Jobs Report • Tech Trouble • Apartment Rents Soar

Summary

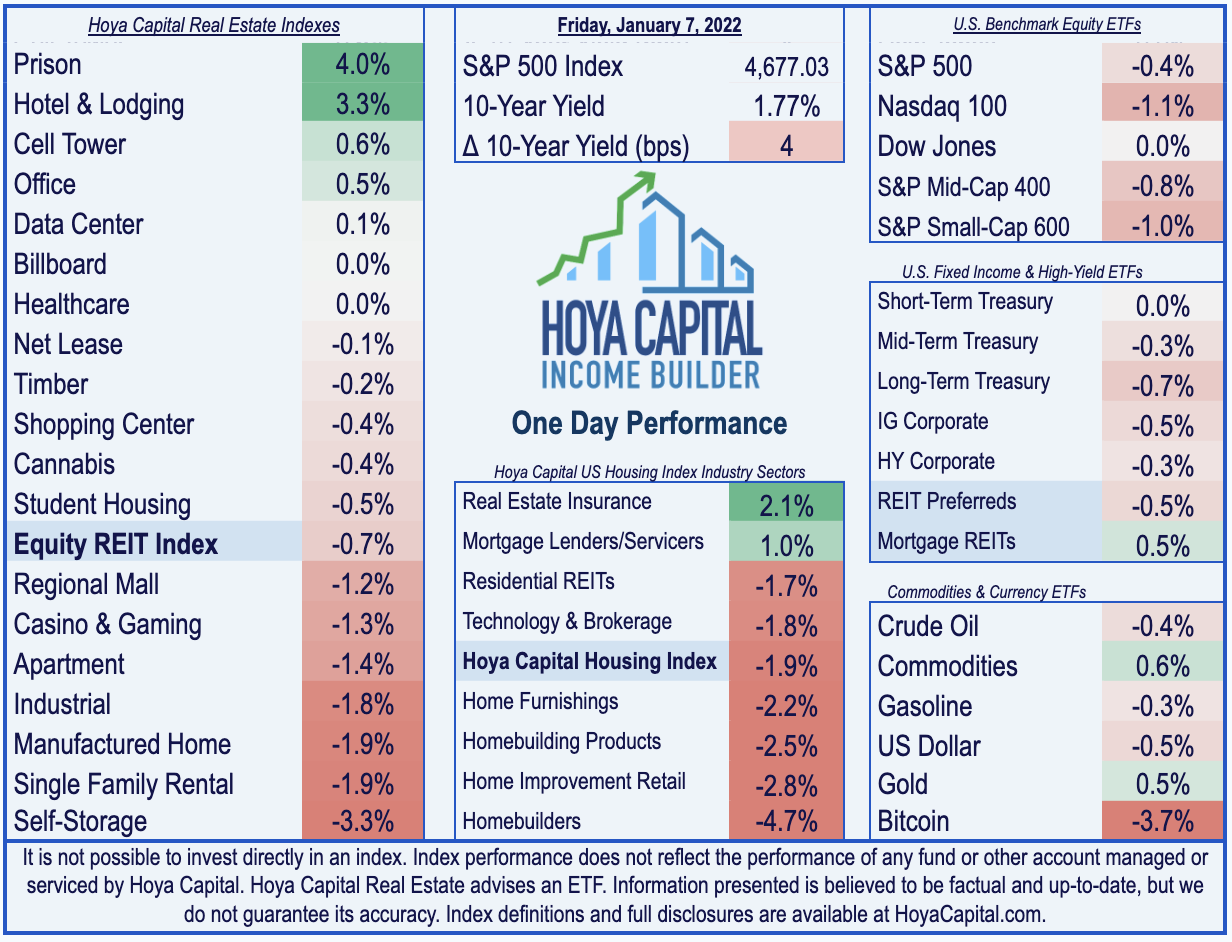

- U.S. equity markets finished lower for the fourth-straight day Friday after mixed employment data appeared to be just enough to keep the Fed on course to hike rates in March.

- Ending the week with cumulative declines of 2%, the S&P 500 slipped another 0.4% today while the tech-heavy Nasdaq declined another 1.1%, ending the week with declines of nearly 5%.

- After posting the strongest gains of any asset class in 2021, real estate equities had a rough start to 2022, posting their worst weekly declines since October 2020, lower by 4.3%.

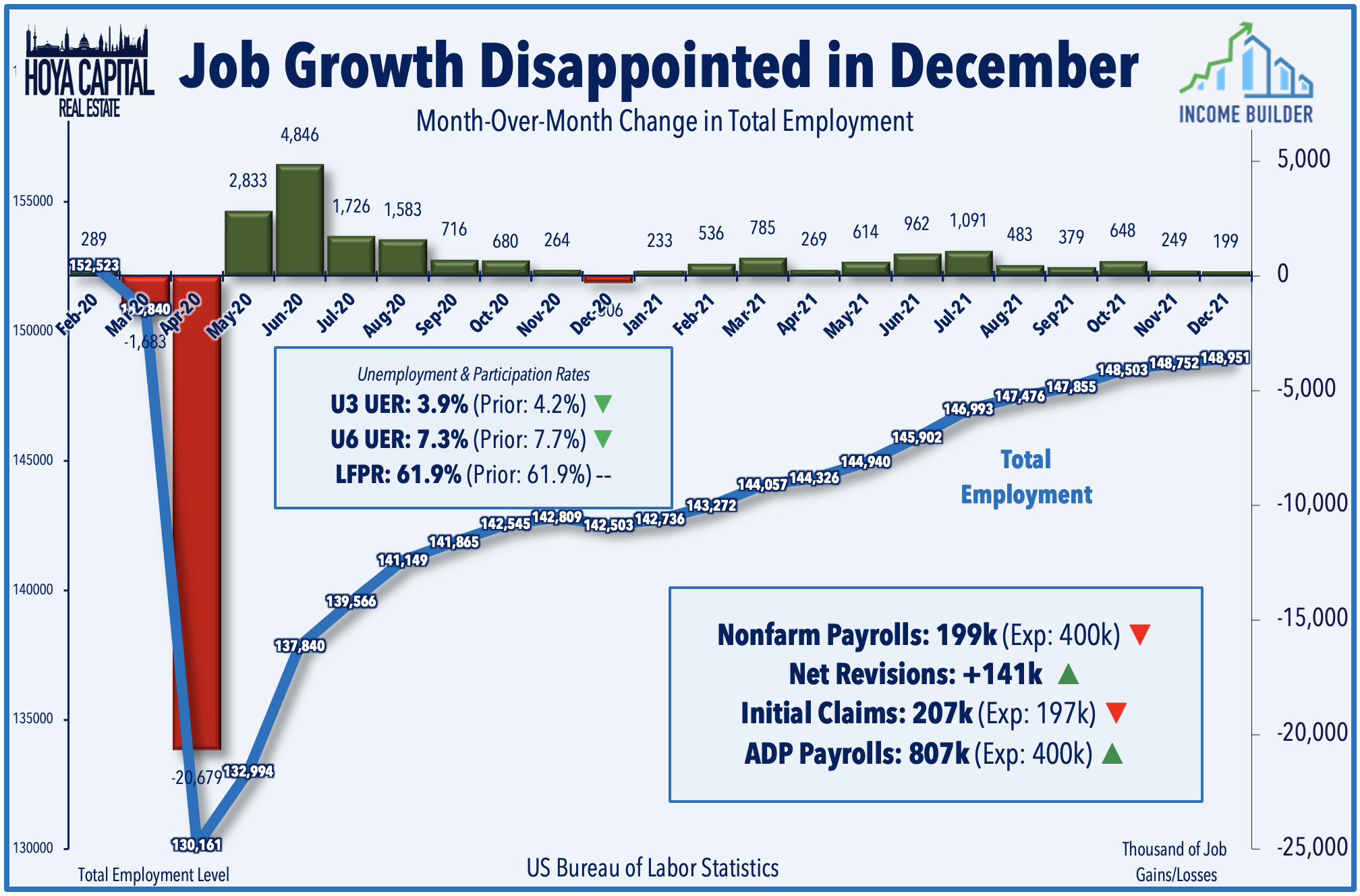

- The U.S. economy added just 199k jobs in December - well below the consensus expectations of 400k, but prior months were revised higher by 141k. The unemployment rate ticked below 4% but the labor force participation rate remained stubbornly depressed.

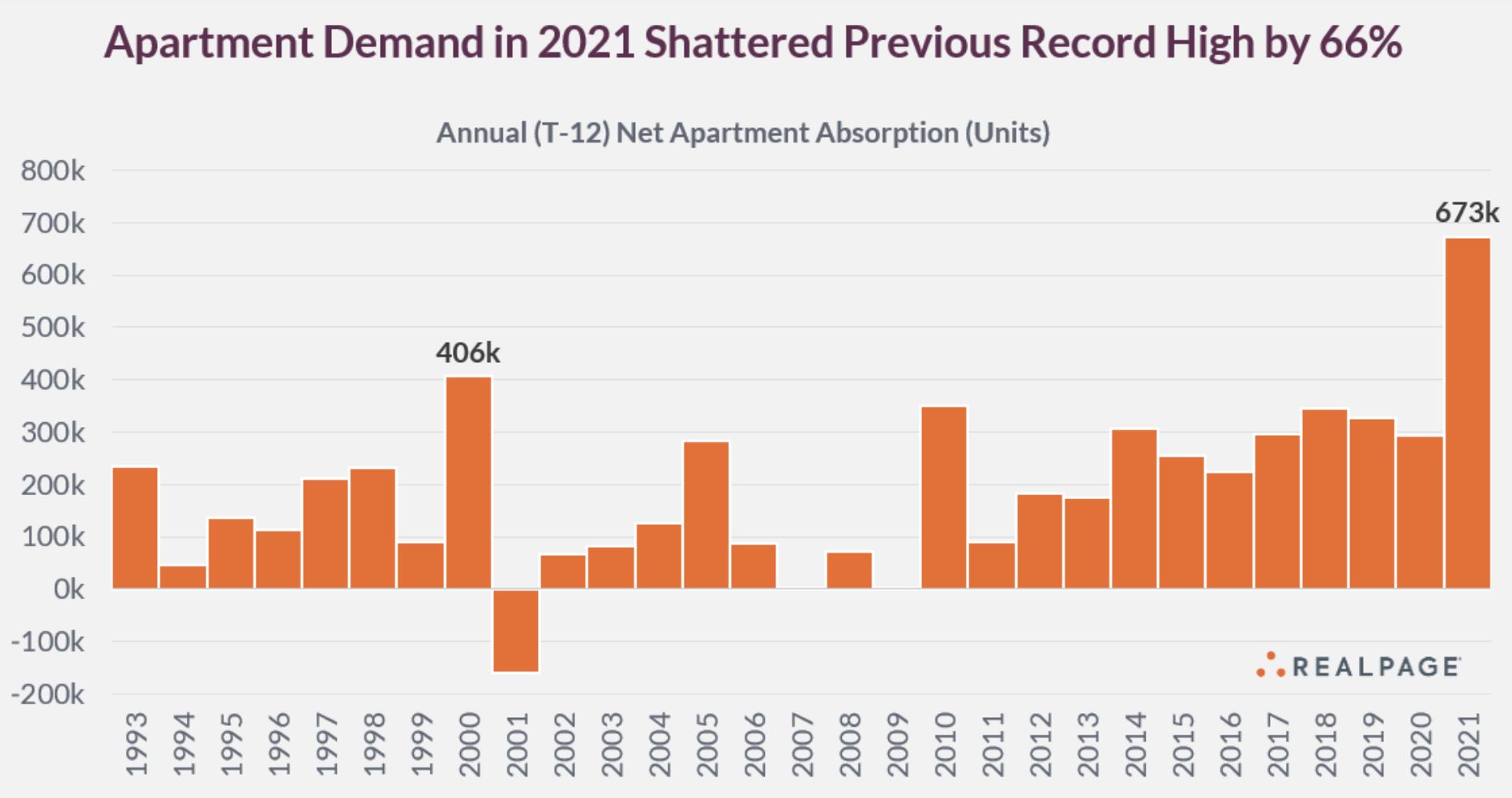

- RealPage reported today that apartment demand soared in 2021 to the highest levels on record. Remarkably, occupancy rates hit or top 96% in 148 of the nation’s 150 largest metro areas.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

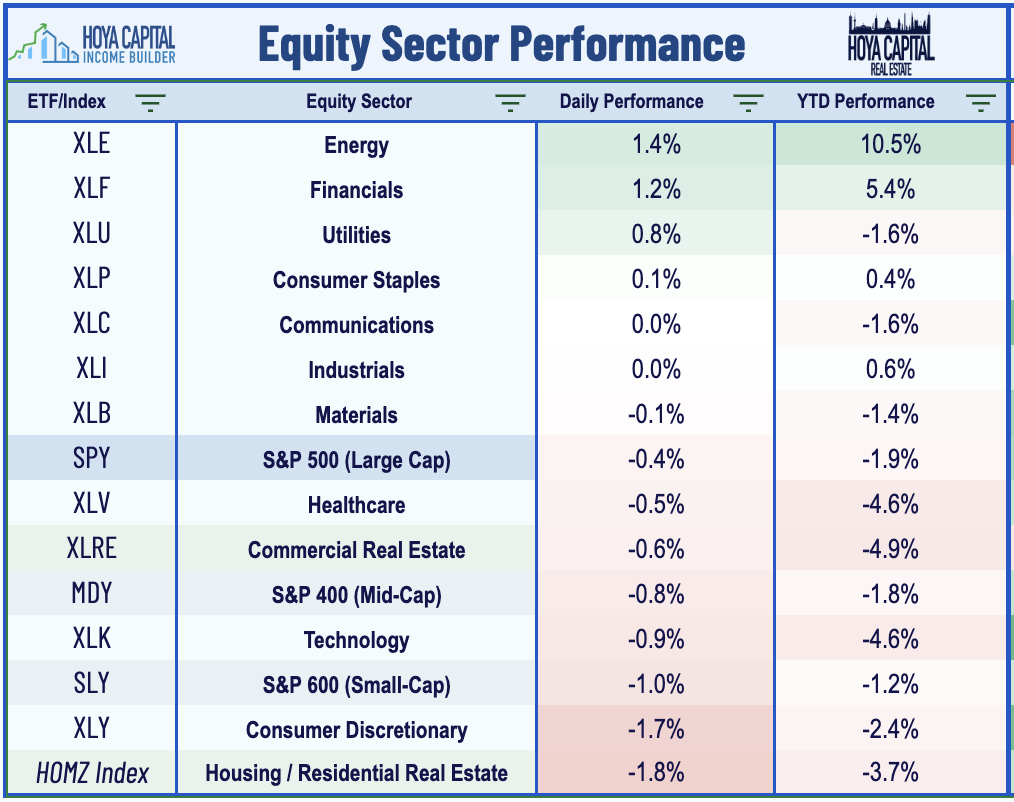

U.S. equity markets finished lower for the fourth-straight day Friday after mixed employment data appeared to be just enough to keep the Fed on course to hike interest rates in the March meeting. Ending the week with cumulative declines of roughly 2%, the S&P 500 slipped another 0.4% on the day while the tech-heavy Nasdaq 100 declined another 1.1% to end the week lower by nearly 5%. After posting the best gains of any asset class in 2021, real estate equities had a rough start to 2021, posting their worst weekly declines since October 2020. The Equity REIT Index slipped 0.7% with 13-of-19 property sectors in negative territory while Mortgage REITs gained 0.5%.

Treasury yields climbed for a fifth consecutive day with the 10-Year Treasury Yield closing at the highest level since the start of the pandemic in early 2020 as today's mixed nonfarm payrolls report appeared to be just strong enough to keep the Federal Reserve on course to begin to hike interest rates in the March meeting. The Energy (XLE) sector was again the leader today among the eleven GICS equity sectors, pushing its gains above 10% for the week. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

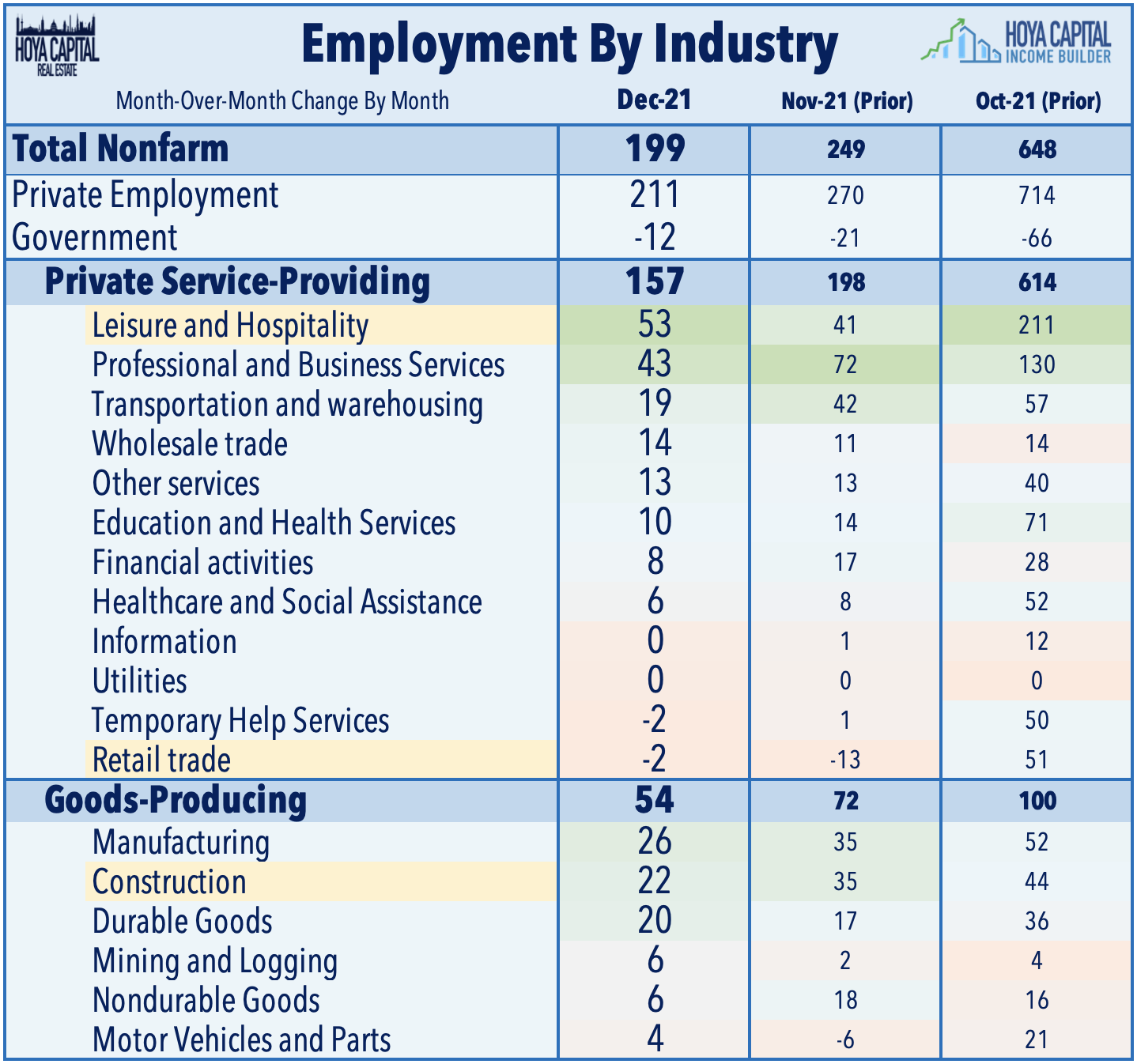

Following a weaker-than-expected nonfarm payrolls report in the prior month, the Bureau of Labor Statistics reported this morning that the U.S. economy added just 199k jobs in December - well below the consensus expectations of 400k. The prior two months were revised higher by a combined 141k, however, and the relatively weak "headline" number followed better-than-expected ADP Payrolls report data earlier in the week and a continuation of solid trends in Jobless Claims data. Nonfarm employment has increased by 18.8 million since April 2020 but is down by 3.6 million, or 2.3%, from its pre-pandemic level in February 2020.

The labor force participation rate was unchanged at 61.9% in December but remains 1.5 percentage points lower than in February 2020. The employment-population ratio increased by 0.2 percentage points to 59.5% in December but is 1.7 percentage points below its February 2020 level. In December, employment continued to trend up in leisure and hospitality, in professional and business services, in manufacturing, in construction, and in transportation and warehousing, but retail trade remains a source of weakness despite the record year for retail sales in 2021 and strong holiday spending trends.

Equity REIT & Homebuilder Daily Recap

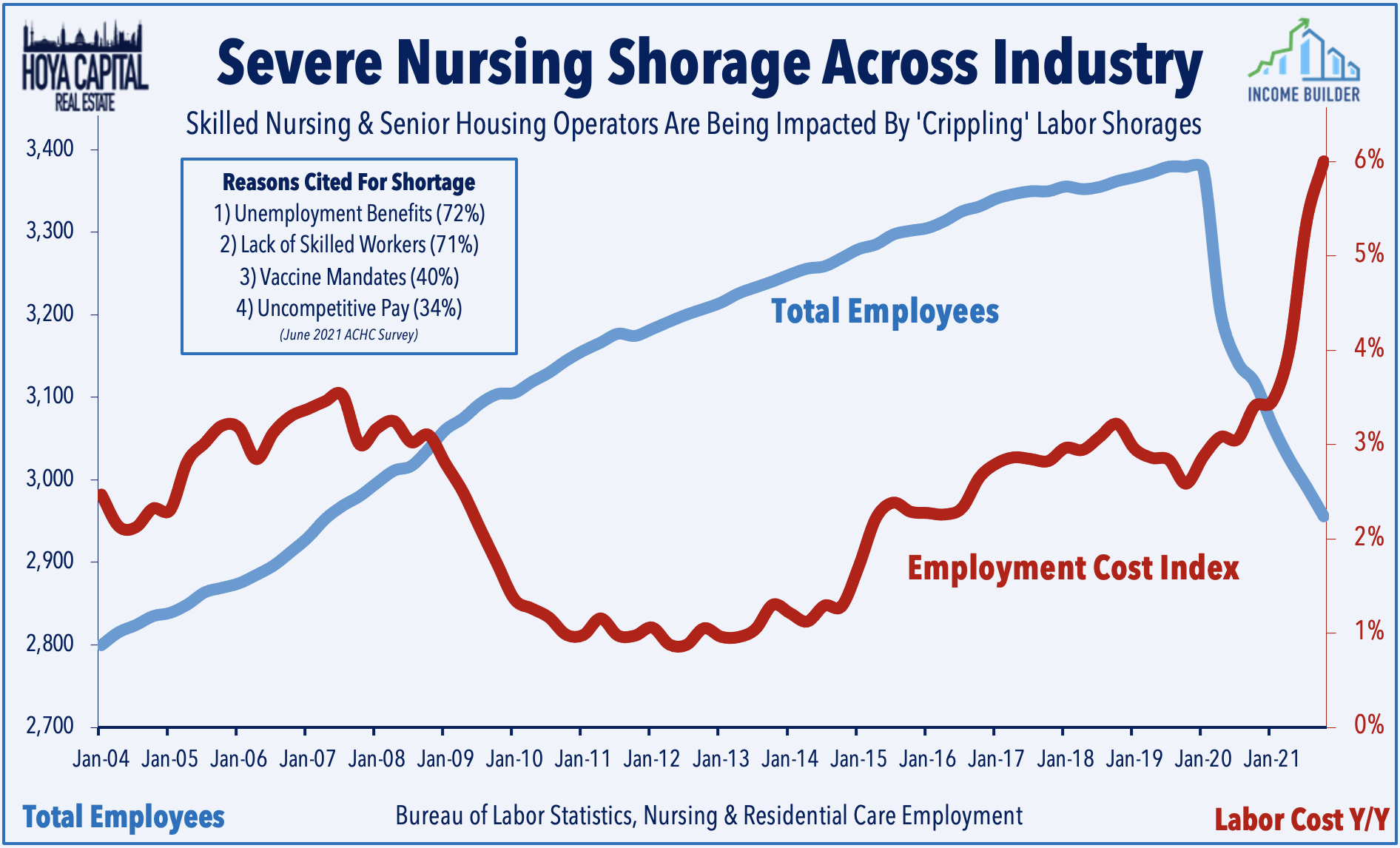

Healthcare: Today we published a Healthcare REITs: Choppy Road To Recovery as an exclusive report for Income Builder members, which discussed our updated outlook and top picks within the healthcare REIT sector. After a vaccine-driven revival, Healthcare REITs were the weakest-performing property sector in 2021 as the promising recovery in the Skilled Nursing and Senior Housing was slowed by the COVID reacceleration. Staffing shortages remain critical issues at skilled nursing and senior housing facilities, a trend that continued in today's payrolls report, pressuring not only operating margins but also forcing some facilities to turn-away business.

Apartments: Apartment demand soared in 2021 to the highest levels on record in according to a report published today by RealPage. Net demand totaled more than 673k units – "obliterating" the previous high set in 2000 by a remarkable 66%. RealPage reported that demand would have been even stronger if not for record-low vacancy, severely limiting the number of units available to rent. Strong demand drove up apartment occupancy 2.1 basis points year-over-year to 97.5%. Both the increase and the resulting rate were the highest on record. Remarkably, occupancy rates hit or top 96% in 148 of the nation’s 150 largest metro areas.

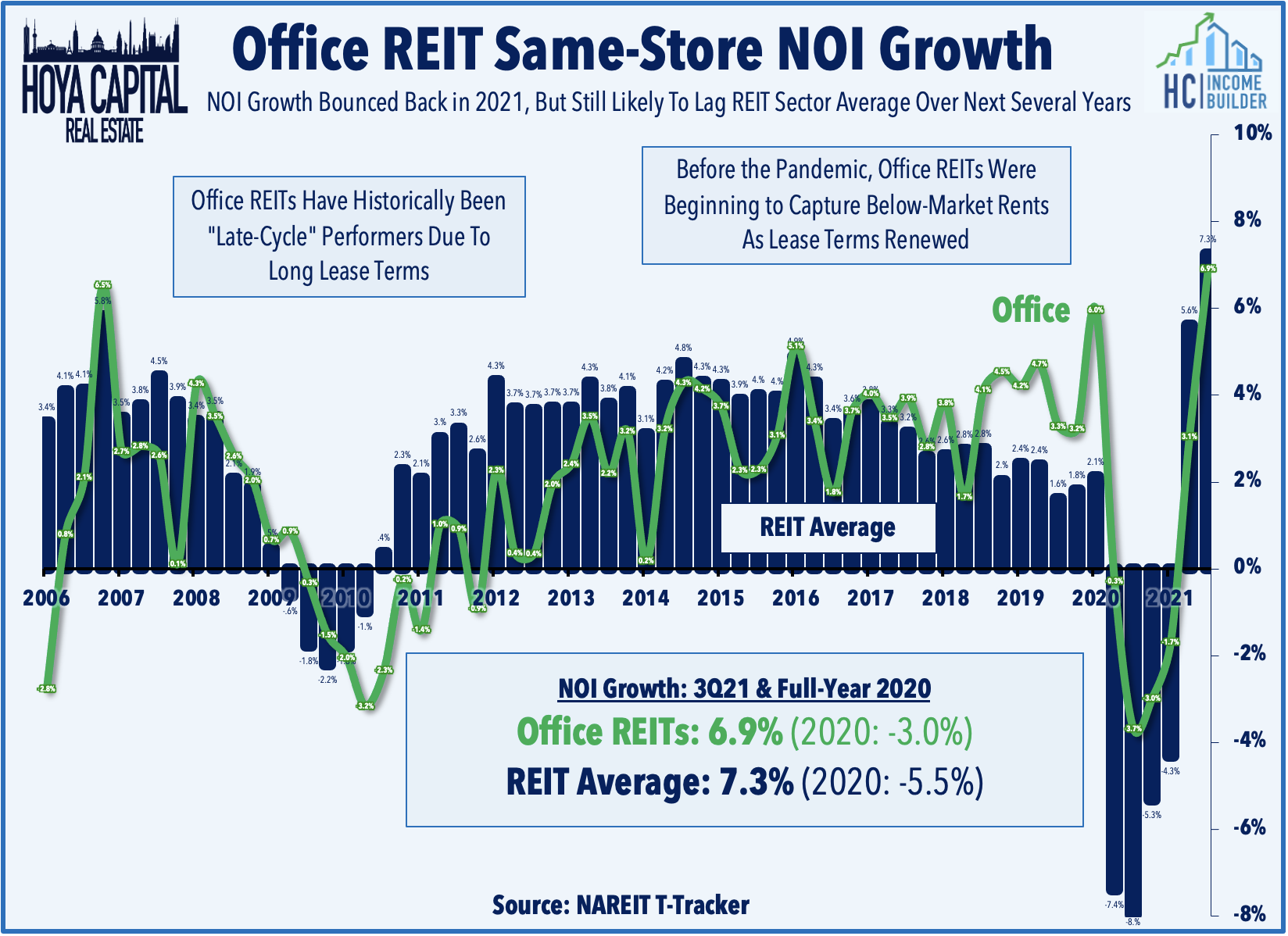

Office: Yesterday, we published Always Sunnier in the Sunbelt. The long-delayed 'return to the office' has been postponed yet again by another wave of the pandemic, but office demand has been stronger than many assume. The office REIT outlook has brightened in recent months - particularly for REITs focused on business-friendly Sunbelt regions - following solid earnings results, favorable leasing trends, and strong comparable pricing. Office utilization rates have recovered only a fraction of pre-COVID levels, however, in dense coastal "shutdown cities" with longer transit-heavy commutes. Start a free two-week trial to read the full report here and how we're allocating to the office sector.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.