Sell-Off Deepens • REIT Earnings • Jobs Day Ahead

U.S. equity markets declined for a fourth-straight session while benchmark interest rates dipped to near-nine-month lows on concern that the latest Fed rate hike may push more banks over the edge.

On pace for its worst-week since the SVB collapse, the S&P 500 finished lower by another 0.7% today, while the Mid-Cap 400 and Small-Cap 600 posted deeper declines of around 1.5%.

Real estate equities were a bright-spot on an otherwise rough day for equity markets as investors parsed a busy slate of 30 REIT earnings reports. The Equity REIT Index advanced 0.8%.

Host Hotels (HST) - the largest hotel REIT - rallied 6% after it reported very strong results and significantly raised its full-year outlook. Net lease REITs Realty Income (O) and Spirit Realty (SRC) also rallied after raising their full-year outlook.

Plymouth (PLYM) was also an upside standout today after rounding out a strong slate of industrial REIT earnings reports. Tech REITs Equinix (EQIX) and Uniti Group (UNIT) rallied after raising their outlook.

Income Builder Daily Recap

U.S. equity markets declined for a fourth-straight session while benchmark interest rates dipped to near-nine-month lows on concern that the latest Fed rate hike may push more banks over the edge. On pace for its worst week since the SVB collapse in early March, the S&P 500 finished lower by another 0.7% today, while the Mid-Cap 400 and Small-Cap 600 posted deeper declines of around 1.5%. The 2-Year Treasury Yield dipped another 12 basis points to 3.78% - hovering around the lowest-levels since last September - while the 10-Year Treasury Yield declined 5 basis points to 3.35%. Real estate equities were a bright-spot on an otherwise rough day for equity markets as investors parsed a busy slate of over 30 REIT earnings reports. The Equity REIT Index advanced 0.8% today, with 14-of-18 property sectors in positive territory, but the Mortgage REIT Index slipped 2.3%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Hotels: Host Hotels (HST) - the largest hotel REIT - rallied 6% after it reported very strong results and significantly raised its full-year outlook. HST boosted its full-year guidance for Revenue Per Available Room ("RevPAR") to 9.0% at the midpoint - up from its prior outlook for 2.5% growth - and now sees FFO growth of 5.9% this year, a 1,010 basis point increase compared to its prior outlook calling for a 4.2% decline in FFO this year. HST noted, "Our results in the first quarter were driven by continued rate strength and increases in occupancy, with meaningful improvement in the group business segment.” Summit Hotels (INN) - which raised its dividend by 50% last week - gained 2% after reporting strong results as well, commenting that "the industry's recovery is increasingly being driven by midweek, group and business-oriented demand." Chatham Lodging (CLDT) finished lower after reporting mixed results, noting that its RevPAR remained about 6% below 2019-levels in Q1, citing weakness in its California properties. We'll hear results this afternoon from Diamondrock (DRH) and RLJ Lodging (RLJ).

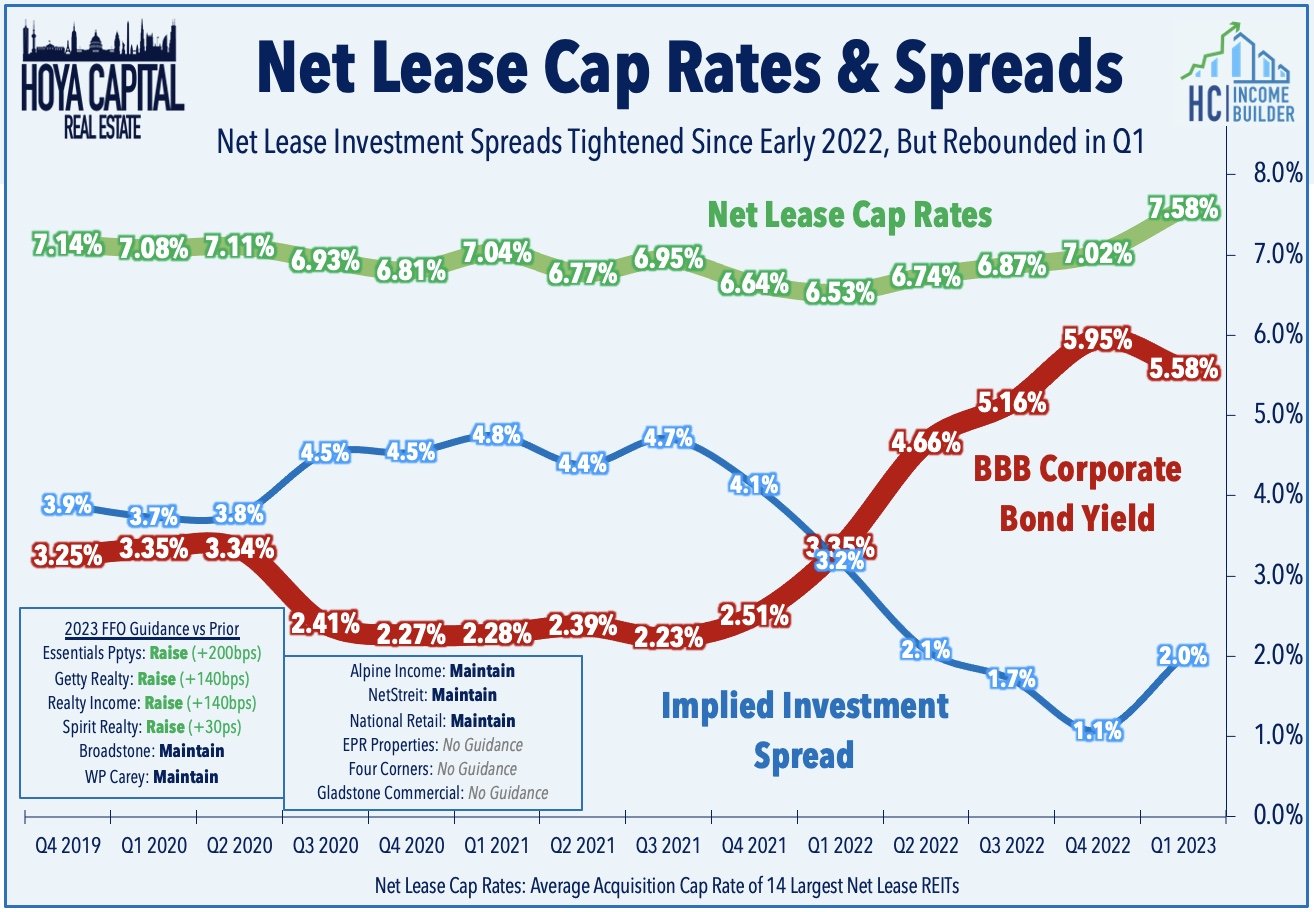

Net Lease: A busy slate of results from the net lease sector showed that cap rates - and investment spreads - have trended meaningfully higher in recent months as private market pricing has finally started to adjust to the higher interest rate environment. Spirit Realty (SRC) - which we own in the Focused Income Portfolio - rallied 4% after reporting strong results and raising its full-year FFO growth outlook to 0.3% - up from its prior outlook for flat growth. SRC acquired seven properties for $239M in Q1 at a capitalization rate of 7.9% - up from its cap rate in Q4 of 7.3%. Realty Income (O) gained 2% after it raised its full-year FFO outlook to 1.0% - up 75 basis points from its prior guidance - and reported that it acquired $1.7 billion of properties in Q1 at a cap rate of 7.0% - up from 6.1% last quarter. Broadstone (BNL) gained 1% after it maintained its full-year outlook calling for FFO growth of 0.7% and reported that it was actually a net seller in Q1, selling $94.3M of properties at a 5.4% cap rate while acquiring $20M of assets at a 7.0% cap rate. We'll hear results this afternoon from Agree Realty (ADC).

Industrial: Today, we published Industrial REITs: No Slowdown Here on the Income Builder Marketplace. After the worst year of performance on record in 2022, Industrial REITs have rebounded this year after earnings results showed a surprising re-strengthening of property-level fundamentals. Recent earnings results showed that demand continues to substantially outpace available supply. Rent growth reaccelerated in Q1, with rental spreads averaging over 40%, while occupancy rates climbed to fresh record highs. Plymouth (PLYM) - which we own in the Dividend Growth Portfolio - rallied 3% today after reporting solid results and maintaining its full-year FFO and NOI outlook. Terreno (TRNO) - which released preliminary results last month - gained about 1% after releasing its full earnings report, highlighted by incredible leasing spreads of 69% in Q1 - its strongest on record. As noted in the report, strengthening rent growth comes despite substantial downward pricing power across other areas of the supply chain. We'll hear results this afternoon from Americold (COLD).

Storage: Public Storage (PSA) gained 3% after reporting strong results and raising its full-year FFO and NOI growth outlook - the only storage REIT to boost its outlook this quarter. PSA now expects its full-year FFO to increase 3.5% - up 20 basis points from its prior outlook. Margin improvement was the highlight of its report with gross margins climbing to a sector-best of 75.6% - up 130 basis points from last year. Demand continues to moderate from the record levels seen mid-pandemic with quarter-end occupancy rates declining to 92.8% - down 230 basis points from a year ago - but PSA noted that move-in volumes rose nearly 13%. Despite declines in occupancy rates, Storage REITs expect FFO to rise 3.0% this year - among the best in the REIT sector, buoyed by strong balance sheets and "sticky" rent growth on existing tenants.

Earlier this week, we published our Earnings Halftime Report. We noted that REIT earings results thus far have been better than the prevailing narrative would suggest. Apartment and Industrial REITs have accounted for nearly half of the guidance boosts thus far. Residential rent growth appears to have firmed in recent months after a rather sharp cooldown in late 2022 amid a broader Spring revival across the housing sector. Retail REITs have reported impressive leasing momentum thus far, while healthcare REITs' operator issues have remained status-quo. In addition to the aforementioned reports, we'll hear results this afternoon from single-family rental REIT American Homes (AMH), shopping center REITs Regency Centers (REG) and Federal Realty (FRT), and apartment REIT Clipper Realty (CLPR)/

Additional Headlines from The Daily REITBeat on Income Builder

B. Riley upgrades HT to Buy from Neutral

Morningstar upgrades EQIX to Hold from Sell

Mortgage REIT Daily Recap

Mortgage REITs continue to be swept up in regional banking concerns, extending their week-long rout. On the residential mREIT side, Rithm Capital (RITM) was little-changed today after it reported adjusted EPS of $0.35/share - covering its $0.25/share dividend - and noted that its Book Value Per Share ("BVPS") declined about 3% to $11.67. MFA Financial (MFA) gained 1% after it reported adjusted EPS of $0.30/share - short of its $0.35/share dividend - but noted that its BVPS increased 2% to $15.15 in Q1. New York Mortgage (NYMT) traded flat after reporting adjusted EPS of $0.12/share - shy of its $0.40/share dividend - while noting that its BVPS declined 2.5% to $12.95. Chimera (CIM) declined 3% after it reported adjusted EPS of $0.13/share - shy of its $0.23/share dividend - while its BVPS declined 1% to $7.41. On the commercial mREIT side, Starwood Capital (STWD) dipped 5% after reporting adjusted EPS of $0.49/share - covering its $0.48/share dividend - and noted that its BVPS declined 2% to $21.37. Franklin BSP (FBRT) gained 2% after reporting adjusted EPS of $0.44/share - covering its 0.355/share - and noted that its BVPS was flat in Q1 at $15.78.

Economic Data This Week

Employment data and the Federal Reserve's interest rate decision highlight a critical week of economic data in the week ahead. The busy slate of employment data is headlined by JOLTS report on Tuesday, ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 180k in April, which follows a solid month of March in which the economy added 236k jobs. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for April - is expected to show a cooldown in wage growth in April to 4.2%. 'Good news is bad news' will likely be the theme of these reports as several Fed officials have pinned their decisions to pivot away from aggressive monetary tightening on a long-awaited cooldown in labor markets.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.