February To Forget • REIT Earnings • Home Price Dip

- U.S. equity markets declined Tuesday - erasing early-session gains in a choppy session - rounding out a rough month for markets amid renewed concern over risks of persistently elevated inflation.

- Erasing its gains on the week, the S&P 500 slipped 0.2% today, extending its February declines to 2.6%. The tech-heavy Nasdaq 100 declined 0.1% while the Dow slipped 232 points.

- Real estate equities were mixed as earnings season winded down with the final handful of reports. Equity and Mortgage REITs finished lower by 0.2%, but Homebuilders were a bright-spot.

- Innovative Industrial (IIPR) surged 7% after reporting better-than-expected results and indicated that rent collection issues haven't spread beyond the previously-announced subset of tenant operators.

- U.S. home prices declined for a sixth-straight month in December, per Case Shiller Index data released this morning. The average national home price is now about 5% below mid-2022 levels.

Income Builder Daily Recap

U.S. equity markets declined Tuesday - erasing early-session gains in a choppy session - rounding out a rough month for stocks and bonds amid renewed concern over risks of persistently elevated inflation. Erasing its gains on the week, the S&P 500 slipped 0.2% today, extending its February declines to 2.6%. The tech-heavy Nasdaq 100 declined 0.1% today while the Dow slipped 232 points. The 10-Year Treasury Yield briefly flirted with the 4%-level - trading as high as 3.98% - before retreating later in the session and closing at 3.92%. Real estate equities were mixed as earnings season winded down with the final handful of reports. The Equity REIT Index slipped 0.2% today with 10-of-18 property sectors in negative territory while the Mortgage REIT Index declined 0.2%. Homebuilders gained 0.9% on data showing that U.S. home prices declined for a sixth-straight month in December with average national home prices now about 5% below mid-2022 levels.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Storage: National Storage (NSA) - which we own in the REIT Focused Income Portfolio - rallied 3% after reporting solid results, noting that its full-year 2022 FFO rose 24.3% - matching its prior guidance - while its full-year NOI rose 14.9%, which was 40 basis points above its prior outlook. For NSA, which trades at discounted multiples to its larger peers after dipping nearly 50% in 2022, guidance calling for slightly positive FFO growth in 2023 was an upside surprise given its relatively high variable rate debt exposure, the majority of which was fixed during the quarter via an interest rate swap agreement. NSA noted that it's been active on the acquisition front in early 2023 via two deals with existing participating regional operators ("PROs") - a model by which NSA acquires properties through a tax-efficient UPREIT structure that offers similar benefits to sellers as a 1031 exchange.

Cannabis: Innovative Industrial (IIPR) surged 7% after reporting better-than-expected results and indicated that rent collection issues haven't spread beyond the previously-announced subset of tenant operators. IIPR reported that it collected 92% of rents in February - consistent with its collection rate in the prior month, which was reported in its January 18th business update that sparked a 25% sell-off over the subsequent week. IIPR failed to collect $4.7M of total February monthly rent from four tenants - Kings Garden, Vertical, Green Peak, and Parallel - and IIPR noted that it's in various stages of negotiations and/or restructurings with these tenants. Importantly, there were no indications of worsening issues with three tenants noted in its January update - Holistic, Calyx Peak, and Sozo - for which IIPR had to apply security deposits to cover part of the owed rent. As discussed in Cannabis REITs: Smoked Out, IIPR has slammed over the past year amid concern over defaults from their cannabis cultivator tenants, which have been smoked by plunging wholesale cannabis prices and setbacks on federal legalization.

Net Lease: Spirit Realty (SRC) slumped 2% today after reporting in-line results, noting that its full-year FFO rose 7.6% in 2022 - matching its prior outlook - while providing initial 2023 guidance calling for flat FFO at the midpoint of its range. Notably, unlike its net lease peers, SRC has more clearly pivoted its external growth strategy in response to the higher interest rate environment, evidenced both by the increase in acquisition cap rates in late 2022 and by its guidance for the year ahead which calls for a significantly slower pace of net acquisitions. SRC's average acquisition cap rate was 7.3% in Q4 - up 100 basis points from Q4 of last year - which was more than double the change seen across the rest of the net lease sector. SRC commented that it plans to "prove out what we've been doing the last few years... and at that point, we can look at potentially increasing volume with a more effective cost of capital." This conservative strategy contrasts with the "business as usual" approach we observed across most other net lease REITs this earnings season.

Today we published Winners of REIT Earnings Season, which was Part 1 of our two-part Earnings Recap series. Rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet. Bifurcation is back: After delivering broad-based double-digit growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Our primary focus this earnings season was on 2023 FFO guidance. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit growth. Technology REITs see 2-3% growth, while retail REITs see flat growth. Many Office REITs and several Healthcare REITs forecast double-digit FFO declines. External growth remains challenged for now, but well-capitalized REITs will have opportunities as reality sets in for many over-levered private-market property owners.

Additional Headlines from The Daily REITBeat on Income Builder

- UMH Properties (UMH), Global Medical REIT (GMRE), Services Property (SVC), Alexander & Baldwin (ALEX), and Whitestone REIT (WSR) will announce earnings after the close

- Healthcare Realty (HR) and Xenia Hotels (XHR) will announce tomorrow morning before the open

- Equinix (EQIX) announced five new long-term Power Purchase Agreements in Spain totaling 225 megawatts (MW).

- Farmland Partners (FPI) announced that Luca Fabbri has been elevated to the role of Chief Executive Officer as part of its previously-announced succession plan. Paul Pittman, who previously served as CEO, will remain as Executive Chairman of the Board and as a full-time FPI employee

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today, with residential mREITs slipping 0.1% while commercial mREITs gained 0.1%. Broadmark Realty (BRMK) was again the leader today following yesterday's announcement that Ready Capital (RC) will acquire the firm in a $787M all-stock at an implied value of $5.90/share. After the close today, BrightSpire (BRSP) - formerly known as Colony Credit - announced that DigitalBridge (DBRG) - formerly Colony Capital and the former external adviser to Brightspire - will sell the majority of its ownership - 30,358,213 shares - in BRSP in a secondary offering. We'll hear results tomorrow morning from Starwood Property (STWD).

Economic Data This Week

The busy week of economic data continues with Construction Spending and Purchasing Managers' Index ("PMI") on Wednesday. On Thursday, we'll be watching the final Jobless Claims report for February ahead of nonfarm employment data in the following week. We'll also be watching Unit Labor Costs data from the revised GDP report on Thursday - an inflation metric that is closely watched by the Federal Reserve.

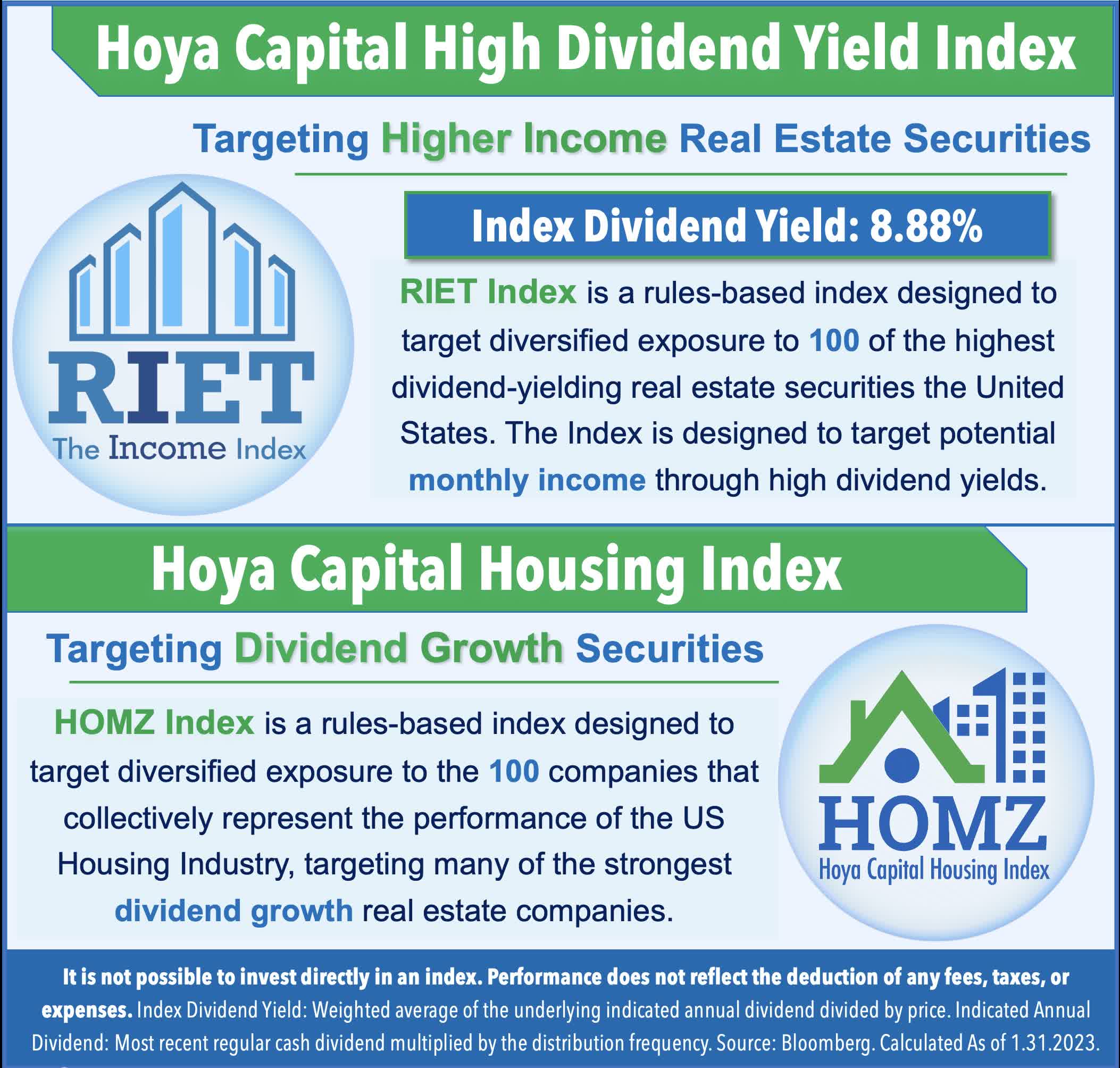

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.