Fed Downshift • REIT Dividend Hikes • C-Suite Shakeups

- U.S. equity markets retreated Wednesday after the Federal Reserve hiked interest rates by another 50 basis points- a downshift from the prior meeting- but signaled that more hikes are still to come.

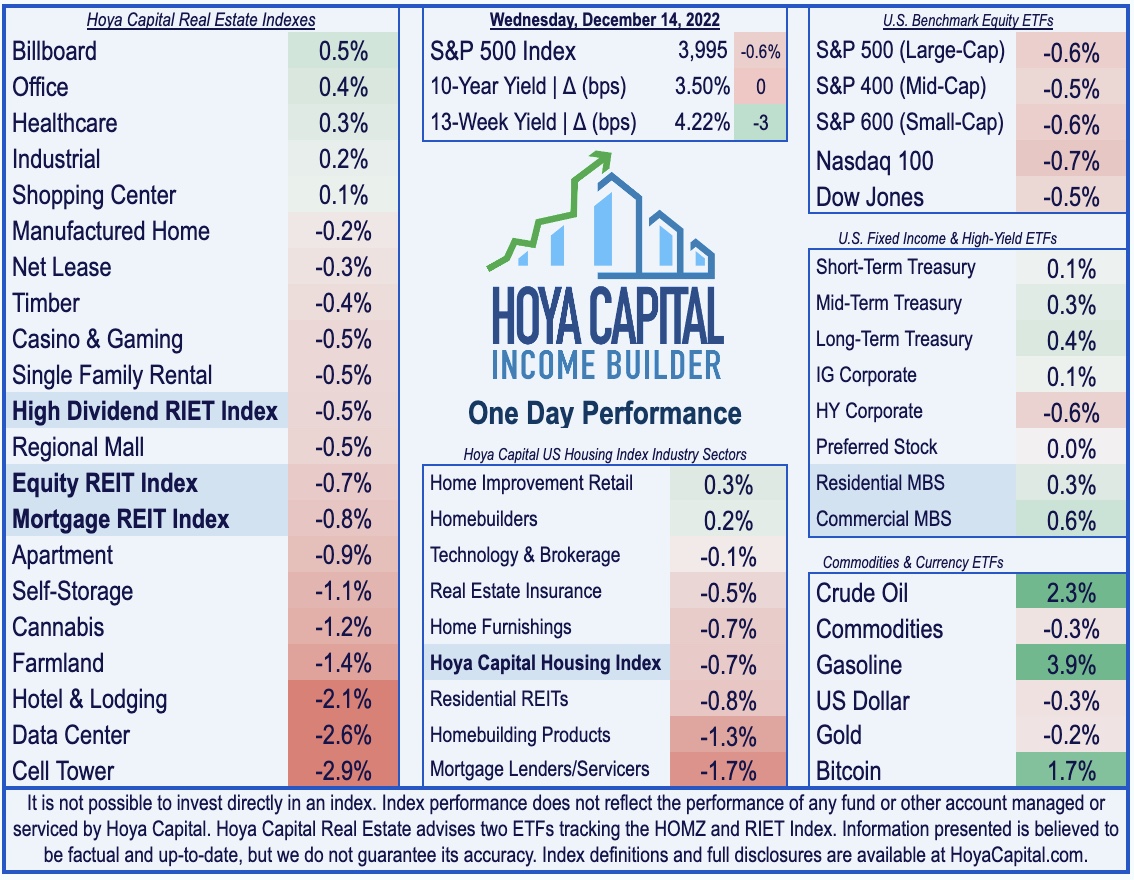

- Snapping a two-day streak of gains, the S&P 500 slipped 0.6% on the day while the tech-heavy Nasdaq 100 declined 0.7%. The 10-Year Treasury Yield finished little-changed at 3.50%.

- Real estate equities were mostly lower on the session as well. Equity REITs slipped 0.7% while Mortgage REITs declined 0.8%. Homebuilders gained on data showing a rebound in mortgage applications.

- Another day, another wave of REIT dividend hikes. Mid-America Apartments (MAA) hiked its quarterly dividend by 12% while net lease REIT Realty Income (O) raised its monthly dividend by 0.2%.

- Digital Realty (DLR) dipped 4% today after the company announced that it would replace CEO Bill Stein with its current CFO Andy Power at the end of the year. DLR has underperformed its peer Equinix (EQIX) over most recent measurement periods.

Income Builder Daily Recap

U.S. equity markets retreated Wednesday after the Federal Reserve hiked interest rates by another 50 basis points - a downshift from prior meetings - but signaled that more rate hikes were still to come. Snapping a two-day streak of gains, the S&P 500 slipped 0.6% on the day while the tech-heavy Nasdaq 100 declined 0.7%. Rate markets had a muted response to the Fed's rate decision with the 10-Year Treasury Yield finishing little-changed at 3.50%. Real estate equities were also mostly lower on the session with the Equity REIT Index slipping 0.7% today with 13-of-18 property sectors in negative-territory while the Mortgage REIT Index finished lower by 0.8%. Homebuilders eked out another gain of 0.2% on data showing a rebound in mortgage applications amid the recent pullback in rates.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Another day, another wave of REIT dividend hikes. Mid America Apartments (MAA) hiked its quarterly dividend by 12% to $1.40/share, representing a forward yield of 3.38%. Net lease REIT Realty Income (O) raised its monthly dividend by 0.2% to $0.2485/share, representing a forward yield of 4.60%. Despite the broader economic slowdown, REIT dividend increases continue to significantly outpace REIT dividend decreases consistent with our discussion in our State of the REIT Nation report last month which noted that REIT payout ratio ratios remain below the long-term historical averages, implying that REITs have significant 'embedded' dividend growth that should be unlocked over the coming quarters. In total, more than a dozen REITs hiked their dividend this week while three REITs reduced their payouts, bringing the full-year total to 120 REIT dividend hikes compared to 12 dividend decreases.

Data Center: Digital Realty (DLR) dipped 4% today after the company announced that it would replace CEO Bill Stein with its current CFO Andy Power at the end of the year. Stein has served as DLR's CEO since November 2015, and it is speculated that the termination was related to the firm's relative underperformance. DLR has underperformed the REIT Index on a 1-year, 3-year, and 5-year basis while its peer Equinix (EQIX) has outperformed the REIT Index in each of those periods. The new CEO Andy Power has served as DLR's President since November 2021 and as its CFO since 2015, overseeing DLR’s global portfolio, asset management, and the firm's financial functions. We discussed last week in Data Center REITs: Positioned For Cloud Competition that property-level fundamentals have strengthened in recent quarters despite an expected downshift in cloud-related spending.

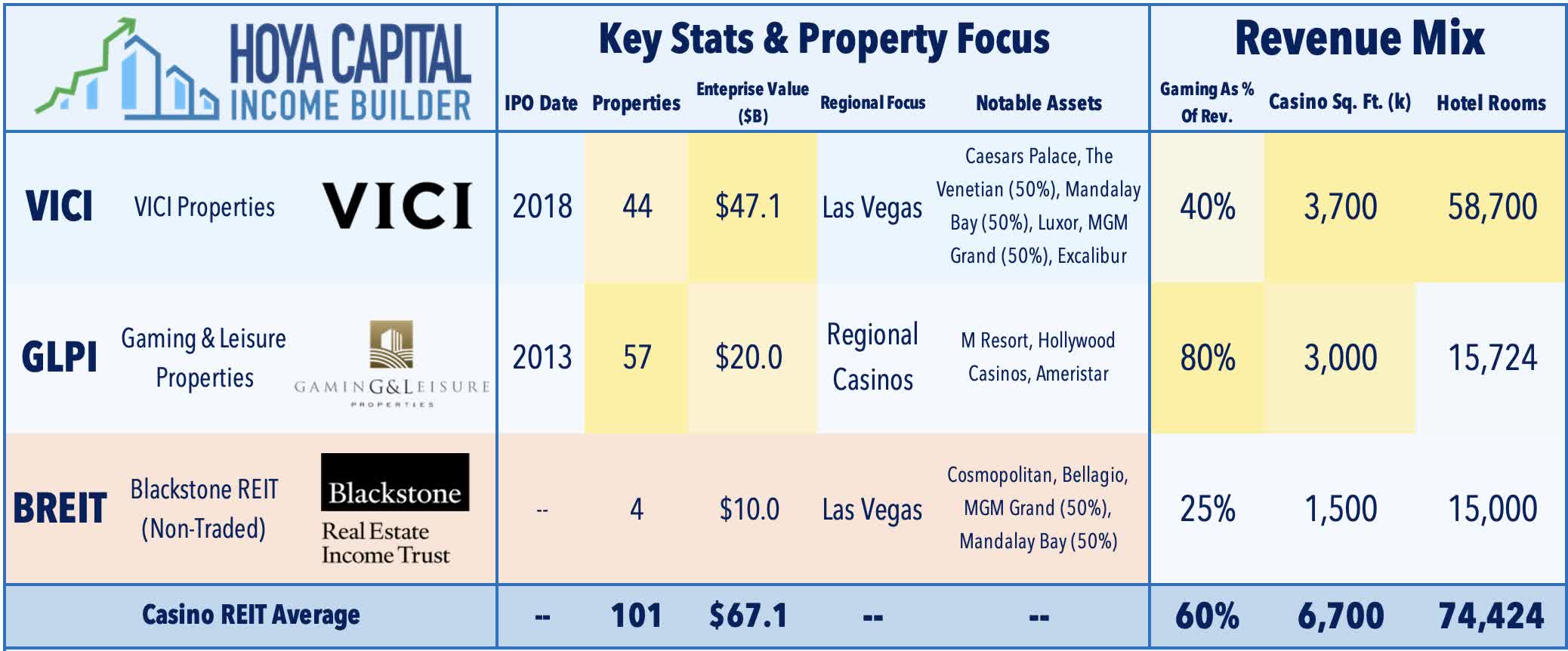

Casino: Yesterday, we published Casino REITs: Hold 'Em As Others Fold 'Em. The lone property sector in positive territory this year, Casino REITs have benefited from their attractive “inflation-hedging” lease structure, the rebound in Las Vegas travel demand, and broader institutional investor acceptance. VICI boasts inflation-linked escalators on 96% of leases while GLPI benefits from indirect inflation hedges linked to tenant performance. Casino REITs have been thrust into the spotlight as apparent beneficiaries of outflows at Blackstone’s (BX) non-traded REIT platform BREIT, spawning a $5.5B acquisition of two Vegas casinos by VICI Properties (VICI). Balance sheet “firepower” and access to longer-term capital have become a significant competitive advantage for public REITs and VICI and GLPI appear particularly well-positioned to play offense while private peers seek an exit.

Additional Headlines from The Daily REITBeat on Income Builder

- BDN announced a cash tender offer for all $350,000,000 of its outstanding 3.95% Guaranteed Notes due February 15, 2023 after it closed its previously announced $350M offering of its 7.550% notes due 2028.

- PEI announced the execution of leases with new tenants throughout its portfolio, highlighting the compelling nature of its footprint to expanding retailers noting that YTD through September, leasing volume has exceeded 2019 by 23%

- TRNO announced the addition of Irene H. Oh as an independent director effective January 1, 2023 expanding its Board of Directors to nine

- Income Builder Members receive access to The Daily REITBeat, an institutional-quality daily note that keeps subscribers apprised of pertinent news, data, and trends specifically within the REIT industry.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished lower today with residential mREITs slipping 0.5% while commercial mREITs declined 1.0%. Over the past 24 hours, Orchid Island (ORC), KKR Real Estate (KREF), Apollo Commercial (ARI), and Sachem Capital (SACH) all held dividends steady at current levels. Last month, we published Mortgage REITs: High Yields Are Fine, For Now which discussed why mREITs have rebounded in recent weeks as earnings results were not as catastrophic as feared. Despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends as improved earnings power from wider investment spreads have helped to offset book value declines.

Economic Data This Week

The busy week of economic data continues on Thursday with Retail Sales data covering the early holiday shopping season which is expected to show a slight decline in seasonally-adjusted spending from the prior month. We'll also be watching Jobless Claims data after continuing jobless claims rose to the highest levels since early February at 1.7 million for the week ended Nov. 26 - the largest three-week increase since the depths of the pandemic in May 2020.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.