Contagion Concerns • PPI Cools • REIT Dividend Hikes

- U.S. equity markets pulled back Wednesday in another volatile session as contagion from the Silicon Valley Bank collapse spread to Europe with mounting liquidity concerns at Credit Suisse.

- After a rebound on Tuesday, the S&P 500 finished lower by 0.7% today - clawing back intra-day declines of nearly 2% - while the tech-heavy Nasdaq 100 gained 0.5%.

- Real estate equities were among the better-performers today as credit concerns were offset by tailwinds from sharply lower benchmark interest rates. The Equity REIT Index declined 0.1% today.

- Amid the market turmoil, we did see some positive dividend news over the past 24 hours with a trio of REITs raising their dividends. Net Lease REIT Realty Income (O) hiked its monthly dividend for the second time this year to $0.2550/share, a 0.2% increase from the prior month.

- Has the Fed been fighting the "ghosts of inflation past?" Producer Price Index data was significantly cooler-than-expected with the Core Index posting a month-over-month decline for the first time since May 2020.

Income Builder Daily Recap

U.S. equity markets pulled back Wednesday in another volatile session as contagion from the SVB collapse spread to Europe with mounting solvency liquidity at Credit Suisse, sparking a renewed bid for safe-haven assets. After a rebound on Tuesday, the S&P 500 finished lower by 0.7% today - clawing back intra-day declines of nearly 2% - while the tech-heavy Nasdaq 100 managed to finish higher by 0.5%. The Dow dipped 281 points. Real estate equities were among the better-performers today as credit concerns were offset by tailwinds from sharply lower benchmark interest rates. The Equity REIT Index declined 0.1% today with 5-of-18 property sectors in positive territory, but the Mortgage REIT Index slipped 3.3%.

Contagion concerns were intensified by turmoil at Credit Suisse (CS), which plunged to all-time lows after its top shareholder ruled out more financial assistance for the long-troubled European bank, forcing Switzerland’s central bank to step in to provide a liquidity backstop. Benchmark interest rates resumed their historic plunge today as investors repriced Fed rate hike expectations. The policy-sensitive 2-Year Treasury Yield dipped to below 3.88% today - down sharply from its high last week at 5.07% - while the 10-Year Treasury Yield dipped another 15 basis points to 3.49%. Energy (XLE) stocks were slammed particularly hard today as global growth concerns sent the Crude Oil benchmark below $70/barrel for the first time since late 2021 while Utilities (XLU) and Communications (XLC) stocks gained over 1%.

Has the Fed been fighting the "ghosts of inflation past?" After Consumer Price Index data yesterday showed a sharp cooldown in "real-time" inflation, Producer Price Index data was significantly cooler-than-expected with the Core PPI Index posting a month-over-month decline for the first time since May 2020. Both services and goods prices declined in February, dragging the annual increase on the headline PPI index to 4.6%, well below the downwardly revised 5.7% level from the previous month. Yesterday, we noted that when the BLS' Shelter Index is replaced with the Zillow ZRI Rent Index - a more accurate measure of changes in shelter costs - we observe a sharp decline in the index since mid-2022 with this "Real-Time CPI" slowing to 3.16% in February and averaging less than 1% over the past eight months.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Amid the market turmoil, we did see some positive dividend news over the past 24 hours with a trio of REITs raising their dividends. Net Lease REIT Realty Income (O) hiked its monthly dividend for the second time this year to $0.2550/share, a 0.2% increase from the prior month. Hotel REIT RLJ Lodging Trust (RLJ) boosted its quarterly payout by 60% to $0.08/share, as initially indicated in its earnings call last month. After the close today, shopping center REIT InvenTrust (IVT) hiked its quarterly dividend by 5% to $0.2155/share, also consistent with indications made during its earnings call last month. We've now seen 38 REITs hike their dividends this year, while eight REITs have lowered their payouts, including mortgage REIT Annaly Capital (NLY) which trimmed its payout by about 25% yesterday afternoon, as indicated in its recent earnings report.

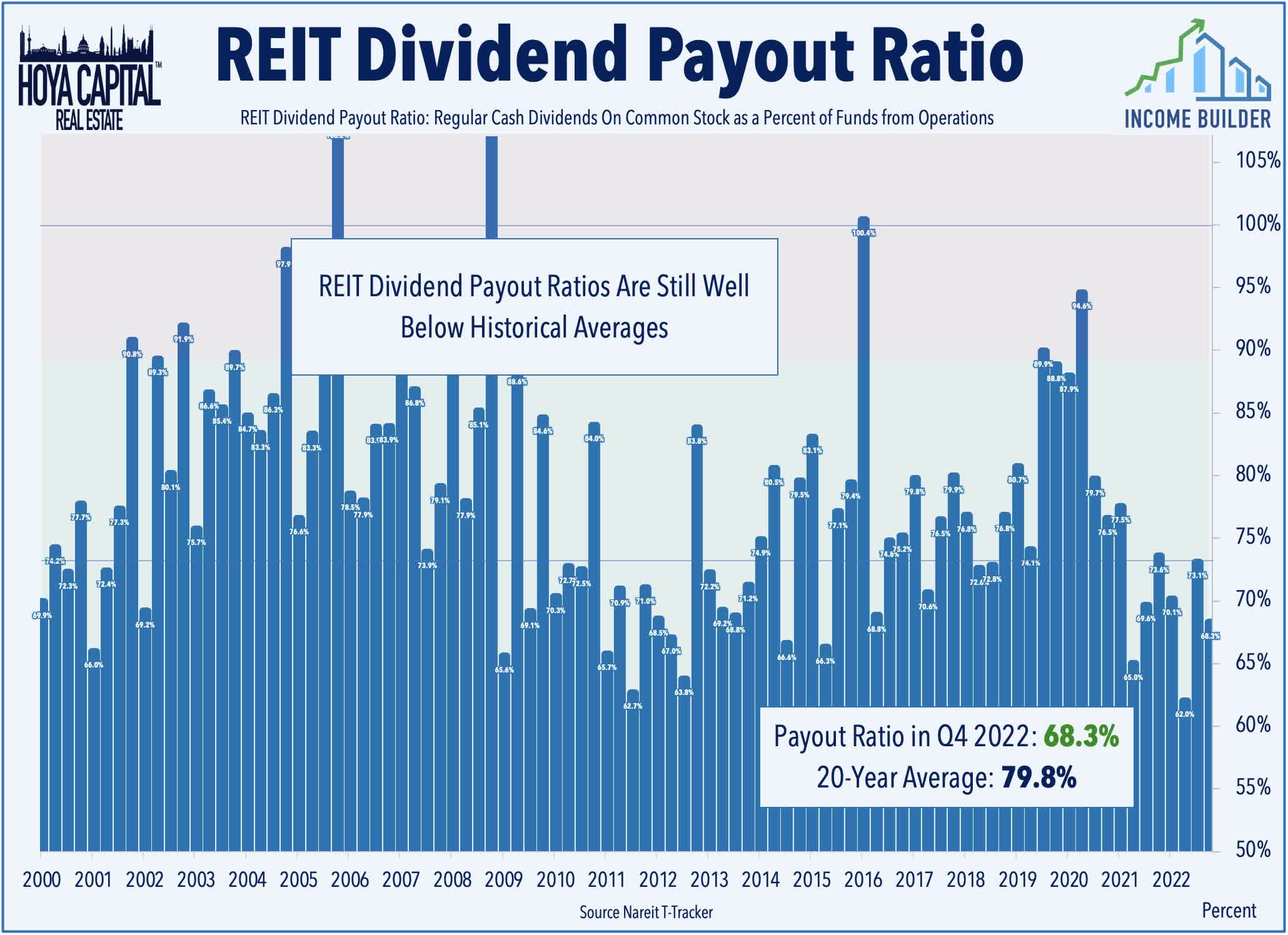

Amid lingering concerns over the potential fallout from several major tech-focused bank failures, our State of the REIT Nation examined high-level REIT fundamentals to chart the likely path forward for the real estate industry. Owing to the harsh lessons from the Great Financial Crisis, most REITs have been exceedingly conservative with their balance sheet and strategic decisions, ceding ground to higher-levered private-market players. With commercial property values now 15-20% below 2022 highs, and with interest rates doubling from last year, distress will become ever-apparent from private-market firms and lenders that pushed leverage limits. Most public REITs are prepared to weather the storm. With the exception of office, malls, and some sub-sectors of healthcare and mortgage REITs, fundamentals across the REIT industry are stronger than before the pandemic. REIT FFO is 10% above pre-pandemic-levels while dividend coverage remains historically strong.

Additional Headlines from The Daily REITBeat on Income Builder

- Simon Property (SPG) closed on a new $5.0 billion multi-currency unsecured revolving credit facility, which replaces its existing $4.0 billion senior unsecured revolving credit facility

- Four Corners (FCPT) announced the acquisition of an Aspen Dental property located in New Mexico for $1.9 million priced at a cap rate in range with previous transactions

- Broadstone Net Lease (BNL) announced that its Board of Directors has authorized the repurchase of up to $150 million of its common stock under a stock repurchase program which will expire on March 14, 2024

- BRT Apartments (BRT) announced 4Q FFO of $.40/share and sees 2023 FFO guidance of $1.08-$1.19/share

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly lower today with residential mREITs slipping 2.1% while commercial mREITs dipped 4.1%. As we'll discuss in a new report on Mortgage REITs published later this evening, commercial mREITs with exposure to the troubled office sector have been under renewed pressure in recent weeks. Ares Commerical (ACRE) - which has the largest office exposure in the space - dipped more than 5% today, while Ladder Capital (LADR), BrightSpire (BRSP) also declined by more than 4%. Over the past month, we've seen a handful of mega-sized loan defaults on office loans from Pimco, Brookfield, and RXR. Last week, Fitch reported that 56% of new real estate delinquencies in February were in the office sector.

Elsewhere, Arbor Realty (ABR) remained under-pressure today after it responded to a published report by short-seller NINGI Research, which accused Arbor and its auditor, Ernst & Young, of various "misstatements and misconduct." ABR - which has been among the strongest performing mREITs over the past five years - commented that the report "lacks merit and contains numerous inaccuracies, misstatements, and otherwise misleading allegations." Yesterday, we pointed out several glaring inaccuracies in the report, including its commentary on Arbor's Current Expected Credit Losses ("CECL") and an inaccurately identified "peer group" of other mortgage REITs for ABR.

Economic Data This Week

The busy week of inflation, retail, and the U.S. housing market data continues on Thursday with Housing Starts and Building Permits as well as the closely-watched weekly Jobless Claims report. On Friday, we'll get the first look at March Consumer Confidence data from the University of Michigan.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.