Wild Turnaround • Fed Ahead • REIT Earnings Begin

Summary

- U.S. equity markets reversed steep early-session declines to close Monday's session with broad-based gains ahead of a frenetic week of Fed commentary, economic data, and major corporate earnings reports.

- After dipping into "correction territory" earlier in the day, the S&P 500 pared intra-day declines of nearly 4% to end a volatile day higher with gains of 0.3%.

- Real estate equities posted a similarly powerful upside reversal as the Equity REIT Index finished higher by 0.2% with all 10-of-19 property sectors in positive territory while Mortgage REITs finished flat.

- Renewed geopolitical concerns with Russia and weak PMI data initially sent stocks tumbling further this morning before the frenetic late-day rally. Homebuilders and other housing-related stocks were among the upside leaders.

- Real estate earnings season kicks off this week. We’ll hear results from manufactured housing REIT Equity Lifestyle (ELS) and office REIT Boston Properties (BXP) over the next 24 hours.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets reversed steep early-session declines to close Monday's session with broad-based gains ahead of a frenetic week of Fed commentary, economic data, and major corporate earnings reports. After dipping into "correction territory" earlier in the day, the S&P 500 pared intra-day declines of nearly 4% to end the day higher by 0.3% while the tech-heavy Nasdaq 100 posted a nearly 5 percentage-point intra-day turnaround. Real estate equities posted a similarly powerful upside reversal as the Equity REIT Index finished higher by 0.2% with all 10-of-19 property sectors in positive territory while Mortgage REITs finished flat.

As discussed in our Real Estate Weekly Outlook, stocks are coming off their worst week since the beginning of the pandemic amid concerns that the Fed is "behind the curve" in combating inflation. Renewed geopolitical concerns with Russia and weak PMI data initially sent stocks tumbling further this morning before a frenetic late-day rally which resulted in 8-of-11 GICS equity sectors finishing in positive territory. Homebuilders and the broader Hoya Capital Housing Index also joined in the upside rebound today while the 10-Year Treasury Yield retreated for the fourth-straight day after hitting its highest level since late 2019.

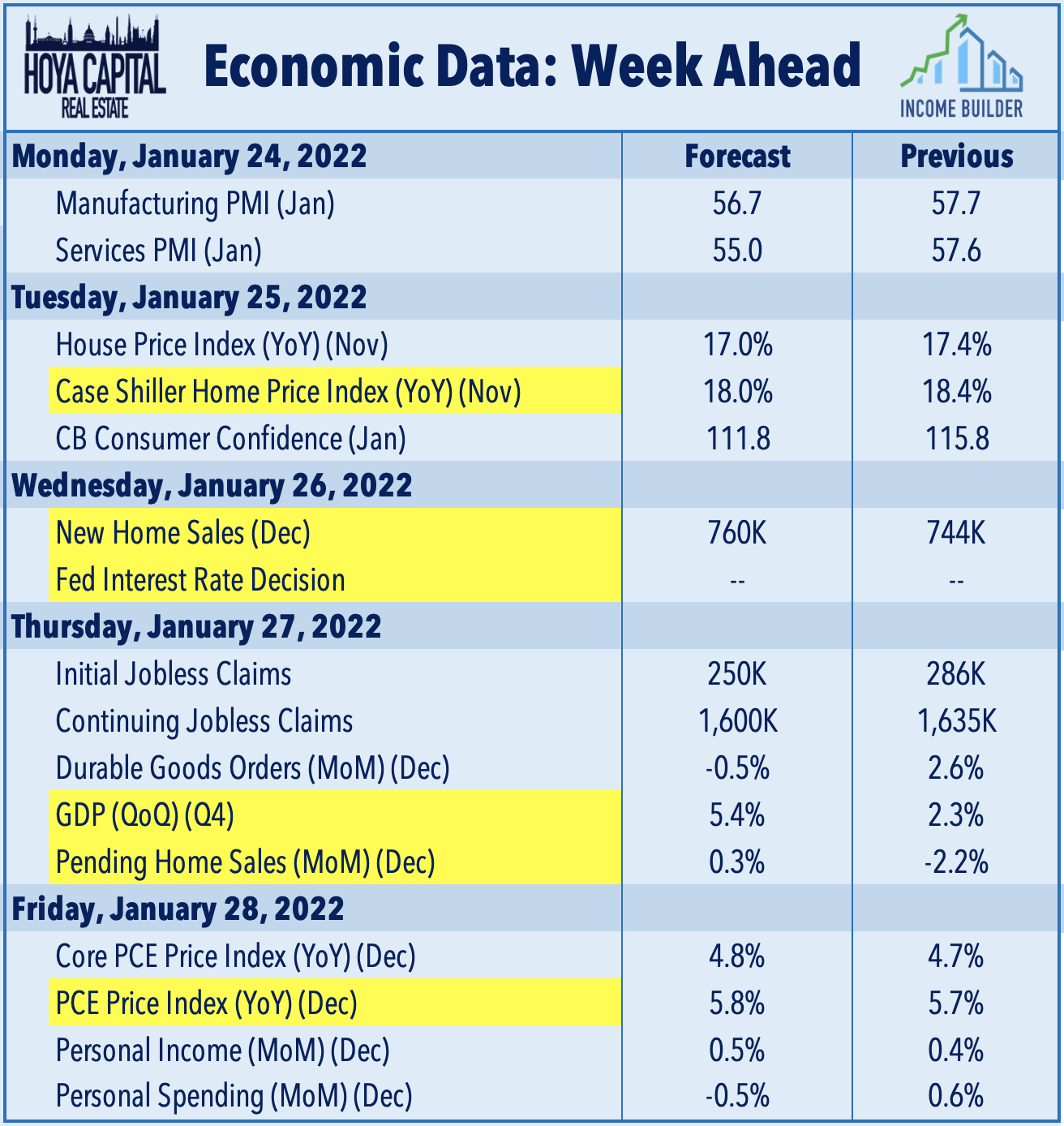

We have another frenetic week of economic data, earnings reports, and Fed-related newsflow in the week ahead, kicking off on Tuesday with the Case Shiller Home Price Index. On Wednesday, we'll see New Home Sales which is expected to show an acceleration in December. Later on Wednesday, we'll hear from the Federal Reserve at the conclusion of their two-day FOMC Meeting. On Thursday, we'll get our first look at fourth-quarter GDP data as well as Pending Home Sales for December. On Friday, we'll see inflation data via the PCE Index as well as Personal Income & Spending data.

Equity REIT Daily Recap

Last Friday, we published REIT Earnings Preview: Focus on Fundamentals for Income Builder members. Real estate earnings season kicks off this week, and REITs enter fourth-quarter earnings season at an interesting crossroads, having been the best-performing asset class of 2021, but also one of the weakest through the first three weeks of 2022. REIT property-level fundamentals remain on an upward-trajectory and we expect another strong quarter from residential REITs, in particular, as recent data indicates that rents continue to soar by double-digit rates. We continue to emphasize the importance of diversification across property sectors and market capitalization tiers. We’ll hear results from Equity Lifestyle (ELS) and Boston Properties (BXP) over the next 24 hours.

Hotel: Pebblebrook (PEB) finished lower by 0.4% today after providing a business update in which it noted that December marked the best performing month compared to 2019 since the pandemic began, but has seen a slowdown in demand and uptick in cancellations in January. PEB saw total revenues lower by just 20% versus 2019 levels, noting that leisure travel continued to be healthy throughout December. However, PEB anticipates January 2022 occupancy levels will be well below December 2021 “due to the usual seasonal slowdown and high levels of group and transient cancellations and much slower bookings” due to concerns with Omicron. Recent TSA Checkpoint data has shown that the impact of the COVID reacceleration has been relatively mild with travel still at 80% of 2019-levels.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs declined by 0.5% today while commercial mREITs declined 0.7%. After leading to the upside last week, Ellington Financial (EFC) slipped 2.5% today after announcing that it closed a $417M residential mortgage securitization. Hannon Armstrong (HASI) bounced back today with 3.3% gains but remains the weakest-performing mREIT this year. Last Friday, we published Mortgage REITs: High Yield Opportunities & Risks which discussed our updated sector outlook and previewed Q4 earnings season.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.