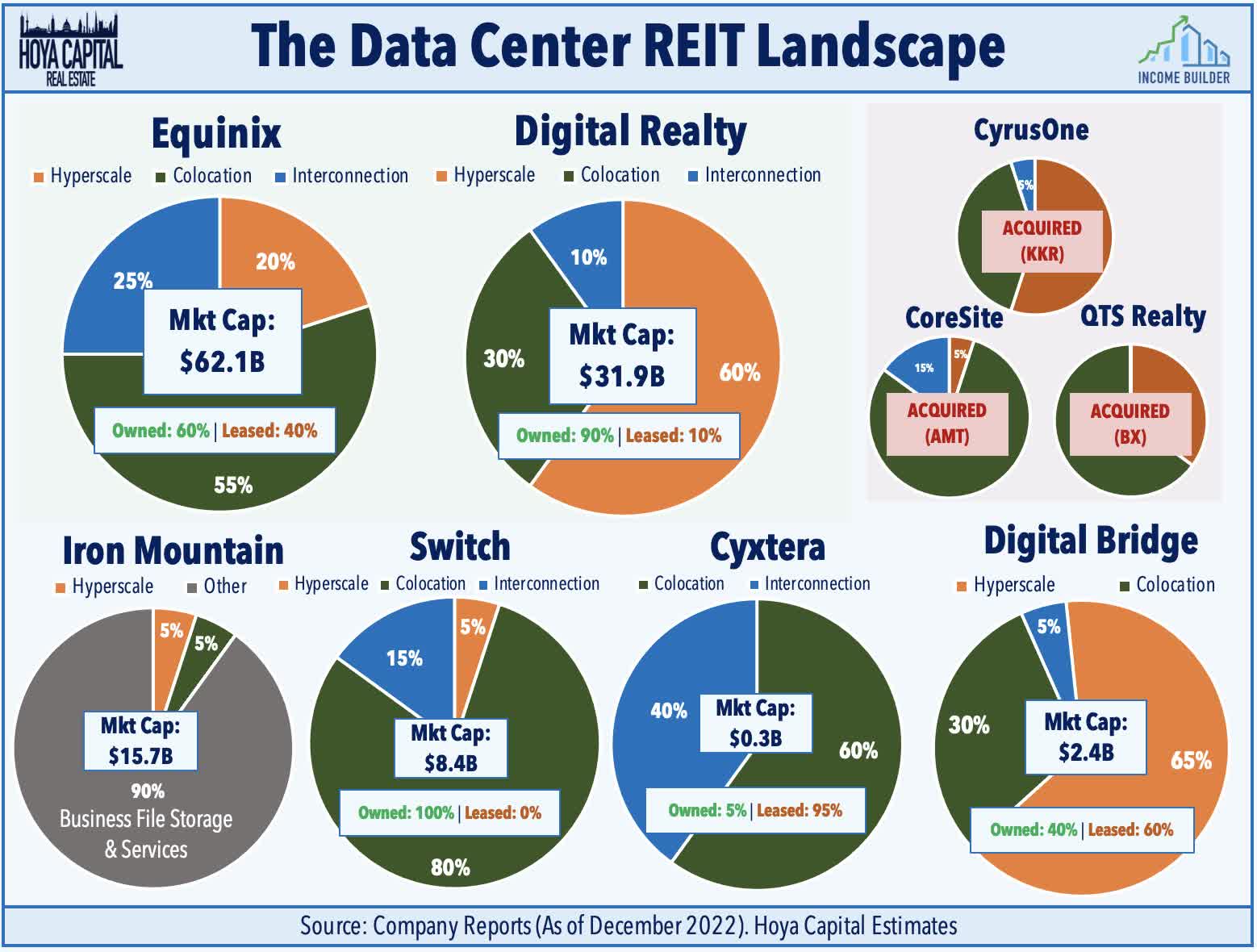

Data Center: DigitalBridge (DBRG) rallied more than 6% following reports that the company is considering a sale of its minority stake in Vantage Data Centers. Citing people with knowledge of the matter, Bloomberg noted that DigitalBridge is seeking to sell its stake for $1.5 billion - a move that is consistent with its strategy-shift towards an "asset-lite" business model that included the transition last year from a REIT to a taxable C Corporation. Vantage Data Centers is among the largest operators in the sector, operating about 26 campuses across Europe, the Middle East and Africa. Bloomberg reports that Vantage is expected to garner interest from private equity firms and infrastructure funds. The two major data center REITs - Equinix (EQIX) and Digital Realty (DLR) - were not specifically named in the report.

Healthcare: Today we published Healthcare REITs: Life After The Pandemic on the Income Builder Marketplace, which discussed our updated sector outlook and recent portfolio allocations within the sector. For Healthcare REITs - the physical epicenter of the pandemic - the road to recovery has remained inconsistent across its distinct sub-sectors, with "private-pay" segments now showing notable improvement while "public-pay" segments relapse. For Senior Housing REITs, the long-awaited recovery is finally taking hold. Robust rent growth is being fueled by rising resident incomes from record-high Cost-of-Living-Adjustments (“COLA”) to Social Security benefits. Public-pay segments - Hospital and Skilled-Nursing - have seen a re-intensification of tenant operator issues amid pressure from soaring labor costs and waning government fiscal support, triggering some missed rents and lease renegotiations.

Additional Headlines from The Daily REITBeat on Income Builder

- Community Healthcare Trust (CHCT) announced that its Board appointed David Dupuy to be the Company's CEO, filling the vacancy created by the death of Timothy Wallace.

- CTO Realty (CTO) provided an update on its recent operating and transaction activities, noting that it achieved 7.7% rent growth on comparable properties with average cash base rent of $21.41 PSF.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished mostly lower today, with residential mREITs slipping 1.6% while commercial mREITs declined 0.8%. Cherry Hill Mortgage (CHMI) dipped more than 10% after recording earnings available for distribution of $0.24 in Q4 - shy of its $0.27 quarterly distribution - while its Book Value Per Share ("BVPS") increased fractionally to $6.06, which was below the average increase of 6% from its Agency-focused peers. Ellington Residential (EARN) reported that its BVPS increased to $8.56 at the end of February - up about 2% since the end of December. The company noted that it had incorrectly indicated that its BVPS had risen "close to 4%" in that period. We'll hear results from Angel Oak (AOMR) tomorrow morning.

Economic Data This Week

Employment data highlight a critical week of economic data in the week ahead headlined by JOLTS and ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in February following the surprisingly strong month of January in which 517k jobs were added. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for February - is expected to show a modest reacceleration in wage growth in February to 4.7% following an encouraging cooldown in January. Speaking of the Fed, investors will also be keenly focused on comments from Fed Chair Powell across two days of congressional testimony this week as part of the central bank's semiannual monetary policy report to the House and Senate.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.