Real Estate Daily Recap: REITs Start Week Lower, Homebuilders Flat

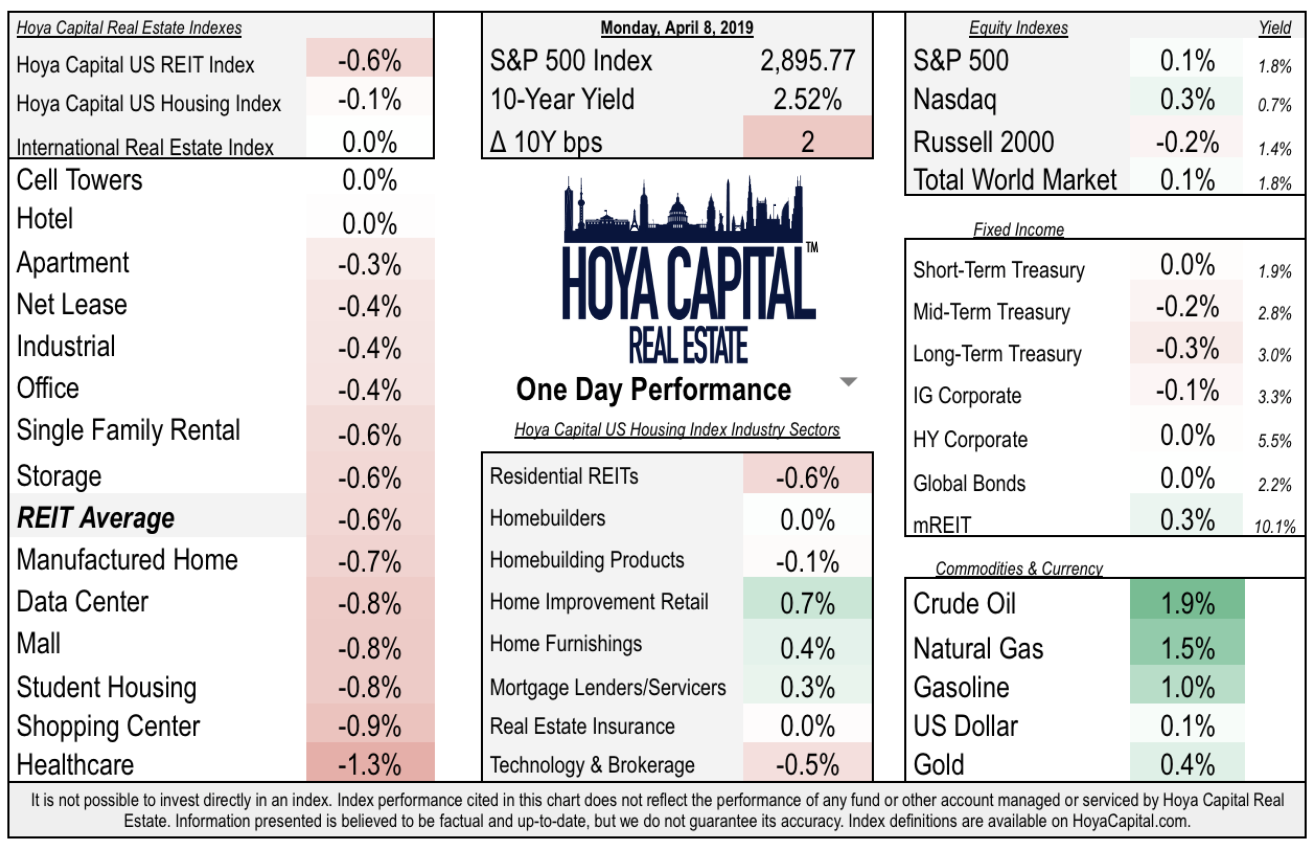

The Hoya Capital US REIT Index finished the day lower by 0.6%, led to the upside by the cell tower and hotel REIT sectors. The healthcare, shopping center, and student housing REIT sectors were the relative underperformers on the day. The S&P 500 finished the day higher by 0.1% while the Nasdaq finished higher by 0.3%. At 2.52%, the 10-Year Yield finished the day higher by 2 basis points but remains roughly 75 basis points lower than it's peak last October.

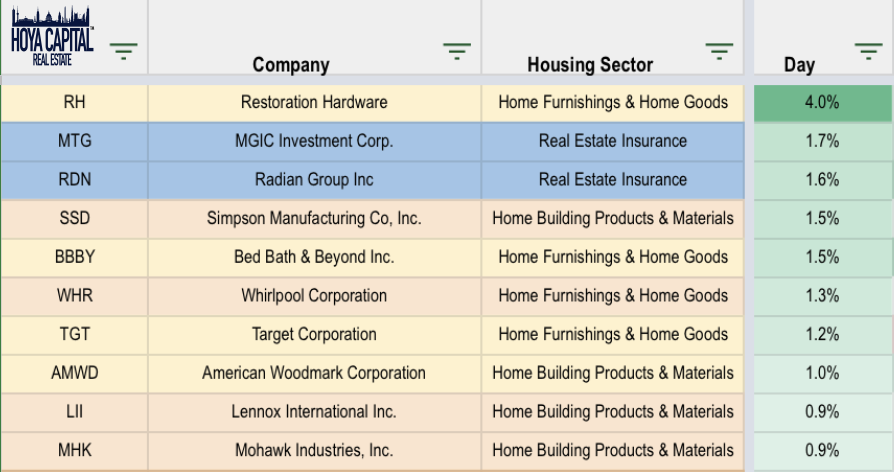

Within the Hoya Capital US Housing Index, the Home Improvement Retail sector was the strongest performer on the day led by Home Depot (HD) and Lowe's (LOW). The Home Furnishings sector also delivered a nice day led by Restoration Hardware (RH), Bed Bath Beyond (BBBY), Target (TGT), and American Woodmark (AWMD).

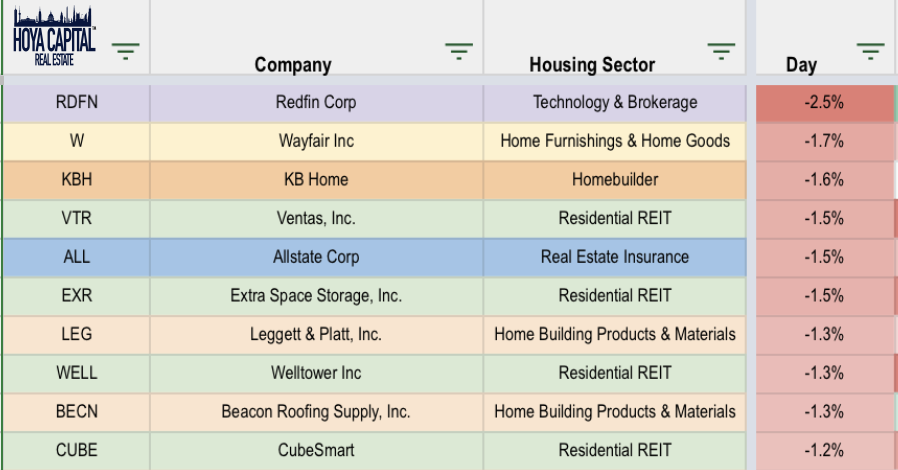

The Residential REIT sector was the relative laggard on the day with Ventas (VTR), ExtraSpace (EXR), Welltower (WELL), and CubeSmart (CUBE) each declining more than 1%. Redfin (RDFN) retreated 2.5% after a strong week.

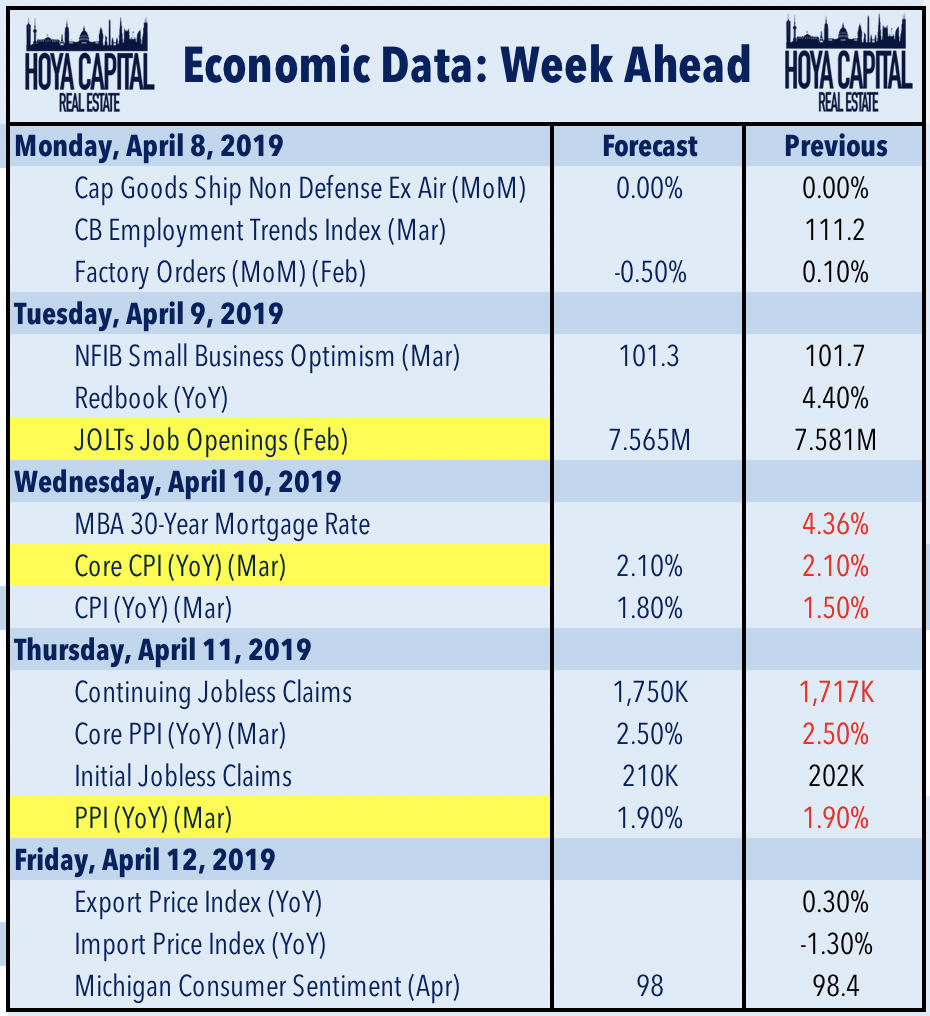

The economic calander for this week includes JOLTs on Tuesday, CPI on Wednesday, and PPI on Thursday.

Disclosure: An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. We consider the information in this presentation to be accurate, but we do not represent that it is complete. It should not be relied upon as the sole source of suitability for investment. Please consult with your investment, tax or legal adviser regarding your individual circumstances before investing. Visit our website for a complete definition of all indexes cited in this report. Investing involves risk and loss of principal is possible.