Inflation Week • Casino M&A • REIT Updates

- U.S. equity markets finished mostly lower Monday ahead of a critical week of inflation data as stocks erased early-session gains following hawkish commentary from a pair of Federal Reserve officials.

- On the heels of a decent first week of the year which snapped a four-week skid, the S&P 500 slipped 0.1% today and finished at session lows. The Nasdaq gained 0.7%.

- Real estate equities were mixed today following a strong start to 2023 buoyed by a retreat in benchmark interest rates. Equity REITs finished flat while Mortgage REITs gained 0.2%.

- Another day, another major casino M&A deal. VICI Properties (VICI) gained 0.5% today after it announced a $201M deal to acquire four casinos in Canada from PURE Canadian Gaming at an 8.0% cap rate.

- A pair of non-voting Fed officials - Bostic and Daly - maintained their hawkish tone in public comments today with each expecting the Fed Funds rate to exceed 5% - above the current upper bound of 4.5% - and hold there for "a long time" to quell inflationary pressures.

Income Builder Daily Recap

U.S. equity markets finished lower Monday ahead of a critical week of inflation data as stocks erased early-session gains following hawkish commentary from a pair of Federal Reserve officials. On the heels of a decent first week of the year which snapped a four-week skid, the S&P 500 slipped 0.1% today - finishing near session lows - while the tech-heavy Nasdaq 100 held onto gains of 0.7%. Real estate equities were mixed today following a strong start to 2023 buoyed by a retreat in benchmark interest rates. The Equity REIT Index finished flat with 10-of-18 property sectors in positive territory. The Mortgage REIT Index advanced 0.2% while Homebuilders slipped 0.7%.

Ahead of the critical CPI inflation report on Thursday, a pair of non-voting Fed officials - Bostic and Daly - maintained their hawkish tone with each expecting the Fed Funds rate to exceed 5% - above the current upper bound of 4.5% - and hold there for "a long time" to quell inflationary pressures. The hawkish rhetoric didn't depress the renewed bid for bonds, however, as the 10-Year Treasury Yield (US10Y) dipped another 5 basis points today to 3.52% - well below its 2022 closing level of 3.90%. Crude Oil prices rebounded today after sharp declines last week. Six of the eleven GICS equity sectors finished higher today with Technology (XLK) and Utilities (XLU) stocks leading to the upside while Healthcare (XLV) and Consumer Staples (XLP) stocks lagged.

It'll be another busy week of economic data with the main event coming on Thursday with the Consumer Price Index for December, which investors and the Fed are hoping will show that the fastest pace of year-over-year increases in inflation is finally behind us. The headline CPI is expected to moderate to a 6.5% year-over-year rate while the Core CPI is expected to decelerate to 5.7%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index - which since July has averaged a -1.9% annualized rate - among the most deflationary five-month periods on record. Critically, gasoline prices averaged $3.21 nationally in December - down about 13% from the prior month and 3% from the prior year. We'll also get our first look at Michigan Consumer Sentiment data on Friday - which includes a closely-watched consumer inflation expectations survey - and we'll be closely watching Jobless Claims data on Thursday as well.

Real Estate Daily Recap

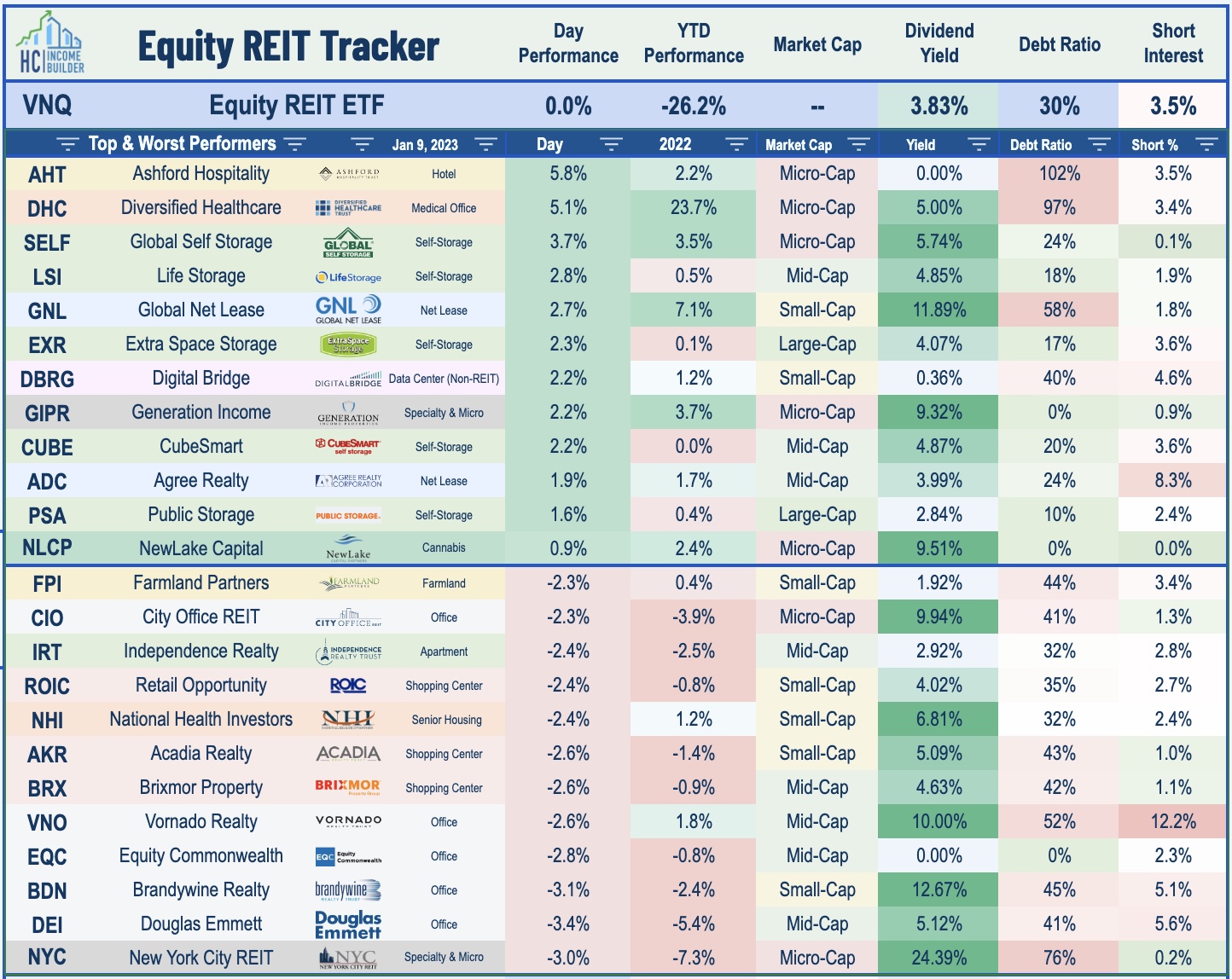

Best & Worst Performance Today Across the REIT Sector

Casino: Another day, another major casino M&A deal. VICI Properties (VICI) - which we own in the REIT Dividend Growth Portfolio - gained 0.5% today after it announced a $201M deal to acquire four casinos in Canada from PURE Canadian Gaming at an 8.0% acquisition cap rate. The portfolio includes the PURE Casino Edmonton, Yellowhead, Calgary, and Lethbridge. The new master lease has an initial total annual rent of $16.1M and has an initial term of 25 years with four five-year tenant renewal options. VICI financed the transaction with a combination of cash on hand and from drawing down funds under its existing revolving credit facility in Canadian dollars. For VICI, the transaction is expected to be immediately accretive to FFO upon closing.

Hotels: Sotherly Hotels (SOHO) advanced about 0.5% after providing preliminary fourth-quarter operating metrics, noting that its Revenue Per Available Room ("RevPAR") was 1.9% below comparable 2019-levels as a 13.3% increase in Average Daily Rates ("ADR") was offset a 13.4% decline in occupancy. SOHO noted that Hurricane Nicole negatively-impacted performance in its South Florida market in November, but RevPAR in December exceeded comparable pre-pandemic levels citing improved returned-to-office rate and as well as expanded group business travel." Recent TSA checkpoint data shows that passenger throughput finished the holiday season relatively strong around the New Year Holiday and into early 2023. The first week of January saw throughput levels that were 5% above pre-pandemic levels.

Industrial: Redford Industrial (REXR) finished flat today after it provided a business update noting that fourth-quarter leasing activity totaled 1.345M sf across 118 leases. Rent spreads were higher by 76.8% on a GAAP basis and 52.5% on a cash basis. REXR's portfolio occupancy was 98.1% at the end of Q4. WP Carey (WPC) - which we own in the REIT Focused Income Portfolio - advanced 0.5% today after it provided a business update that noted that investment volume for the 2022 full year totaled $1.42 billion - below the lower end of its guidance range provided last quarter. Industrial and warehouse assets comprised approximately two-thirds of its 2022 investment volume and approximately two-thirds of its 2022 investment volume was located in North America and one-third in Europe.

Mall: Macerich (MAC) finished slightly lower today after announcing recent financing activities that totaled nearly $1.4B as it seeks to address its upcoming debt maturities. MAC closed a $370M refinance of the Green Acres Mall and Green Acres Commons, extending the maturity by five years at a fixed interest rate of 5.90%. MAC also closed a three-year extension of its $300M loan on Santa Monica Place at a floating rate of LIBOR + 1.48%. MAC also noted that it's in the process of refinancing the existing $405M mortgage loan on Scottsdale Fashion Square with a new five-year $700M fixed-rate loan - expected to close in Q1 - which would generate $150M of incremental liquidity. In Mall REITs: The Bleeding Has Stopped, For Now we discussed how fundamentals have stabilized for the troubled mall sector as the pace of store closings dipped to historic lows in 2022.

Additional Headlines from The Daily REITBeat on Income Builder

- Boston Properties (BXP) closed on a new $1.2 billion unsecured term loan facility that matures in May 2024 with a twelve-month extension option and an accordion feature that increases the total capacity to $1.5B.

- S&P assigned a “BBB+” issuer credit rating to Kimco (KIM) with a stable outlook following the completion of the restructuring to an UPREIT.

- Raymond James upgraded Welltower (WELL) and ExtraSpace (EXR) while downgrading Realty Income (O), Public Storage (PSA), and Spirit Realty (SRC).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their strong start to the year with residential mREITs gaining another 0.9% today while commercial mREITs gained 0.3%. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.