Real Estate Daily Recap: Homebuilders Jump, REITs Continue to Rally

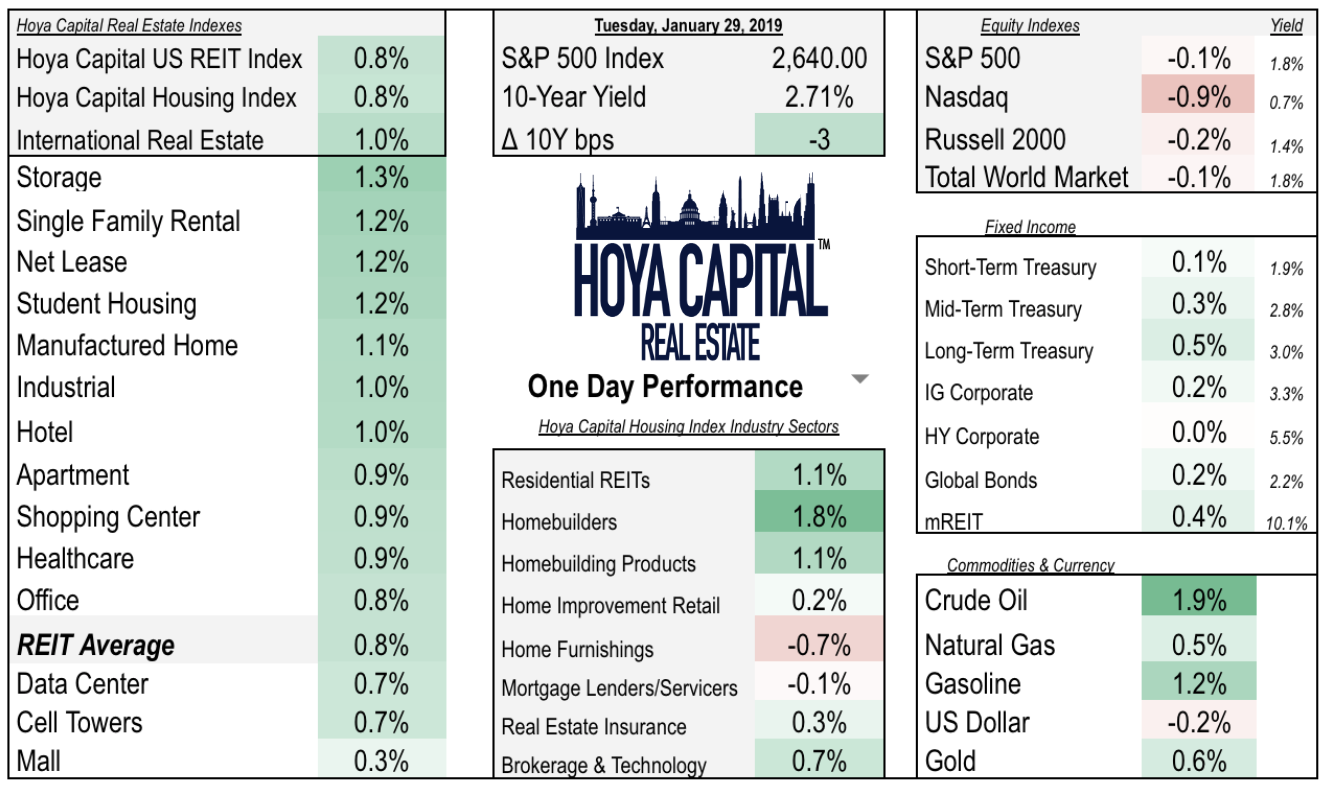

The REIT ETFs (VNQ and IYR) ended the day higher by nearly 1% for the second straight day, led by the self-storage, single family rental, and net lease sector. Earnings season kicks into high-gear this week with results from apartment REIT Equity Residential (EQR) out this afternoon.

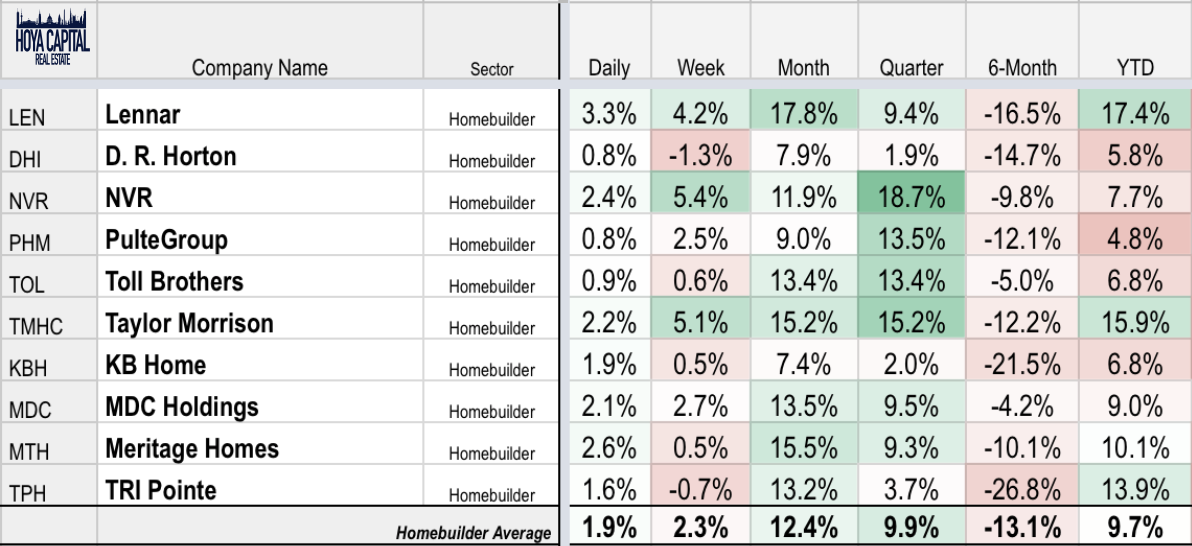

Homebuilder ETFs (XHB and ITB) finished up by nearly 2% following solid results from Pulte (PHM) this morning. The homebuilding products sector also climbed 1% following strong results from Eagle Materials (EXP). A.O. Smith (AOS) also reported results this morning, ending the day down slightly. Lennar (LEN), Meritage (MTH) and NVR (NVR) were the three strongest performing homebuilders on the day.

The S&P 500 ETF (SPY) ended the day roughly flat while the Nasdaq ETF (QQQ) ended the day down roughly 1%. Energy prices bounced back after dipping yesterday, but interest rates trended sligthly lower across the yield curve with the 10-Year yield ended lower by 3 basis point.