Peak Inflation? • Bonds Rebound • Shelter CPI Catch-Up

- U.S. equity markets were modestly-lower Tuesday following data showing the highest rate of consumer inflation in four decades, but bonds caught a bid amid potential early signs of peaking inflation.

- Adding to declines of 1.6% yesterday, the S&P 500 and Nasdaq 100 each slipped another 0.4% today, but Mid-Caps and Small-Caps were again notable outperformers.

- Residential REITs led the gains across real estate equities today as shelter inflation picked up steam. The Equity REIT Index declined 0.2% with 10-of-19 property sectors in positive territory.

- The BLS reported this morning that consumer prices surged at the fastest pace in over four decades in March. CPI rose 1.2% from last month - the largest month-over-month increase since Hurricane Katrina in 2005 - and rose 8.6% year-over-year, the highest annual increase since 1982.

- There have been early hints of easing inflation in energy prices and transportation, but shelter costs will continue to put upward pressure on headline inflation metrics. Shelter costs increased 0.5% in March and accounted for nearly two-thirds of the monthly increase in the Core CPI Index.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets were modestly-lower Tuesday following data showing the highest rate of consumer inflation in four decades, but bonds caught a bid amid early amid signs of peaking inflation in several key categories. Adding to declines of 1.6% yesterday, the S&P 500 and Nasdaq 100 each slipped another 0.4% today, but Mid-Caps and Small-Caps were again notable outperformers. Real estate equities were mixed today as the Equity REIT Index declined 0.2% with 10-of-19 property sectors in positive territory while Mortgage REITs gained 0.4%.

Bond investors finally saw some relief today from the historic "bond rout" seen throughout early 2022 as the 10-Year Treasury Yield declined 6 basis points today while the 2-Year Treasury Yield fell to 2.39% - its lowest close since late March. High-yield corporate bonds (HYG) and mortgage backed-bonds (MBB) - which have been among the harder-hit fixed income segments this year - led the bond rebound today. Four of the eleven GICS equity sectors finished in the green today, led to the upside by Energy (XLE) stocks after Crude Oil (CL1:COM) prices surged more than 5% today back above $100/barrel while Financials (XLF) and Healthcare (XLV) dragged on the downside.

The BLS reported this morning that consumer prices surged at the fastest pace in over four decades in March as inflation has so far proven to be less "transitory" than many economists and politicians projected. The Consumer Price Index rose 1.2% from last month - the largest month-over-month increase since Hurricane Katrina in 2005 - and rose 8.6% year-over-year, the highest annual increase since 1982. Prices for food, rent, and gasoline were once again the largest contributors to inflation as the energy index rose 32.0% over the last year, and the food index increased 8.8% percent, the largest 12-month increase since May 1982.

As we've discussed for the last year, we continue to see persistent pressure on the headline inflation metrics due to the delayed impact of soaring rents and home values, which are just beginning to filter in the data. The cost of shelter increased 0.5% in March and accounted for nearly two-thirds of the monthly increase in the Core CPI Index. Private market rent data has shown that national rent inflation has been in the 10-15% range over the past quarter while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

Real Estate Daily Recap

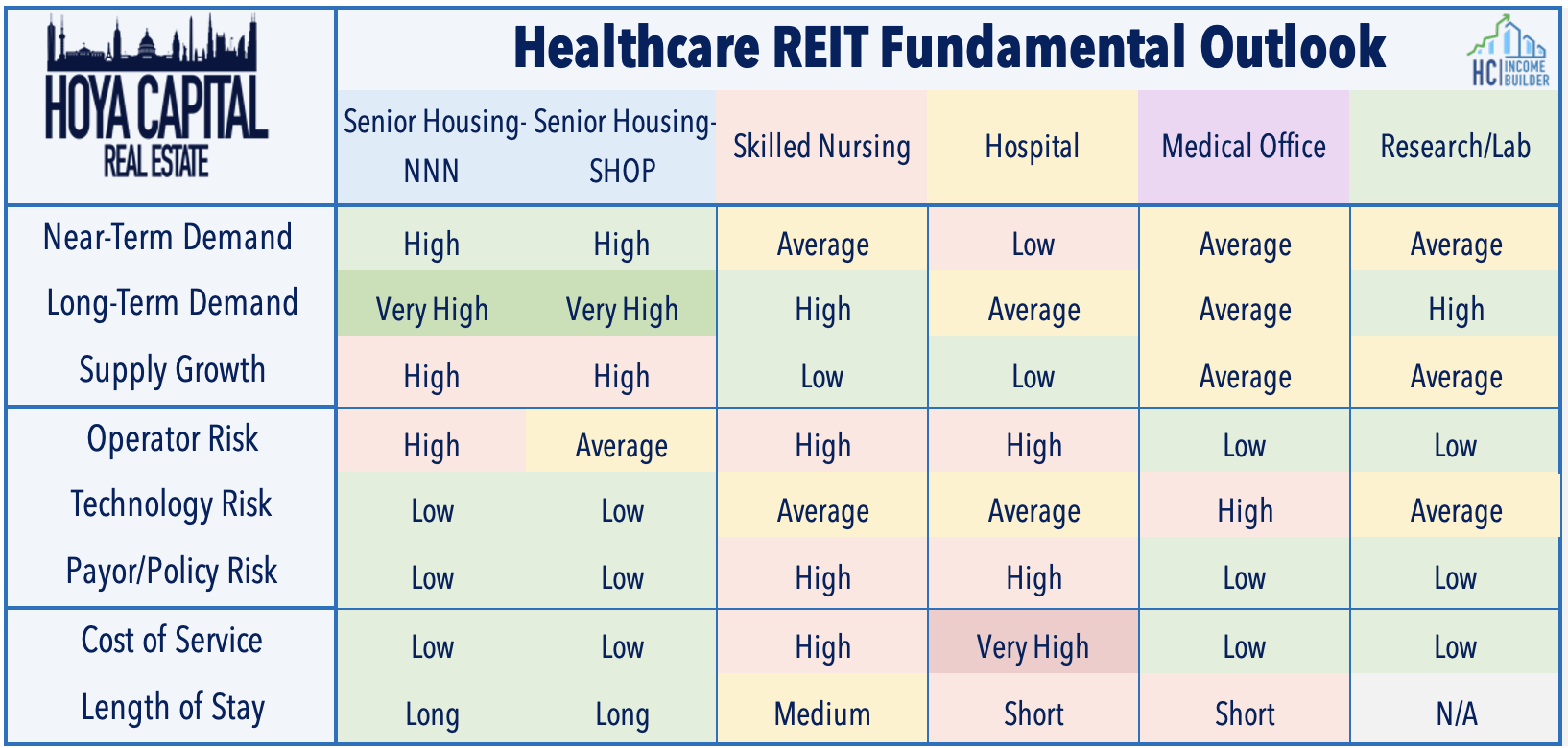

Healthcare: Today we published Healthcare REITs: Life After The Pandemic. Healthcare REITs - which were the weakest-performing property sector in 2021 - have been one of the top-performing REIT sectors in early 2022 as COVID headwinds finally begin to abate. Encouragingly, the Omicron COVID wave merely slowed- but didn't derail- the demand recovery. Staffing shortages have been the more-critical issue of late, and some operators are faring better than others. After a decade of lackluster performance and strenuous portfolio repositioning, the long-awaited demographic tailwinds are finally arriving for senior housing REITs, while new supply growth has moderated. Encouragingly, the Omicron COVID wave merely slowed - but didn't derail - the demand recovery. Staffing shortages have been the more critical issue of late, and some operators are faring better than others.

Office: The Wall Street Journal reported on the office market today, highlighting the looming wave of leases up for renewal this year after many tenants agreed to short-term extensions to previous leases during the pandemic. A recent JLL report noted that a record 243 million square feet of space could expire this year, potentially pushing the office vacancy rate higher in the process. In our recent office report, we discussed that despite low levels of office utilization rates, office leasing demand - and earnings results from these office REITs - has been surprisingly resilient, particularly for REITs focused on business-friendly Sunbelt regions and specialty lab space.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs were higher by 0.5% today while residential mREITs declined 0.6%. AGNC Investment (AGNC) was among the leaders today after it held its dividend steady at $0.12/month, representing a forward yield of 11.5% while Dynex Capital (DX) held its dividend steady at $0.13/month, representing a forward yield of 9.9%. The average residential mREIT pays a dividend yield of 11.50% while the average commercial mREIT pays a dividend yield of 7.56%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 0.65% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%.

Economic Data This Week

Inflation data highlights the busy slate of economic data in the week ahead. On Tuesday, the BLS will report the Consumer Price Index for March which is expected to show the highest rate of consumer inflation since 1982 at 8.4% while the Producer Price Index on Wednesday is expected to show a second-straight month of double-digit inflation rates on producers. We'll see Michigan Consumer Sentiment on Thursday which is expected to show a continued free-fall in consumer confidence in April that some analysts expect could dip below the depths of the Great Financial Crisis when the index bottomed at 55.3 in November 2008. On Thursday, we'll also see Retail Sales data for March, which investors will be watching for early signs of waning consumer spending. Equity markets will be closed on Friday in observation of the Easter holiday while bond markets will close early.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.