Tech Rebound • Strong Jobs Data • mREIT Dividend Cut

- U.S. equity markets rebounded Thursday- led by a rebound in technology stocks- following strong employment data and a retreat in energy prices, offsetting pressure from a continued rise in Treasury yields.

- Climbing back into positive territory for the week, the S&P 500 advanced 1.5% today while the tech-heavy Nasdaq 100 rallied 2.2%, extending a rally of over 13% from its recent lows.

- Real estate equities were mixed today with cannabis and healthcare REITs leading to the upside as the Equity REIT Index advanced 0.5% with all 15-of-19 property sectors in positive-territory.

- The U.S. labor market remains a bright spot in an increasingly choppy economic environment as Initial Jobless Claims data today showed the fewest jobless filings since September 1969.

- Small-cap Western Asset Mortgage (WMC) was among the laggards today after cutting its dividend by 33% to 0.04/share - the third mortgage REIT to reduce its dividend this year compared to seven dividend increases.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Thursday - led by a rebound in technology stocks - following strong employment data and a retreat in energy prices, offsetting pressure from a continued rise in Treasury yields. Climbing back into positive territory for the week, the S&P 500 advanced 1.5% today while the tech-heavy Nasdaq 100 rallied 2.2%, extending a rally of over 13% from its recent lows earlier this month. Real estate equities were mixed today with cannabis and healthcare REITs leading to the upside as the Equity REIT Index advanced 0.5% with all 15-of-19 property sectors in positive-territory while Mortgage REITs advanced 0.4%.

The U.S. labor market remains a bright spot in an increasingly choppy economic environment as Initial Jobless Claims data today showed the fewest jobless filings since September 1969 while PMI data was also better-than-expected, rising to an eight-month high in March. The 10-Year Treasury Yield closed modestly higher today - but slightly below its three-year highs of 2.39% set earlier this week, while WTI Crude Oil (CL1:COM) pulled back 3%. Homebuilders remained under pressure today followed mixed results from KB Home (KBH), which slumped after reporting ongoing supply chain issues, commenting that its "biggest challenge today is completing homes, not selling them, as demand continues to be robust."

Real Estate Daily Recap

Hotels: Yesterday evening, we published an updated report on the Hotel REIT sector on the Income Builder Marketplace. Hotel REITs - one of just three property sectors in positive-territory this year - entered 2022 with positive fundamental momentum and reasons for cautious optimism following four-straight years of underperformance. Spring Break is back- for some, at least. Sunbelt and leisure-focused markets continue to substantially outperform Coastal business-focused markets. Recent high-frequency data has been encouraging, contrasting with the gloomy attitude in confidence surveys. TSA Checkpoint data rebounded to 90% of pre-pandemic levels last week while average national hotel occupancy is back at its 20-year average. In the report, we discussed our recent trade and our updated outlook for 2022.

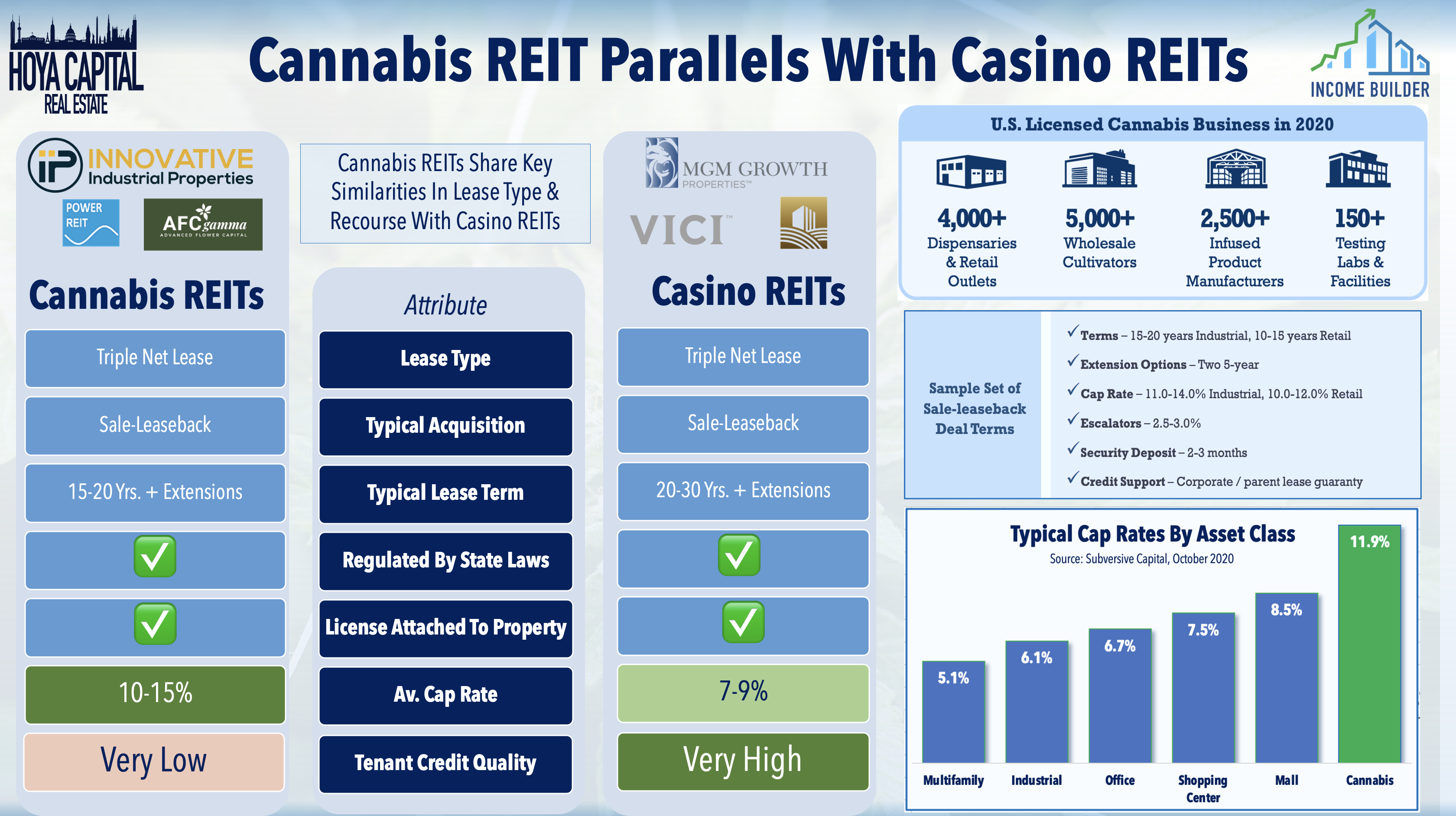

Cannabis: Yesterday, we also published Cannabis REITs: Own The Pharmland. Cannabis REITs have stumbled in early 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization. Owning the "Pharmland" - the physical real estate - has been one of the few themes in the space that has worked as cannabis ETFs have delivered dismal investment performance since 2019. Thriving in the murky and often contradictory regulatory framework of legalized marijuana, recent movement in Washington on cannabis-related bills has raised questions about the future prospects in a federally-legalized environment.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs advanced 0.5% today while residential mREITs advanced 0.4%. Small-cap Western Asset Mortgage (WMC) was among the laggards today after cutting its dividend by 33% to 0.04/share - the third mortgage REIT to reduce its dividend this year compared to seven dividend increases. The average residential mREIT pays a dividend yield of 11.01% while the average commercial mREIT pays a dividend yield of 7.45%.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.