Failure Fallout • Speculative Unwind • Jobs Day

- U.S. equity markets finished sharply-lower again Friday as financial stability concerns rattled markets following the rapid collapse of Silicon Valley Bank, becoming the largest bank failure since 2008.

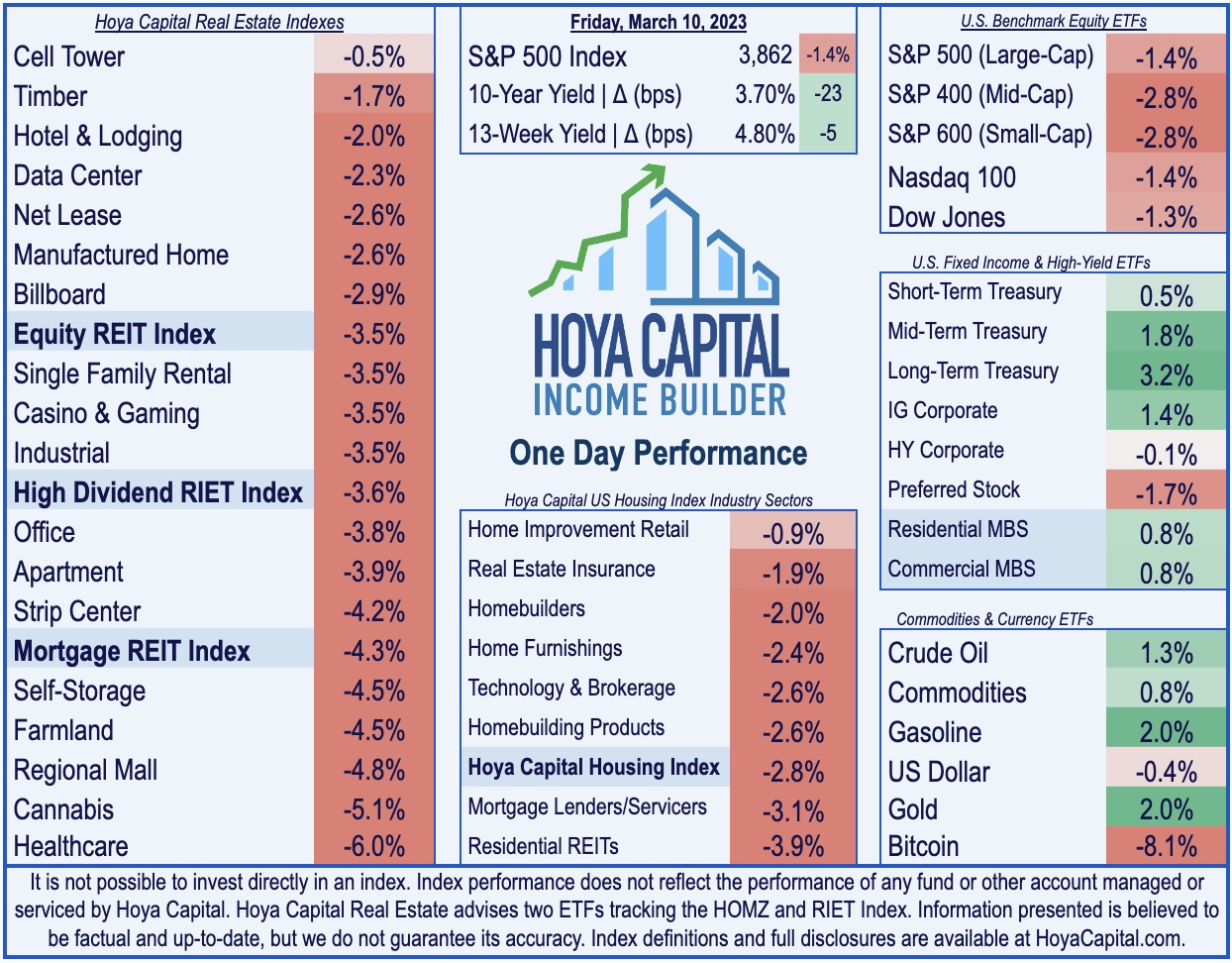

- Effectively erasing all of its gains for the year and posting its worst week since September 2022, the S&P 500 dipped another 1.4% today and declined 4.5% on the week.

- Real estate equities were among the hardest-hit sectors today and for the week. The Equity REIT Index slid 3.5% today with all 18 property sectors in negative territory.

- The second-largest banking collapse in history, the collapse of Silicon Valley Bank - which focuses its lending on high-risk startups and technology firms - was remarkably swift, triggered initially by a credit rating downgrade, and cascaded quickly into a "run" on deposits.

- The U.S. economy added 311k jobs in February - above expectations of 205k, but the relevant inflation-related metric - Average Hourly Earnings - was cooler-than-expected while the unemployment rate increased.

Income Builder Daily Recap

U.S. equity markets finished sharply-lower again Friday as financial stability concerns rattled markets following the rapid collapse of Silicon Valley Bank - the 16th largest bank in the U.S. - becoming the largest bank failure since 2008. Effectively erasing all of its gains for the year and posting its worst week since September 2022, the S&P 500 dipped another 1.4% today while the Mid-Cap 400 and Small-Cap 600 each slid by nearly 3%. The Dow dipped 345 points. Real estate equities were among the hardest-hit sectors today and for the week. The Equity REIT Index slid 3.5% today with all 18 property sectors in negative territory, while the Mortgage REIT Index dipped 4.3%.

The second-largest banking collapse in history behind Washington Mutual in 2008, the collapse of Silicon Valley Bank (SIVB) - which focuses its lending on high-risk startups and technology firms - was remarkably swift, triggered initially by a seemingly mundane credit rating downgrade, but cascaded quickly into a "run" on deposits that the firm was unable to contain. The collapse followed a similar liquidation of crypto-lender Silvergate Capital earlier in the week, which together raised questions over the health of lenders focused on more highly-speculative businesses. After climbing to the highest level since 2007 earlier this week at 5.07%, the policy-sensitive 2-Year Treasury Yield plunged nearly 50 basis points over the subsequent two days to close the week at 4.59% as investors re-priced Fed rate hike expectations. All eleven GICS equity sectors were lower on the session.

Financial stability concerns seized the headlines from the most closely-watched report of the week - the BLS' nonfarm payrolls report for February, which showed that the U.S. economy added 311k jobs in February - above expectations of 205k. The most relevant inflation-related metric in determining the path of Fed policy - Average Hourly Earnings - was cooler-than-expected, however, rising at a 4.6% annual rate, which was below the forecast of 4.7%. Over the past three months, the annualized increase in AHE has averaged 3.5%, which is only slightly above the 2015-2019 average of 2.9%. There was more "good news" on the inflation front, as the unemployment rate also increased to 3.6% from 3.4% in the prior month as the labor force participation rate recovered to its highest level since March 2020.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Cannabis: Small-cap NewLake Capital Partners (OTCQX:NLCP) dipped more than 11% today after it rounded-out earnings season for the cannabis REIT sector with a mixed report, noting that while it collected 100% in rents in Q4, it expects its collection rate to dip to 90-93% in Q1 due to nonpayment from Revolutionary Clinics - its third-largest tenant representing roughly 10% of its monthly rents. NLCP commented, "we can’t underestimate the difficult environment the operators are enduring" and cited regulatory setbacks, price compression, and financing challenges as the major headwinds. Earlier in earnings season, Innovative Industrial (IIPR) reported that it is collecting roughly 92% of rents in Q1. AFC Gamma (AFCG) reported that about 1% of its loans are on non-accrual status but increased its Current Expected Credit Loss reserve ("CECL") reserve from 1.8% to 4.97% during Q4. Chicago Atlantic Real Estate (REFI) reported that all of its loans are currently performing, but did increase its credit loss reserve from roughly 1% to 2%.

Healthcare: Yesterday, we published Healthcare REITs: Life After The Pandemic, which discussed our updated sector outlook and recent portfolio allocations. For Healthcare REITs - the physical epicenter of the pandemic - the road to recovery has remained inconsistent across its distinct sub-sectors, with "private-pay" segments now showing notable improvement while "public-pay" segments relapse. For Senior Housing REITs, the long-awaited recovery is finally taking hold. Robust rent growth is being fueled by rising resident incomes from record-high Cost-of-Living-Adjustments (“COLA”) to Social Security benefits. Public-pay segments - Hospital and Skilled-Nursing - have seen a re-intensification of tenant operator issues amid pressure from soaring labor costs and waning government fiscal support, triggering some missed rents and lease renegotiations.

Additional Headlines from The Daily REITBeat on Income Builder

- iSTAR (STAR) and Safehold (SAFE) announced that stockholders of both companies have each voted to approve the proposed merger between STAR and SAFE at their respective special meetings of stockholders held virtually today, March 9, 2023 noting that the companies are currently targeting closing the transactions on or about March 31, 2023

- Moody’s affirmed the “Baa2” senior unsecured rating and issuer rating of Life Storage (LSI) with a stable outlook

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were sharply lower today, with residential mREITs dipping 3.8% while commercial mREITs declined by 4.4%. Despite the strong session for the iShares Mortgage-Backed Bond ETF (MBB), mortgage REIT valuations reflected the concern of potential fallout from the liquidation of Silicon Valley Bank's (SIVB) - which held a relatively large MBS portfolio. Three mREITs held their dividends steady over the past 24 hours - MFA Financial (MFA) held its quarterly dividend steady at $0.35/share, Orchid Island (ORC) held its monthly dividend steady at $0.16/share, and New York Mortgage (NYMT) held its quarterly dividend steady at $0.40/share.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.