UK Disinflation • Office Default • REIT Earnings

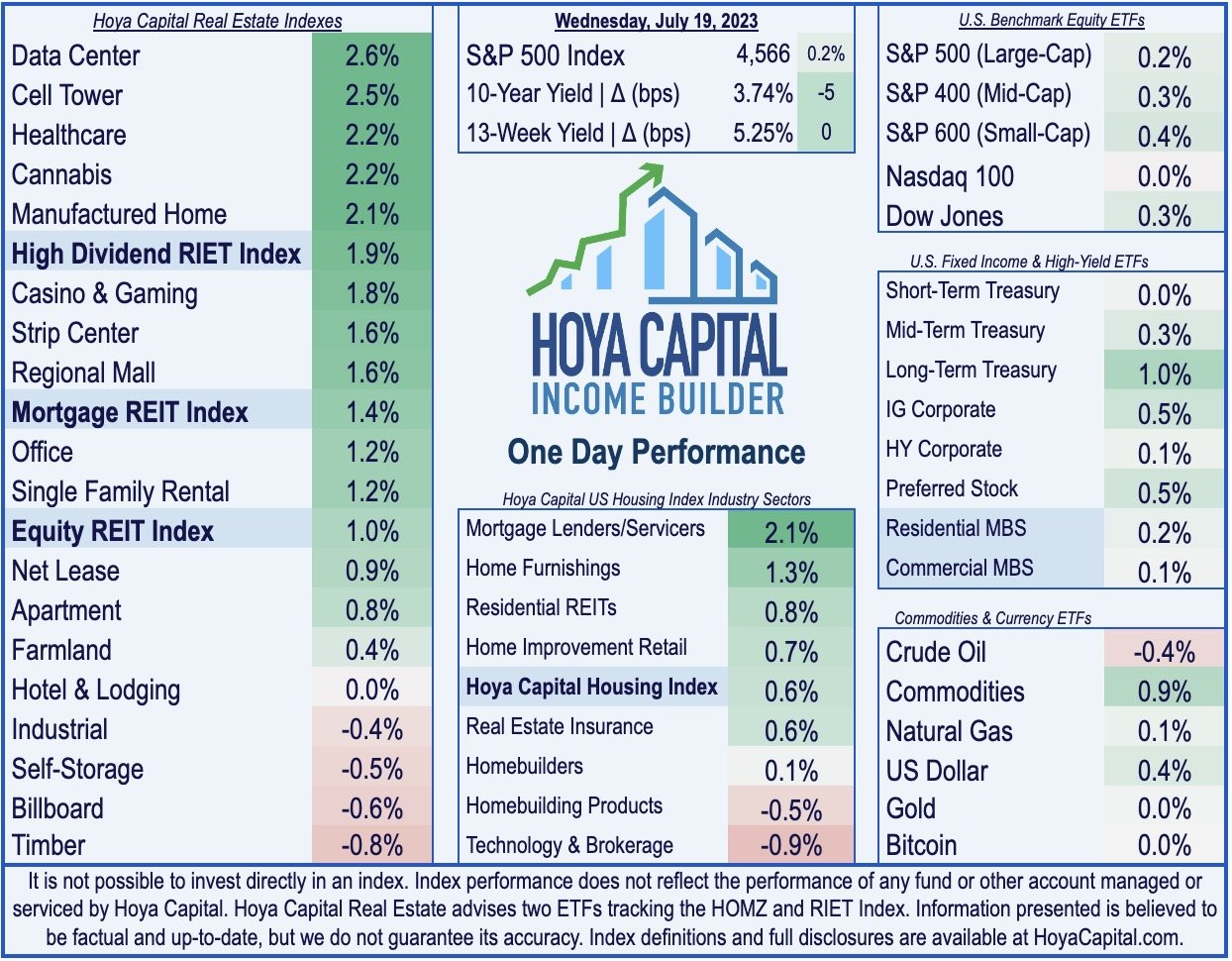

U.S. equity and bond markets extended their rally Wednesday while global benchmark interest rates retreated after UK inflation data showed similar disinflationary trends as exhibited across recent U.S. inflation reports.

Closing at the highest levels since January 2022, the S&P 500 gained another 0.2% today. The Dow gained 109 points, posting an eight-straight day of gains.

Lifted by a continued retreat in benchmark interest rates, real estate equities were again among the leaders today ahead of a busy afternoon of earnings reports. Equity REITs gained 1.0%.

Bloomberg reported yesterday that Starwood Capital defaulted on a $212.5M mortgage on a 29-story Atlanta office building, one of a half-dozen loan defaults in recent months from highly-leveraged private equity portfolios.

As discussed in our REIT Earnings Preview, industrial REITs Rexford (REXR) and First Industrial (FR) report earnings results this afternoon, as does cell tower REIT Crown Castle (CCI) and office REIT SL Green (SLG).

Income Builder Daily Recap

U.S. equity and bond markets extended their rally Wednesday while global benchmark interest rates retreated after UK inflation data showed similar disinflationary trends as exhibited across recent U.S. inflation reports. Closing at the highest levels since January 2022, the S&P 500 gained another 0.2% today, while the Mid-Cap 400 and Small-Cap 600 posted gains of 0.3% and 0.4%, respectively. The Dow gained 109 points, posting an eight-straight day of gains. Lifted by a continued retreat in benchmark interest rates, real estate equities were again among the leaders today ahead of a busy afternoon of earnings reports. The Equity REIT Index gained 1.0% today, with 14-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.4%. Homebuilders and the broader Housing Index finished higher as well today despite a modest downside surprise on new home construction data.

Office: Bloomberg reported yesterday that Starwood Capital defaulted on a $212.5M mortgage on a 29-story Atlanta office building, one of a half-dozen loan defaults in recent months from highly-leveraged private equity portfolios. The mortgage loan was originated at a loan-to-value of nearly 80% in 2018 - more than double the comparable leverage profile of the average office REIT. Despite the relative outperformance of Sunbelt over to coastal office markets, the company was unable to find a buyer to pay more than the total debt balance, consistent with recent estimates which peg the average decline for office assets at between 20-40%, depending on the region and sub-market. Compounding issues from the increased debt service cost and a dwindling equity interest, the building's occupancy rate dipped from around 85% to just above 60% this year after its largest tenant vacated at the end of 2022. Trepp reported last month that delinquency rates on CMBS office loans jumped 128 basis points to 4.2% in May, which was the highest since 2018.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.