Yields Jump • GDP Revision • REIT Updates

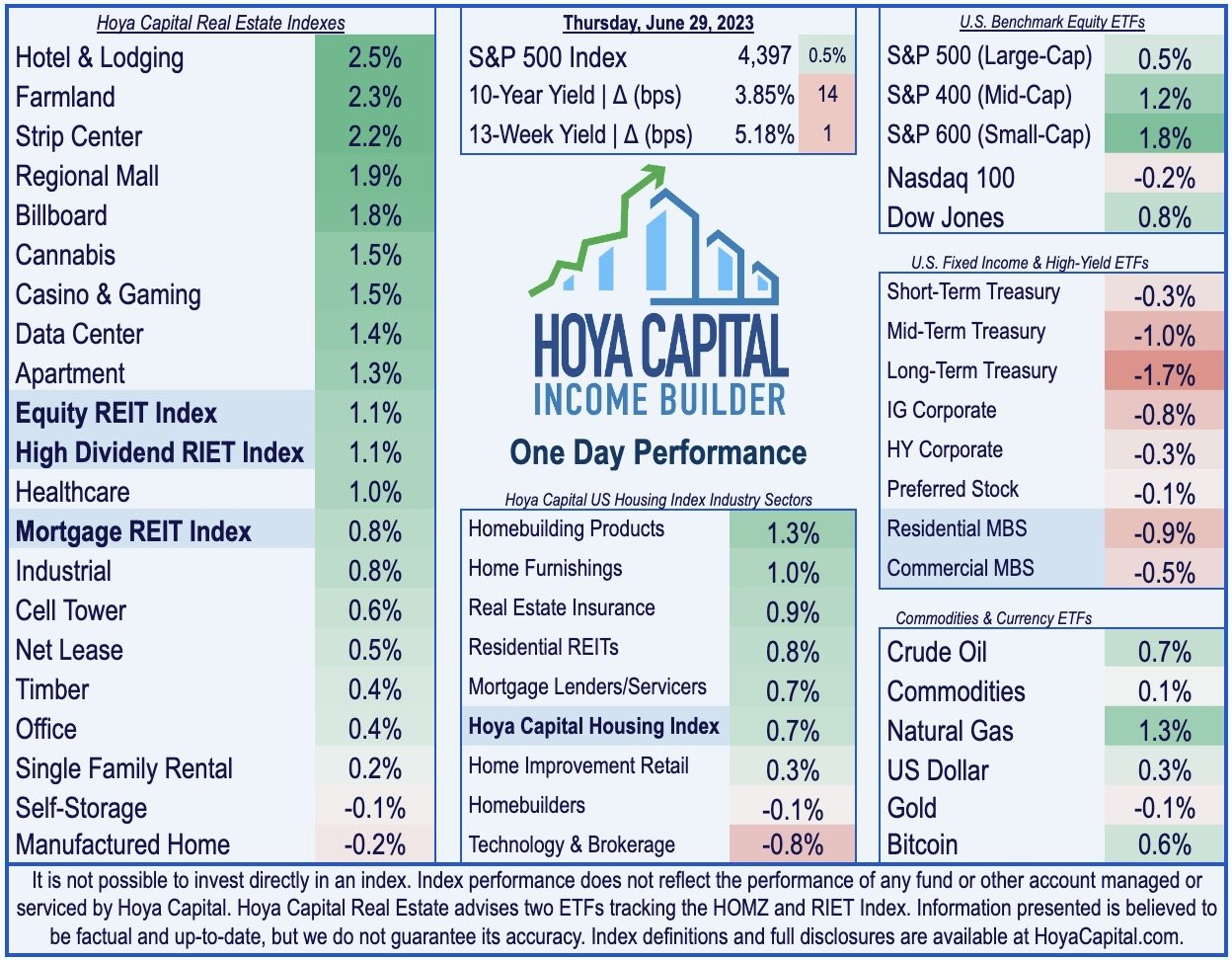

U.S. equity markets advanced while benchmark interest rates jumped after a stronger-than-expected slate of employment and GDP data pushed back recession concerns but lifted bets for additional rate hikes.

Lifting its week-to-date gains to over 1%, the S&P 500 advanced 0.5% today, while the Mid-Cap and Small-Cap benchmarks rallied more than 1%, pushing their week-to-date gains to over 4%.

Real estate equities also continued their strong week despite the lift in benchmark interest rates. The Equity REIT Index finished higher by 1.1% today, with 16-of-18 property sectors in positive-territory.

Initial jobless claims retreated in the holiday-shortened week, challenging some of the softness seen over the prior three weeks of reports. First quarter GDP data was revised upward to a 2% annualized pace, while Core PCE prices - the report's primary inflation metric - was revised downward.

EPR Properties (EPR) gained 2% today after it announced yesterday afternoon that it reached a comprehensive lease restructuring deal with struggling movie theater operator Regal Cinemas which includes a new master lease for 41 of the 57 properties and the termination of operations at 16 properties.

Income Builder Daily Recap

U.S. equity markets advanced while benchmark interest rates jumped after a stronger-than-expected slate of employment and GDP data pushed back recession concerns but lifted bets for additional rate hikes. Lifting its week-to-date gains to over 1%, the S&P 500 advanced 0.5% today, while the Mid-Cap 400 and Small-Cap 600 each rallied more than 1%, pushing their week-to-date gains to around 4%. The tech-heavy Nasdaq 100 slipped 0.2% today, however, and is roughly flat on the week. Real estate equities also continued their strong week despite the lift in benchmark interest rates. The Equity REIT Index finished higher by 1.1% today, with 16-of-18 property sectors in positive territory, while the Mortgage REIT Index advanced 0.8%.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.