Homebuilders Rally • Another Inflation Record • Dividend Hikes

Summary

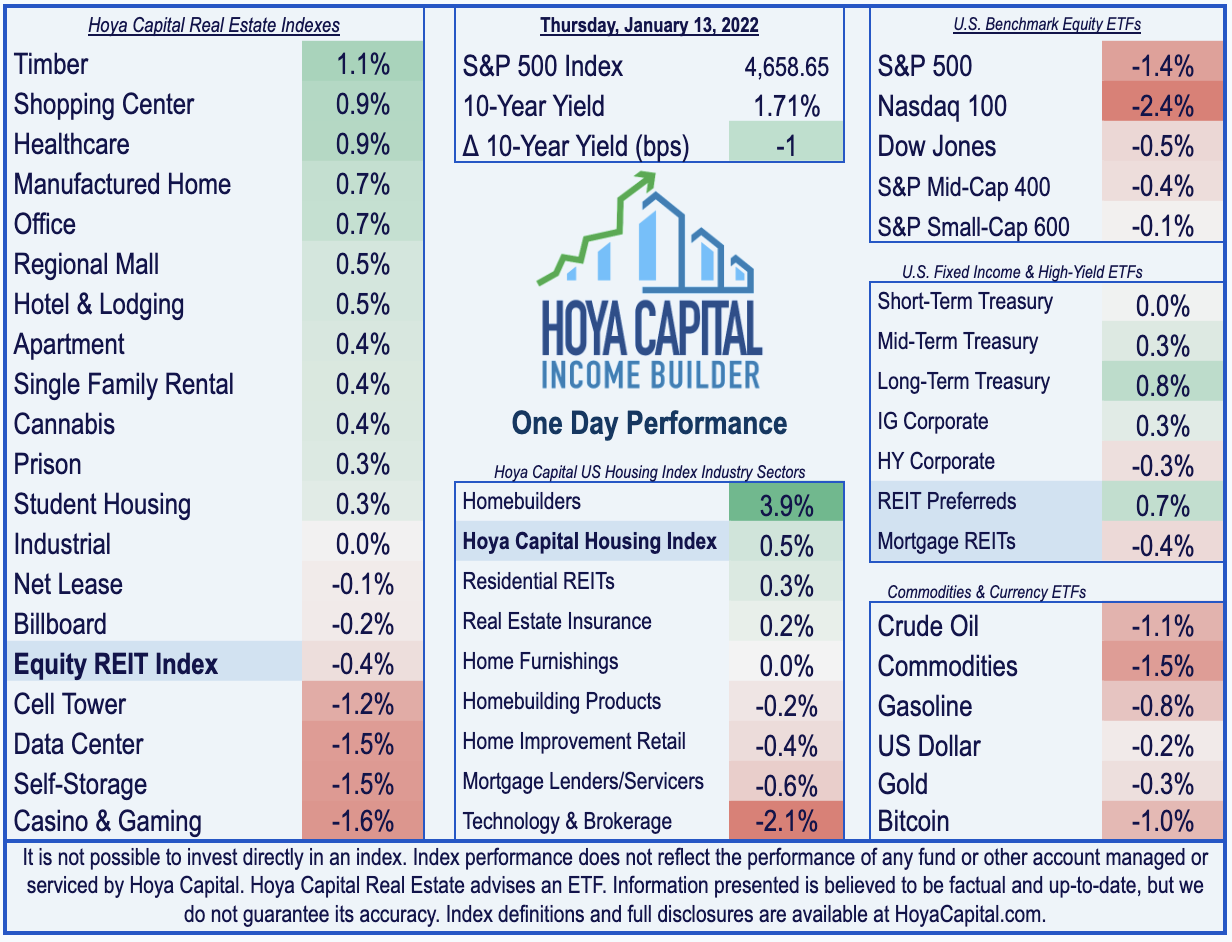

- U.S. equity markets finished lower Thursday with technology stocks lagging once again after another record-high inflation report with the PPI Index showing nearly double-digit annual inflation in producer prices.

- Snapping a two-day rebound which followed a five-day skid, the S&P 500 slipped 1.4% today while the tech-heavy Nasdaq 100 slumped 2.4%. The 10-Year Yield remained just above 1.70%.

- Residential REITs and homebuilders were again bright-spots today, but pressure on technology REITs dragged the Equity REIT Index lower by 0.4% despite 12-of-19 property sectors finishing in positive territory.

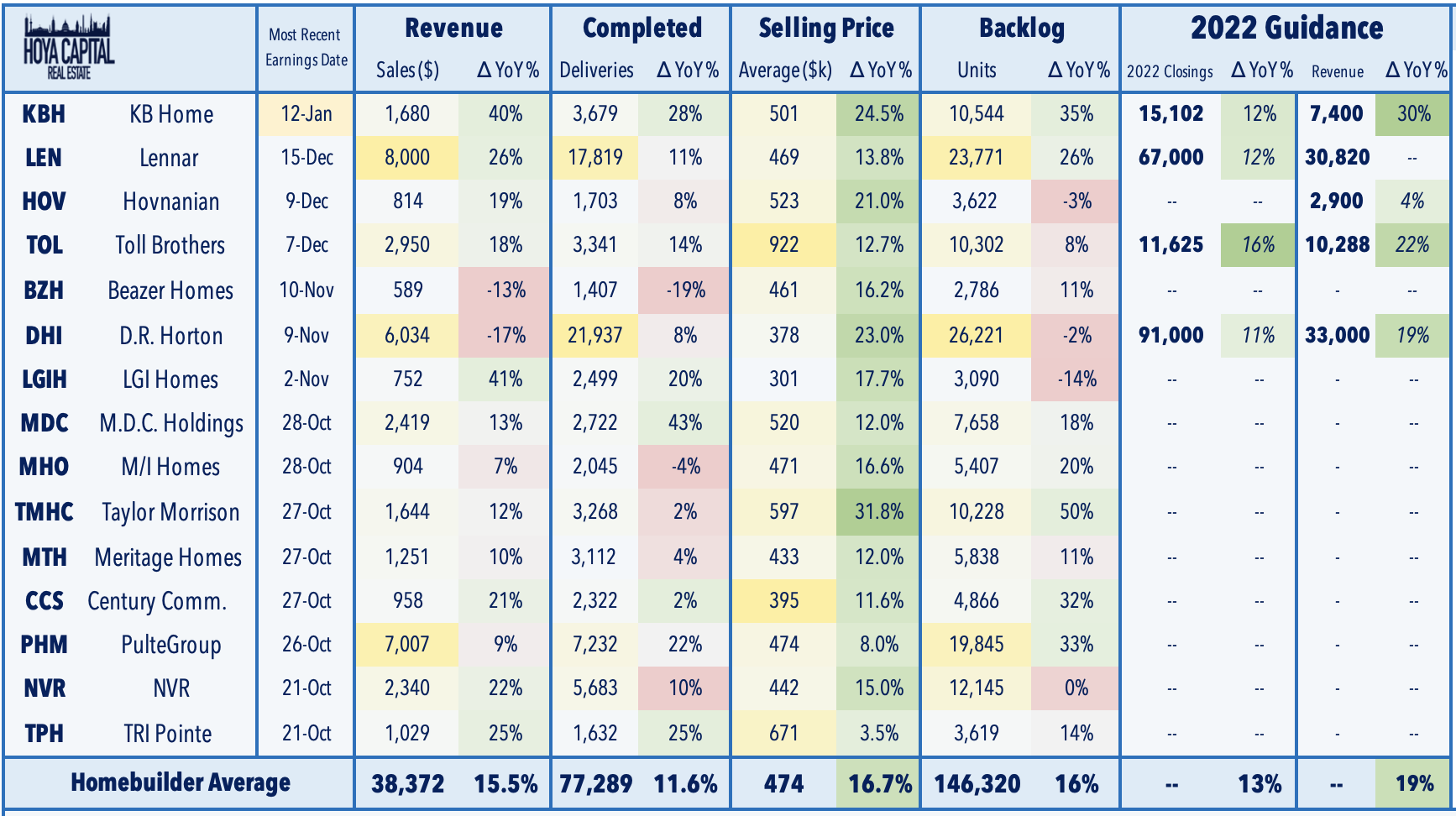

- Homebuilder KB Home (KBH) rallied more than 16% after reporting solid Q4 results and providing strong guidance which calls for 30% revenue growth in 2022. KBH delivered EPS growth of more than 70% in 2021, yet continues to trade at mid-single-digit P/E ratios.

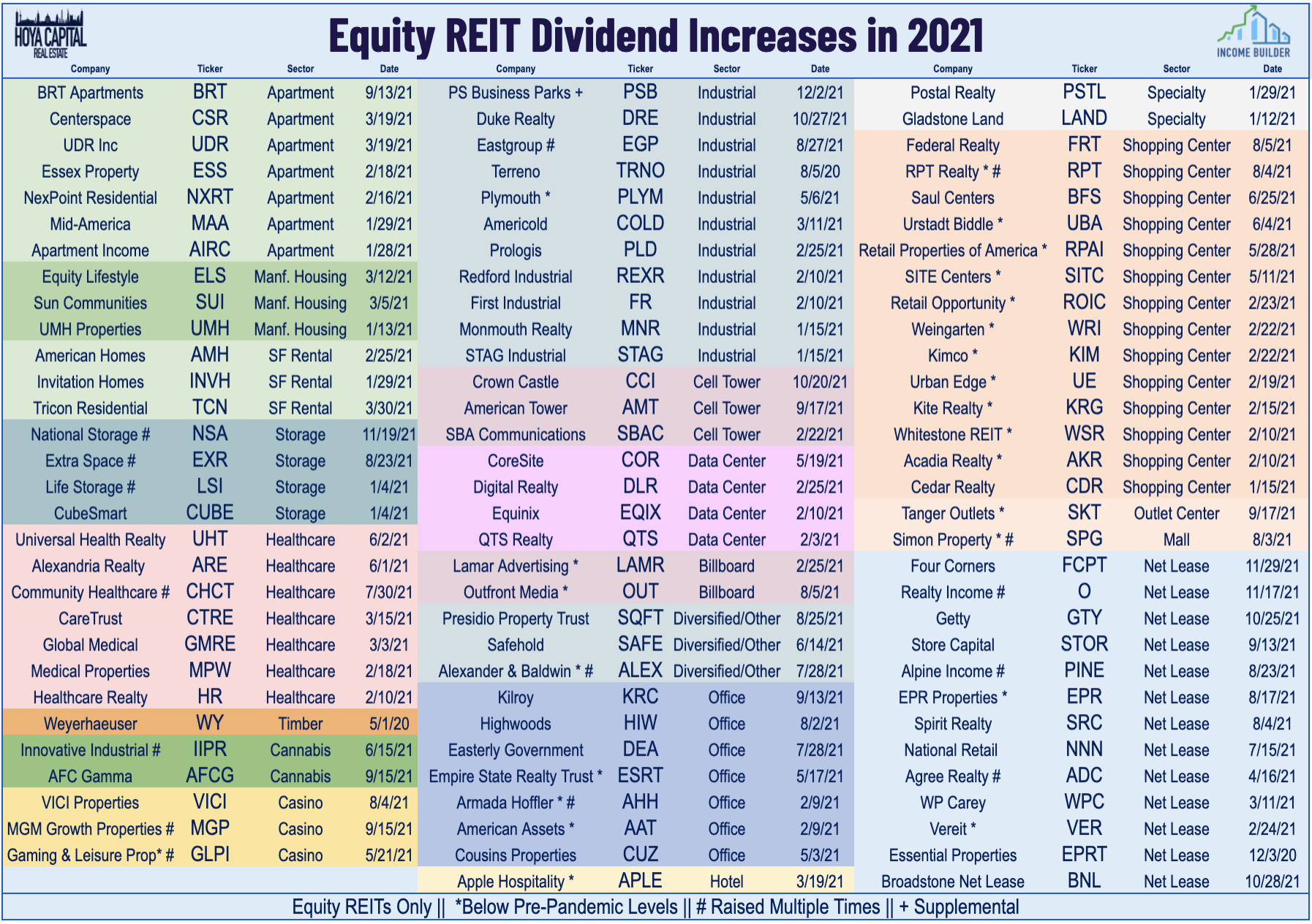

- Another handful of REITs hiked their dividends over the last 24 hours. UMH Properties (UMH) rallied more than 3% after it hiked its dividend by 5.3% while Seven Hills Realty (SEVN) rallied more than 7% today after it hiked its dividend by 67%.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished lower Thursday with technology stocks lagging once again after another record-high inflation report with the PPI Index showing nearly double-digit annual inflation in producer prices. Snapping a two-day rebound which followed a five-day skid, the S&P 500 slipped 1.4% today while the tech-heavy Nasdaq 100 slumped 2.4%. The Mid-Cap 400 declined 0.4% while the Small-Cap 600 finished off by 0.1%. Residential REITs and homebuilders were again bright-spots today, but pressure on technology REITs dragged the Equity REIT Index lower by 0.4% despite 12-of-19 property sectors finishing in positive-territory while Mortgage REITs declined 0.4%.

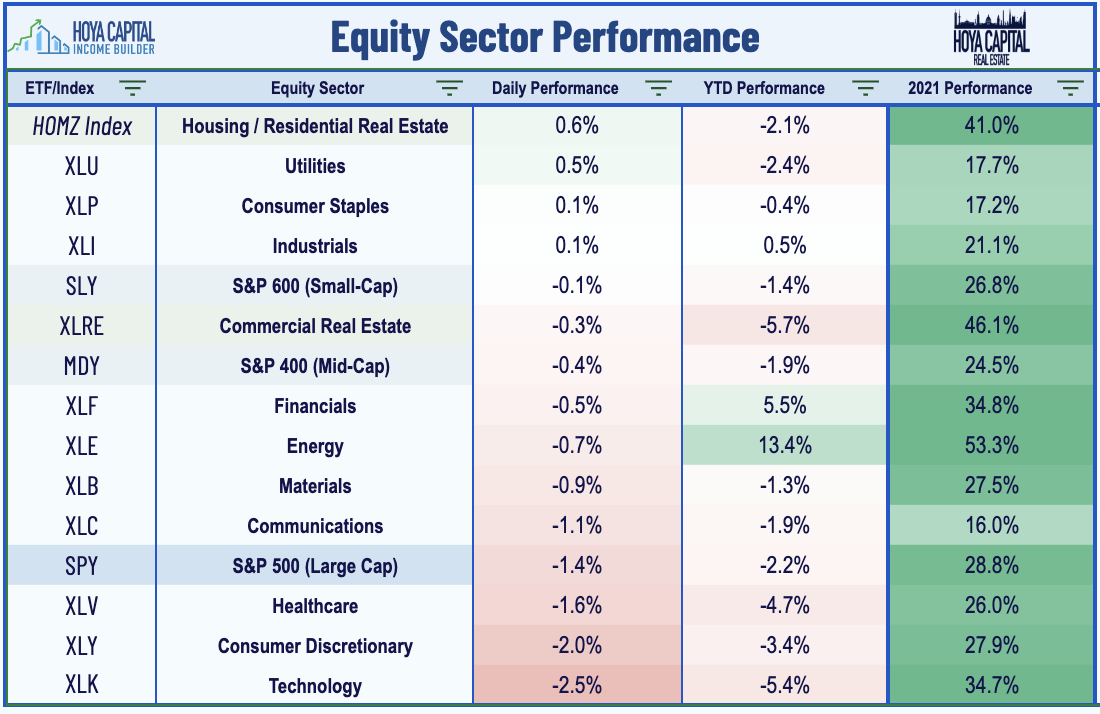

After eclipsing the highest level since the start of the pandemic earlier this week, the 10-Year Treasury Yield has pulled back over the past three days despite CPI and PPI inflation data showing continued upward price pressures. Three of the eleven GICS equity sectors were higher today, led to the upside by the Utilities (XLU) and Consumer Staples (XLP) sectors while Technology (XLK) slumped. Homebuilders and the broader Hoya Capital Housing Index were among the leaders again today following strong earnings results from KB Home (KBH) which confirmed that demand continues to outpace considerably supply across the new home construction industry.

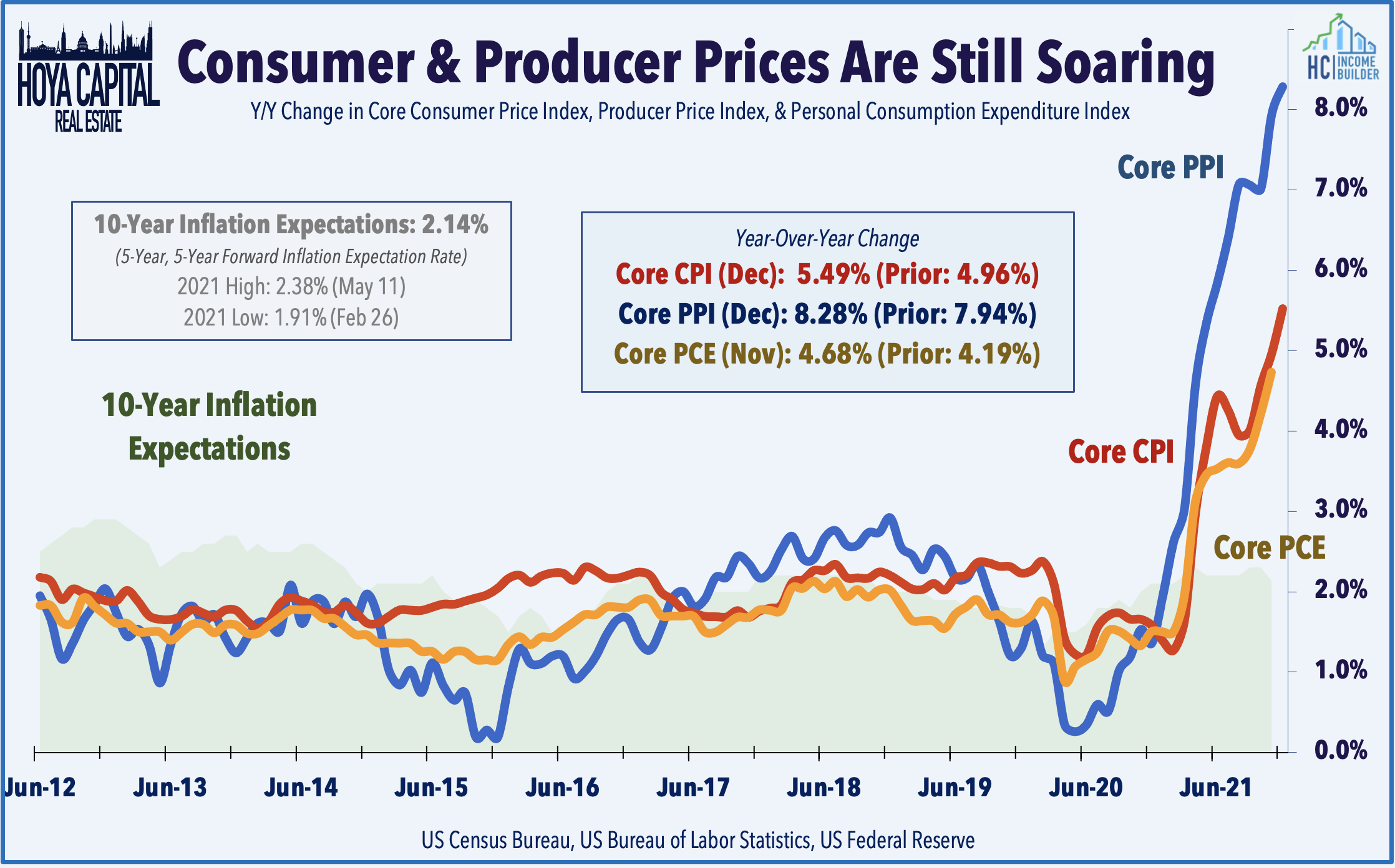

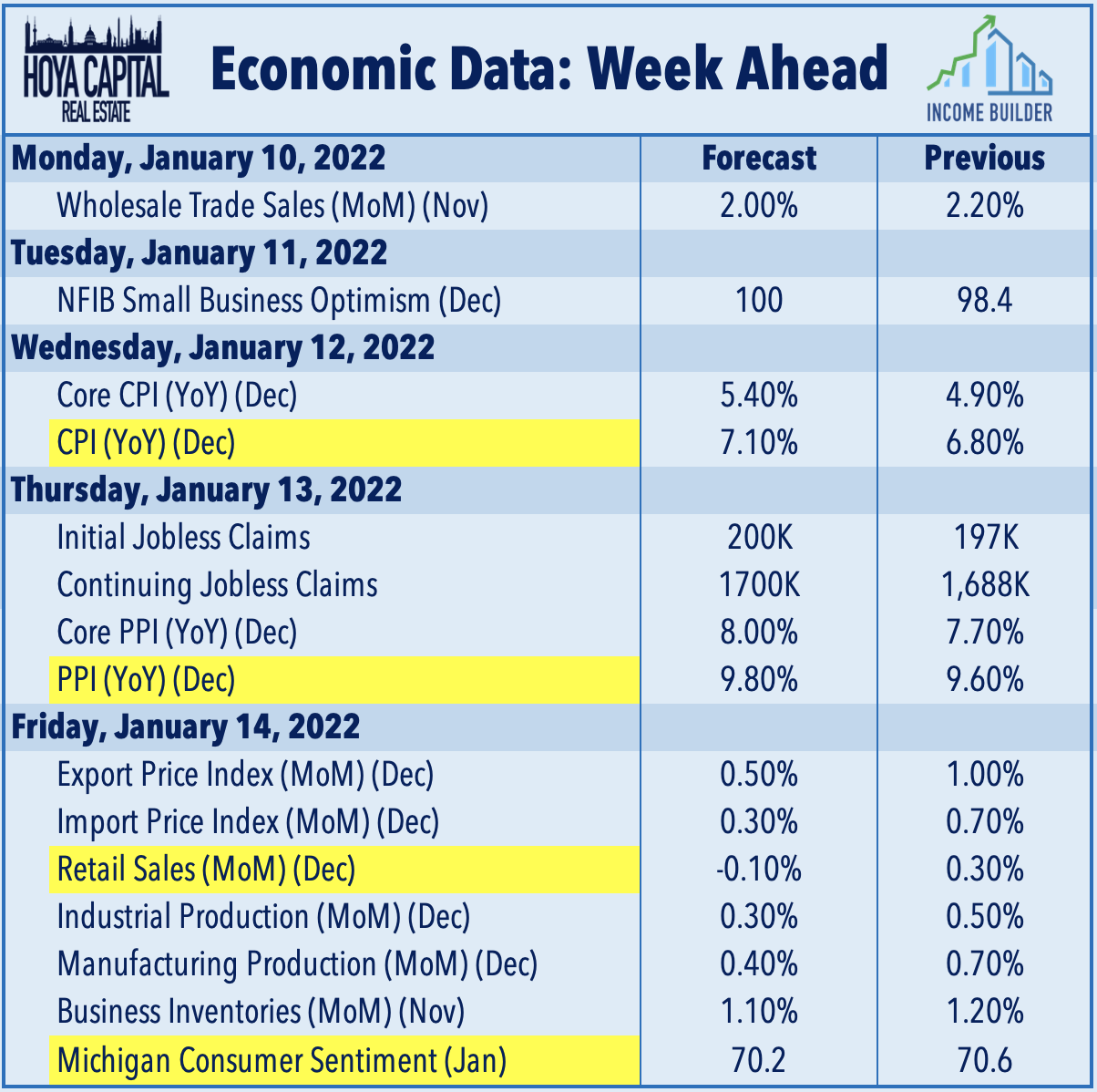

Inflation Stays Red Hot: The BLS reported this morning that producer prices rose at the fastest rate on record in December with the headline PPI Index soaring 9.7% from last year. Excluding food and energy, Core Producer Prices 8.3%, also the largest gain on record and above the expected rise of 8.0%. This hotter-than-expected producer price data comes after the BLS reported yesterday that consumer prices rose at 7.0% rate in December - the highest annual increase since 1982 as inflation has so far proven to be less "transitory" than many economists projected.

Equity REIT & Homebuilder Daily RecapHomebuilders: KB Home (KBH) rallied more than 16% after reporting solid Q4 results and providing strong guidance which calls for 30% revenue growth in 2022. KBH delivered EPS growth of more than 70% in 2021 despite "extremely challenging operating conditions with labor shortages and supply chain disruptions, along with municipal and related delays." This evening, we'll publish an exclusive report on Income Builder which will discuss recent trends and our updated outlook on the homebuilding sector.

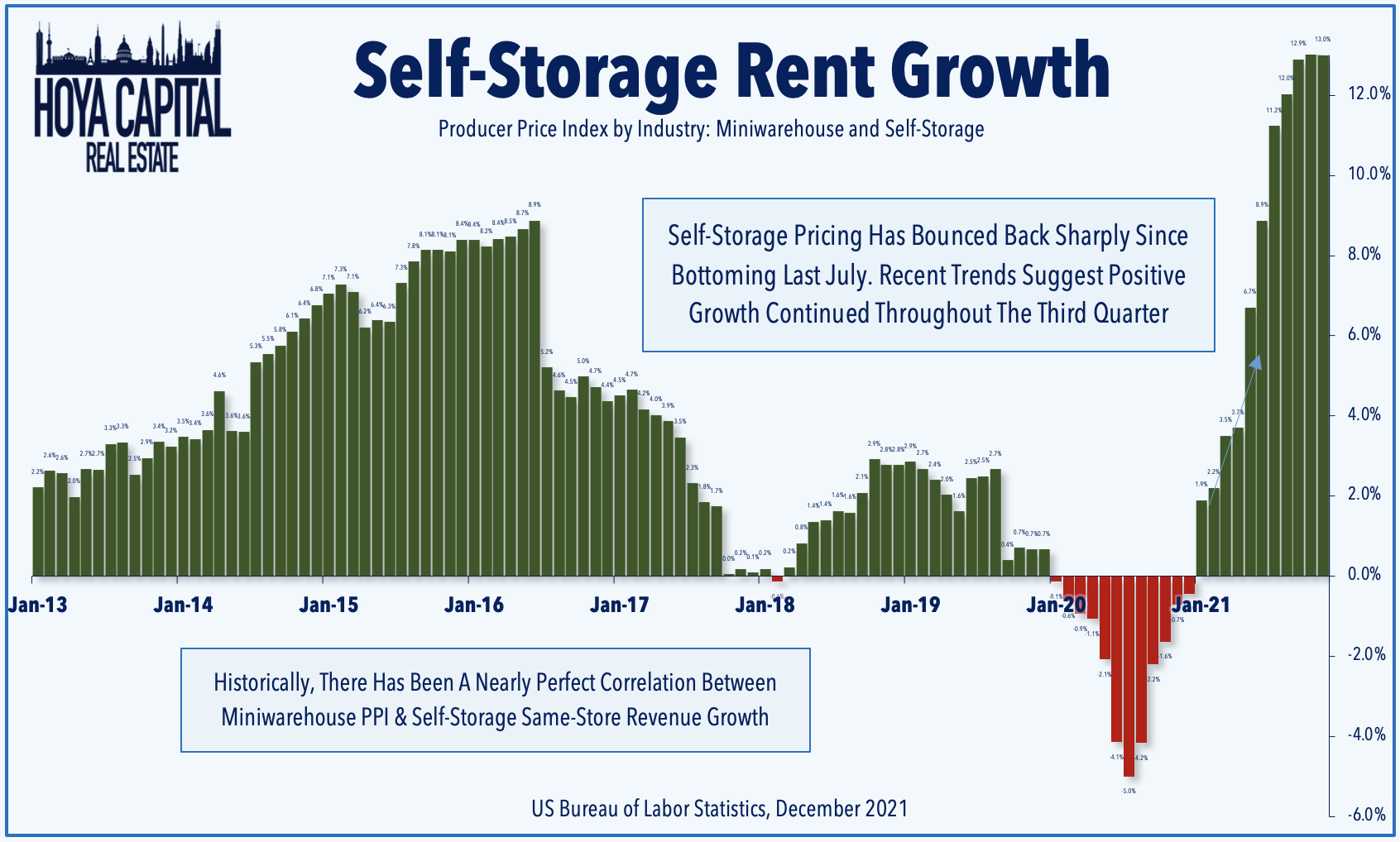

Storage: Today, we published Storage REITs: Space Race Rebound which discussed why self-storage demand has come roaring back over the last eighteen months, powering a robust rebound for the previously-slumping storage sector. Forward-looking indicators and industry commentary suggest that the positive momentum should continue into 2022. The Producer Price Index for self-storage facilities - which has historically exhibited a near-perfect correlation with same-store revenue growth metrics - showed continued strength deep into Q4. Residential REITs have historically been one of the most effective inflation hedges across all asset classes, and self-storage REITs are no exception, resulting from short lease terms and "sticky" demand.

Another handful of REITs hiked their dividends over the last 24 hours. UMH Properties (UMH) rallied more than 3% after it hiked its dividend by 5.3% to $0.20/quarter. Before UMH's dividend hike last year, it had held its rate steady at $0.18 for over a decade. Elsewhere, Office Properties (OPI), Diversified Healthcare (DHC), Servies Properties (SVC), and Industrial Logistics (ILPT) held their dividends steady at their current rates. As discussed in our State of the REIT Nation report, FFO growth significantly outpaced dividend growth in 2021, pushing REIT dividend payout ratios to just 67% in Q3 - well below the 20-year average of 75% - indicating that REITs are well equipped to continue to raise their payouts in the quarters ahead.

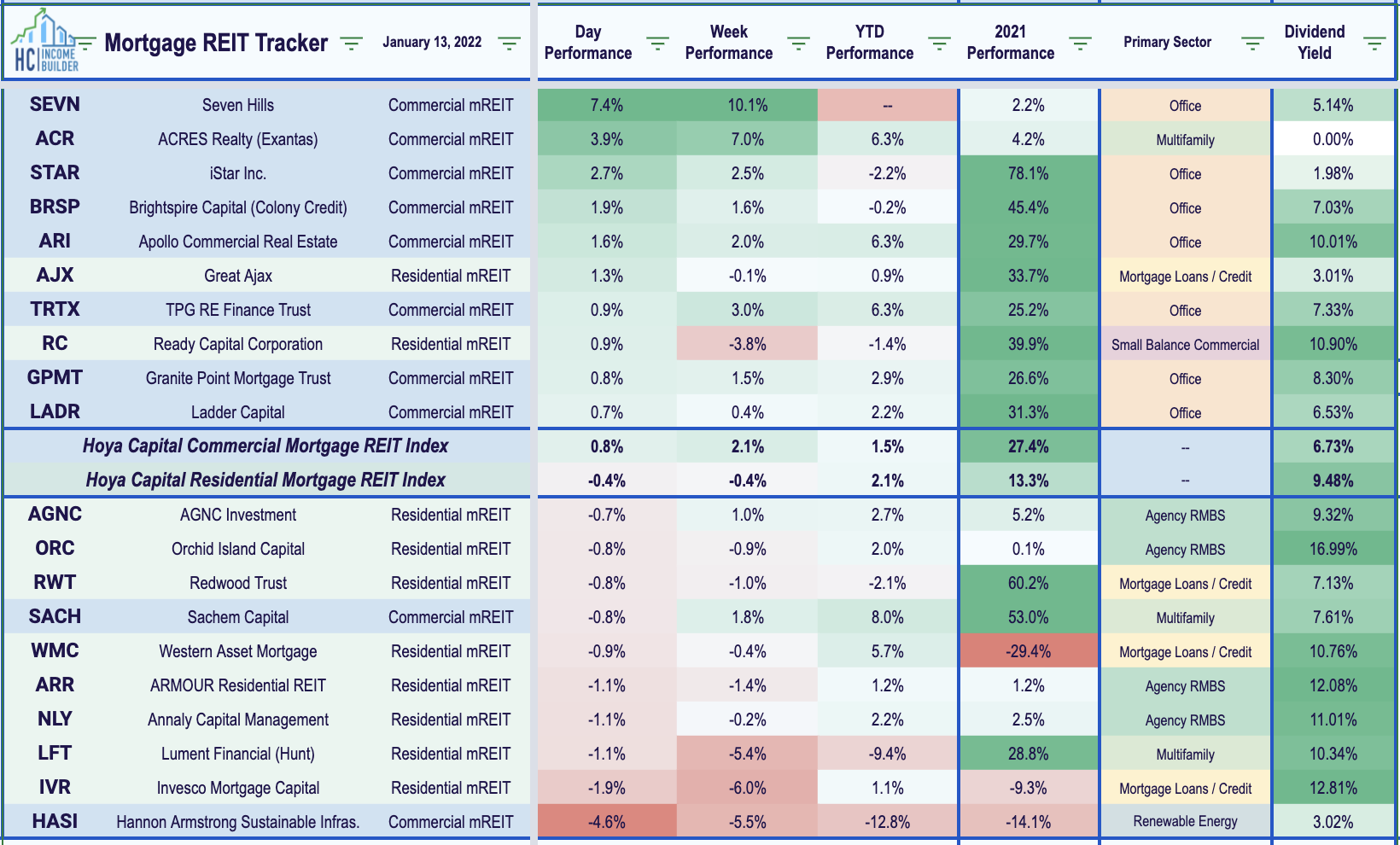

Mortgage REIT Daily RecapPer the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs gained 0.8% today while residential mREITs slipped 0.4% today. For full-year 2021, the NAREIT Mortgage REIT Index delivered price returns of 7.0% and total returns of 16.0%. Seven Hills Realty (SEVN) rallied more than 7% today after it hiked its dividend by 67% to $0.25/share/quarter, representing a forward yield of roughly 9.2%. The average residential mREIT pays a dividend yield of 9.48% while the average commercial mREIT pays a dividend yield of 6.73%.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.