Crypto Crisis • Stocks Slammed • Jobless Claims Jump

- U.S. equity markets finished sharply-lower Thursday after solvency concerns at crypto-focused firms and weaker-than-expected jobless claims data triggered "risk-off" sentiment that sent benchmark interest rates lower across the curve.

- Dipping to its lowest-level in seven weeks, the S&P 500 dipped 1.9% today while the Mid-Cap 400 and Small-Cap 600 each slid by nearly 2.5%. The Dow dipped 544 points.

- Real estate equities remained under pressure as well. The Equity REIT Index declined 2.5% today with all 18 property sectors in negative territory, while the Mortgage REIT Index dipped 4.0%.

- Ahead of the pivotal nonfarm payrolls report on Friday, DOL data this morning showed that Initial Jobless Claims jumped by the most in five months last week while Continuing Claims posted its biggest weekly gain since November 2021.

- Four months after the implosion of the largest cryptocurrency exchange - FTX - the speculative unwind resumed today with the apparent collapse of two crypto-focused banks, Silicon Valley Bank and Silvergate Capital, which sent shockwaves across the banking sector.

Income Builder Daily Recap

U.S. equity markets finished sharply-lower Thursday after solvency concerns at crypto-focused firms and weaker-than-expected jobless claims data triggered "risk-off" sentiment that sent benchmark interest rates lower across the curve. Dipping to its lowest level in seven weeks, the S&P 500 dipped 1.9% today while the Mid-Cap 400 and Small-Cap 600 each slid by nearly 2.5%. The Dow dipped 544 points. Real estate equities remained under pressure as well, with the Equity REIT Index sliding 2.5% today with all 18 property sectors in negative territory, while the Mortgage REIT Index dipped 4.0%. Homebuilders were among the leaders after data from Zillow showed that home prices increased in February for the first time in six months while rents also increased 0.3%, indicating a modest rebound in housing demand.

Four months after the implosion of the largest cryptocurrency exchange - FTX - the speculative unwind resumed today with the apparent collapse of two crypto-focused banks, Silicon Valley Bank and Silvergate Capital, which sent shockwaves across the banking sector, while also fueling a bid for safe-haven Treasuries. After climbing to the highest level since 2007 earlier this week, the policy-sensitive 2-Year Treasury Yield plunged nearly 20 basis points today to close at 4.87% while the 10-Year Treasury Yield retreated by 5 basis points to 3.93%. Ahead of the pivotal nonfarm payrolls report on Friday, DOL data this morning showed that Initial Jobless Claims jumped by the most in five months last week while Continuing Claims posted the biggest weekly gain since November 2021. All eleven GICS equity sectors were lower on the session with Financials (XLF) stocks dragging on the downside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Office: Rounding out earnings season for the REIT sector, Orion Office (ONL) dipped about 3% after reporting mixed results, noting that its full-year FFO declined 4.3% in full-year 2022 - slightly above than its prior guidance - but provided a weak outlook for 2023 which calls for an 11.7% decline in FFO at the midpoint of its guidance range. While ONL did achieve a relatively solid 4% cash rent spread for full-year 2022, it did comment that its continuing to see "headwinds" as "tenants continue to push leasing decisions out, are shrinking their space needs, and new tenants are waiting to commit to new space." Elsewhere in the sector, Alexander's (ALX) announced that it reached a deal to sell its Rego Park III land parcel in Queens for $71M and noted that there will be a financial statement gain of approximately $54 million.

Cannabis: Small-cap cannabis lender Chicago Atlantic Real Estate (REFI) was among the better-performing mortgage REITs today after it reported decent fourth-quarter results, noting that all of its loans are currently performing despite the stiff headwinds facing the cannabis industry but did increase its credit loss reserve from $2.5 million to $4 million. REFI noted that the increase wasn't the result of any specific loan, but rather "a culmination of multiple factors including third-party evaluations...[responding] to the headwinds that not just the cannabis space is exhibiting, but also the broader economy." REFI reported distributable EPS of $0.57 in Q4 - covering its $0.47/share dividend - while its full-year outlook stated that it expects its quarterly dividend to "be a minimum of $0.47/share" in full-year 2023.

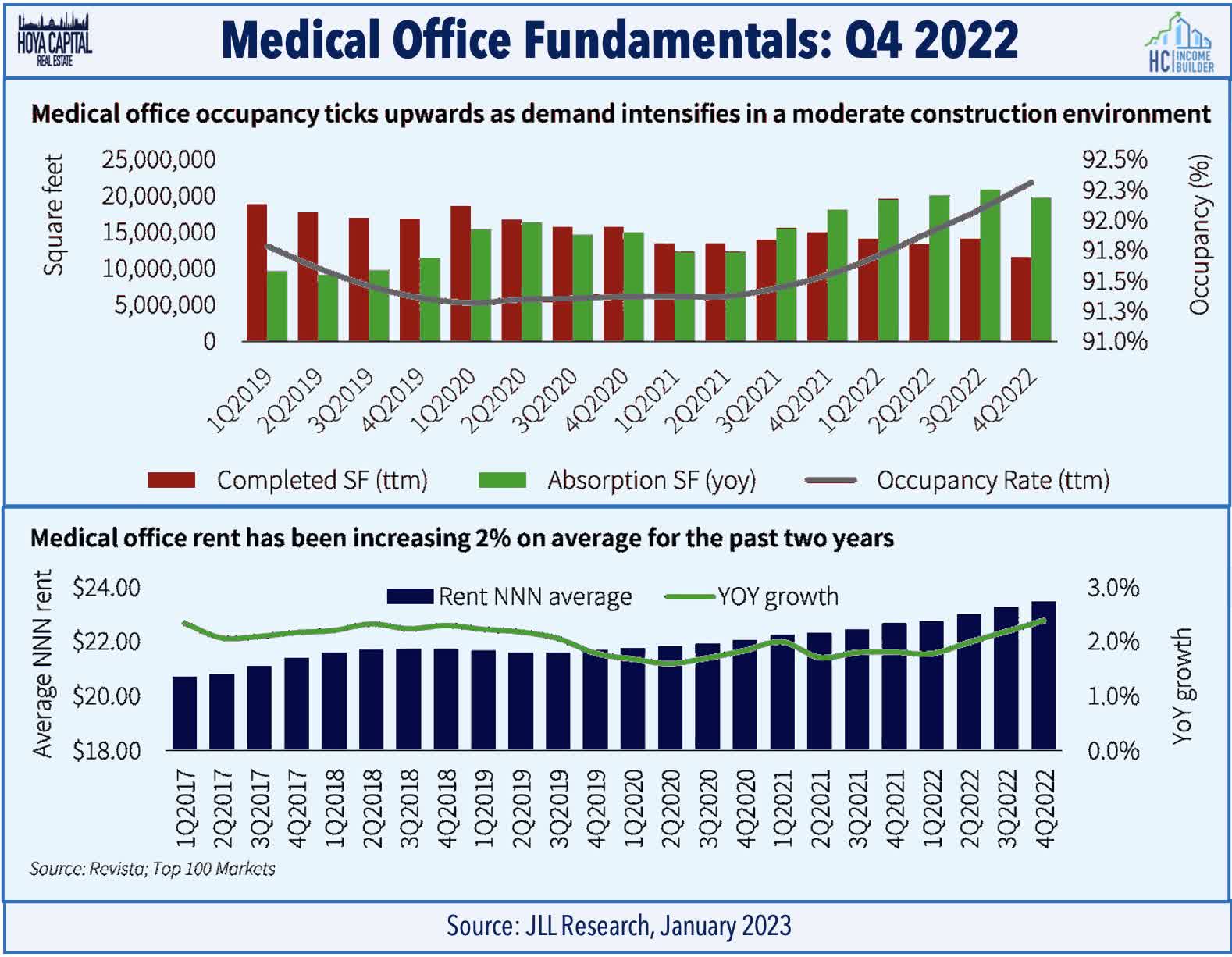

Healthcare: Today, we published Healthcare REITs: Life After The Pandemic which discussed our updated sector outlook and recent portfolio allocations. For Healthcare REITs - the physical epicenter of the pandemic - the road to recovery has remained inconsistent across its distinct sub-sectors, with "private-pay" segments now showing notable improvement while "public-pay" segments relapse. For Senior Housing REITs, the long-awaited recovery is finally taking hold. Robust rent growth is being fueled by rising resident incomes from record-high Cost-of-Living-Adjustments (“COLA”) to Social Security benefits. Public-pay segments - Hospital and Skilled-Nursing - have seen a re-intensification of tenant operator issues amid pressure from soaring labor costs and waning government fiscal support, triggering some missed rents and lease renegotiations. Medical Office Building ("MOB") fundamentals are back to being "boring" - but that's quite alright. While inflation risks linger, recent trends suggest that concerns over telehealth and work-from-home disruptions appear to be overstated.

Additional Headlines from The Daily REITBeat on Income Builder

- Moody’s upgraded the corporate credit rating of SBA Communications (SBAC) to “Ba2” from “Ba3” and its senior unsecured debt ratings to “Ba3” from “B1” with a stable outlook

- Moody’s downgraded Office Properties Income's (OPI) senior unsecured rating to “Ba2” from “Ba1” with a negative outlook

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly-lower today with residential mREITs slipping 3.0% while commercial mREITs declined by 2.6%. Angel Oak (AOMR) - which curiously dipped more than 12% yesterday before the release of earnings results this morning - rebounded by 8% today after reporting that its Book Value Per Share ("BVPS") declined about 10% in Q4 to $9.49 - the steepest decline in the mREIT sector this earnings season. The majority of the loss ($0.77) was driven by a large loan sale in November, and excluding the sale, its book value was roughly flat in Q4. When asked about its dividend, AOMR noted that its "still comfortable" with its current level. Elsewhere, New York Mortgage Trust (NYMT) completed its one-for-four reverse stock split.

Economic Data This Week

All eyes turn to the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in February following the surprisingly strong month of January, in which 517k jobs were added. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for February - is expected to show a modest reacceleration in wage growth in February to 4.7% following an encouraging cooldown in January.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.