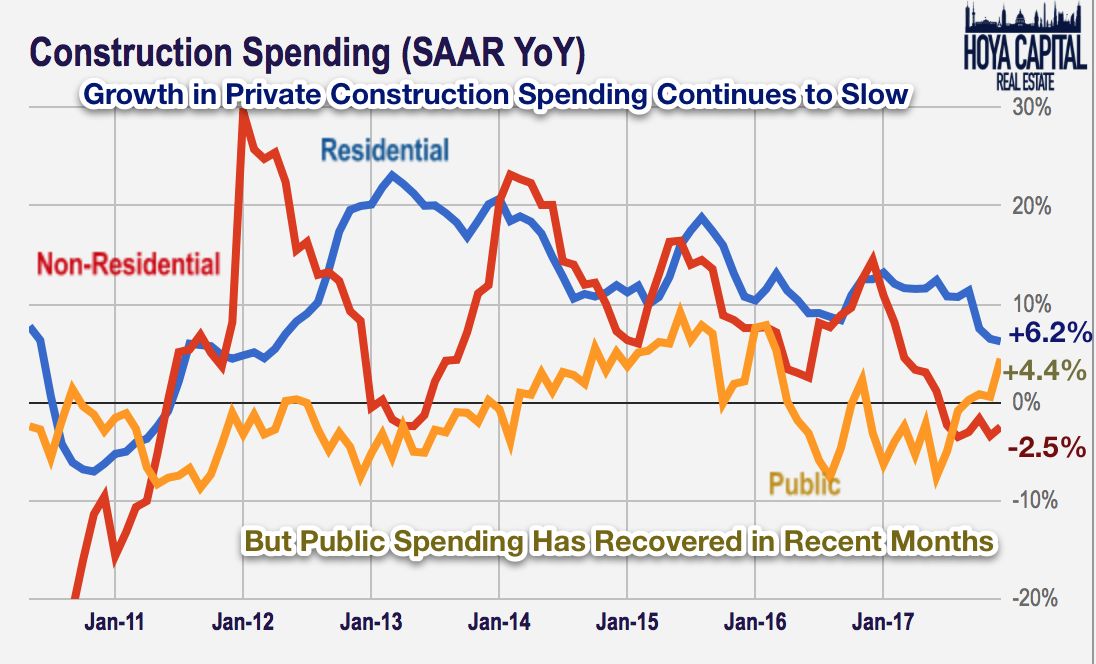

Private Construction Spending Continued To Slow in December

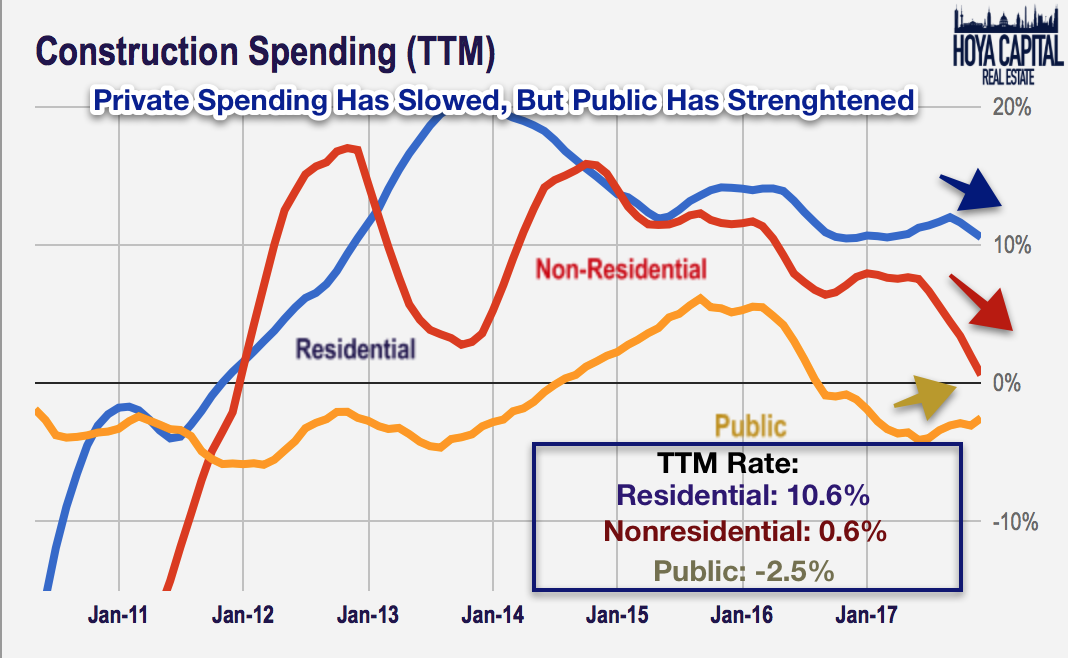

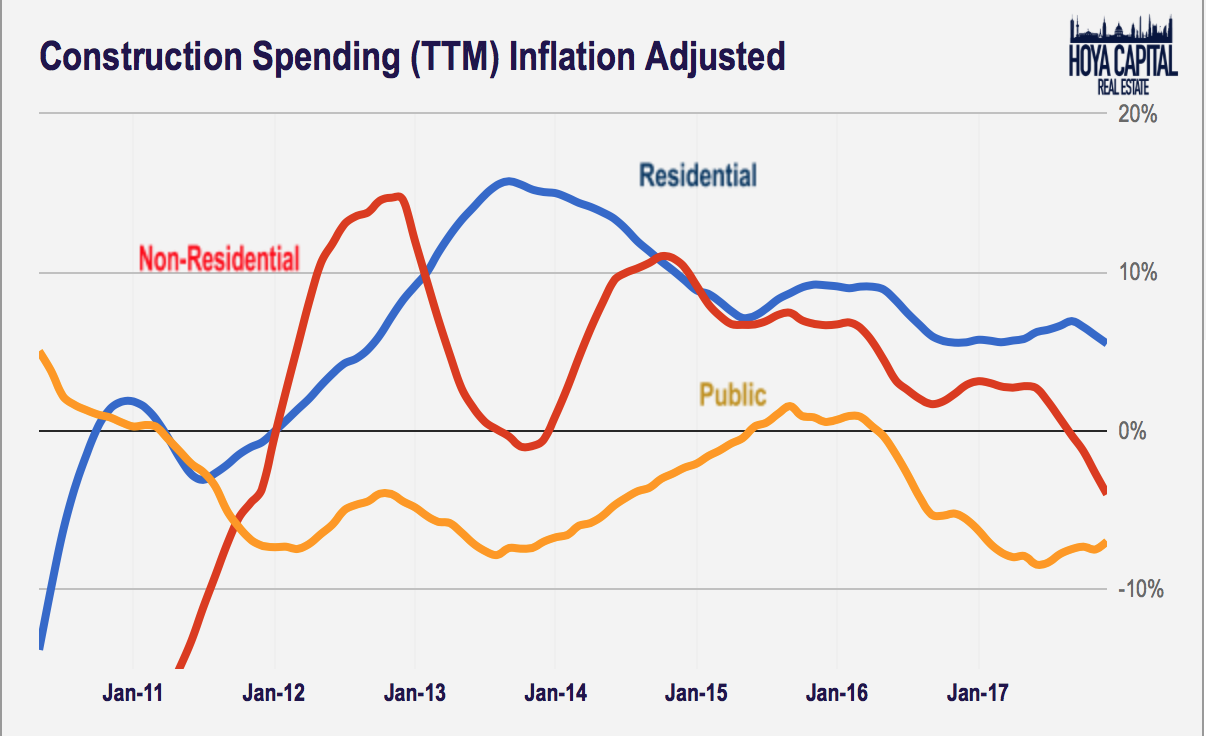

Total construction spending rose 3.8% in 2017, dragged down by a slowdown in private spending to end the year. Residential spending rose 10.6% in 2017 while nonresidential spending rose just 0.6%. Public spending ended the year lower by 2.5%, but was strong in December. With construction costs rising roughly 4% per year, it's helpful to present the data on an cost-adjusted basis, which we show below.

From the Census Bureau: "Spending on private construction was at a seasonally adjusted annual rate of $963.2 billion, 0.8 percent (±1.2 percent)* above the revised November estimate of $955.9 billion. Residential construction was at a seasonally adjusted annual rate of $526.1 billion in December, 0.5 percent (±1.3 percent)* above the revised November estimate of $523.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $437.1 billion in December, 1.1 percent (±1.2 percent)* above the revised November estimate of $432.1 billion. The value of private construction in 2017 was $950.7 billion, 5.8 percent (±1.0 percent) above the $898.7 billion spent in 2016. Residential construction in 2017 was $515.9 billion, 10.6 percent (±2.1 percent) above the 2016 figure of $466.6 billion and nonresidential construction was $434.8 billion, 0.6 percent (±1.0 percent)* above the $432.1 billion in 2016." Below is a chart of the Seasonally Adjusted Annualized Rate.