Yields March Higher • REIT Earnings • Hawkish Fed

- U.S. equity markets remained under pressure Wednesday as benchmark interest rates continued to march higher following hawkish Fed commentary and manufacturing PMI data showing a mild reacceleration in price pressures.

- Closing at its lowest-level in nearly six weeks, the S&P 500 slipped 0.5% today while the tech-heavy Nasdaq 100 dipped 0.8% to its lowest-level since late January.

- Rate concerns kept downward pressure on real estate equities today, with the Equity REIT Index slipping another 1.3% with 15-of-18 property sectors in negative territory. Mortgage REITs slipped 2.2%.

- Xenia Hotels (XHR) was among the leaders today after reporting strong results, noting that its Revenue Per Available Room ("RevPAR") was 0.6% above its 2019-comparable - its first quarter above pre-pandemic levels - and reported strong demand trends in early 2023.

- UMH Properties (UMH) dipped more than 7% after reporting mixed results, noting that its full-year FFO declined 2.3% in 2022 as higher financing costs and higher property-level expenses offset another relatively strong year of revenue growth.

Income Builder Daily Recap

U.S. equity markets remained under pressure Wednesday as benchmark interest rates continued to march higher following hawkish Fed commentary and PMI data showing a mild reacceleration in price pressures. Closing at its lowest level in nearly six weeks, the S&P 500 slipped 0.5% today while the tech-heavy Nasdaq 100 dipped 0.8% to its lowest level since late January, but the Dow managed to eke out a 5-point gain. The 10-Year Treasury Yield crossed through the 4%-level for the first time since early November as investors increasingly price-in expectations of a "higher-for-longer" monetary policy environment. Rate concerns kept downward pressure on real estate equities today as earnings season wrapped-up. The Equity REIT Index slipped another 1.3% today with 15-of-18 property sectors in negative territory while the Mortgage REIT Index declined 2.2%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Hotel: Xenia Hotels (XHR) - which we own in the REIT Dividend Growth Portfolio - was among the leaders today after reporting strong results, noting that its Revenue Per Available Room ("RevPAR") was 0.6% above its 2019-comparable - its first quarter above pre-pandemic levels - and reported strong demand trends in early 2023. Encouragingly, XHR was one of six hotel REITs to restore its full-year outlook. XHR expects RevPAR growth of 6.0% at the midpoint of its range - roughly in-line with its peers - but forecasts a modest decline in FFO at the midpoint of its range attributed to higher interest expense. Consistent with commentary from its peers, XHR noted that it has seen a "transition from a leisure-driven recovery to a more traditional mix of leisure, business transient and group demand." Recent TSA Checkpoint data shows relatively strong demand trends in early 2023 with both January and February exceeding pre-pandemic throughput levels.

Manufactured Housing: UMH Properties (UMH) dipped more than 7% after reporting mixed results, noting that its full-year FFO declined 2.3% in 2022 as higher financing costs and higher property-level expenses offset another relatively strong year of revenue growth. UMH noted that its same-store expenses were up 10.2% in 2022, driven by large increases in property tax and payroll increases. UMH provided limited formal guidance for 2023, but did comment that it expects same-store expense growth to "normalize" to a range of 6.5% to 8.5% range, but still expects NOI growth in the "high single digits." While UMH has been working to improve its balance sheet in recent years, the firm still a debt ratio near 40% - double that of its peers - with about 20% of this debt subject to variable interest rates. UMH expects to raise rents by 5% in 2023, slightly below the expected 6.5% increase from Equity Lifestyle (ELS) and the 6.3% expected increase from Sun Communities (SUI).

Healthcare: Medical office REIT Healthcare Realty (HR) declined about 1% after reporting mixed results, noting that its full-year FFO declined 1.2% in 2022 - roughly in line with expectations. While HR did not provide FFO guidance 2023, it did provide relatively upbeat commentary and noted that it expects its same-store NOI to accelerate to 3.0% for the year at the midpoint of its range, up from 2.6% in 2022. HR commented that "MOB fundamentals remain favorable with robust demand for outpatient facilities...we see green shoots that inflation pressure and labor costs are easing, especially for health systems." Global Medical (GMRE) traded lower by about 2% after reporting in-line results, recording full-year FFO growth of 3.2% in 2022. While GMRE did not provide full-year FFO guidance either, it did note that it expects that its occupancy rate - which ended the quarter at currently at 96.5% - will be above 96% throughout the year. GMRE expects to slow its pace of acquisitions this year, commenting that it "saw a large number of opportunities in Q4, but opted to pass as we saw nothing compelling giving our cost of capital."

Yesterday we published Winners of REIT Earnings Season, which was Part 1 of our two-part Earnings Recap series. Rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet. Bifurcation is back: After delivering broad-based double-digit growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Our primary focus this earnings season was on 2023 FFO guidance. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit growth. Technology REITs see 2-3% growth, while retail REITs see flat growth. Many Office REITs and several Healthcare REITs forecast double-digit FFO declines. External growth remains challenged for now, but well-capitalized REITs will have opportunities as reality sets in for many over-levered private-market property owners.

Additional Headlines from The Daily REITBeat on Income Builder

- American Tower (AMT) priced $700 million of 5.50% senior unsecured notes due 2028 and $800 million of 5.65% senior unsecured notes due 2033 and intends to use proceeds to repay its revolving credit facility.

- Getty Realty (GTY) priced an underwritten public offering of 3,000,000 shares of common stock, raising gross proceeds of $100 million ($33.33/share) and intends to use the net proceeds to fund property acquisitions and to repay its revolving credit facility.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly lower today, with residential mREITs slipping 2.3% while commercial mREITs declined 2.4%. Starwood Property (STWD) was the top-performer today after reporting solid results, recording distributable EPS of $0.50 - covering its $0.48 dividend - and a fractional increase in its Book Value Per Share ("BVPS") to $21.70. A common theme across the commercial mREIT space, office exposure was the focus of the earnings call. STWD noted that its office exposure is 23% of its loan book - down from 38% in 2019. Of note, STWD commented that in office markets, "you have a tale of two worlds: the United States and everywhere else. Everywhere besides the U.S. offices are leasing." STWD also noted that 97% of its loan portfolio is comprised of floating-rate loans.

Economic Data This Week

The busy week of economic data continues the final Jobless Claims report for February ahead of nonfarm employment data in the following week. We'll also be watching Unit Labor Costs data from the revised GDP report on Thursday - an inflation metric that is closely watched by the Federal Reserve.

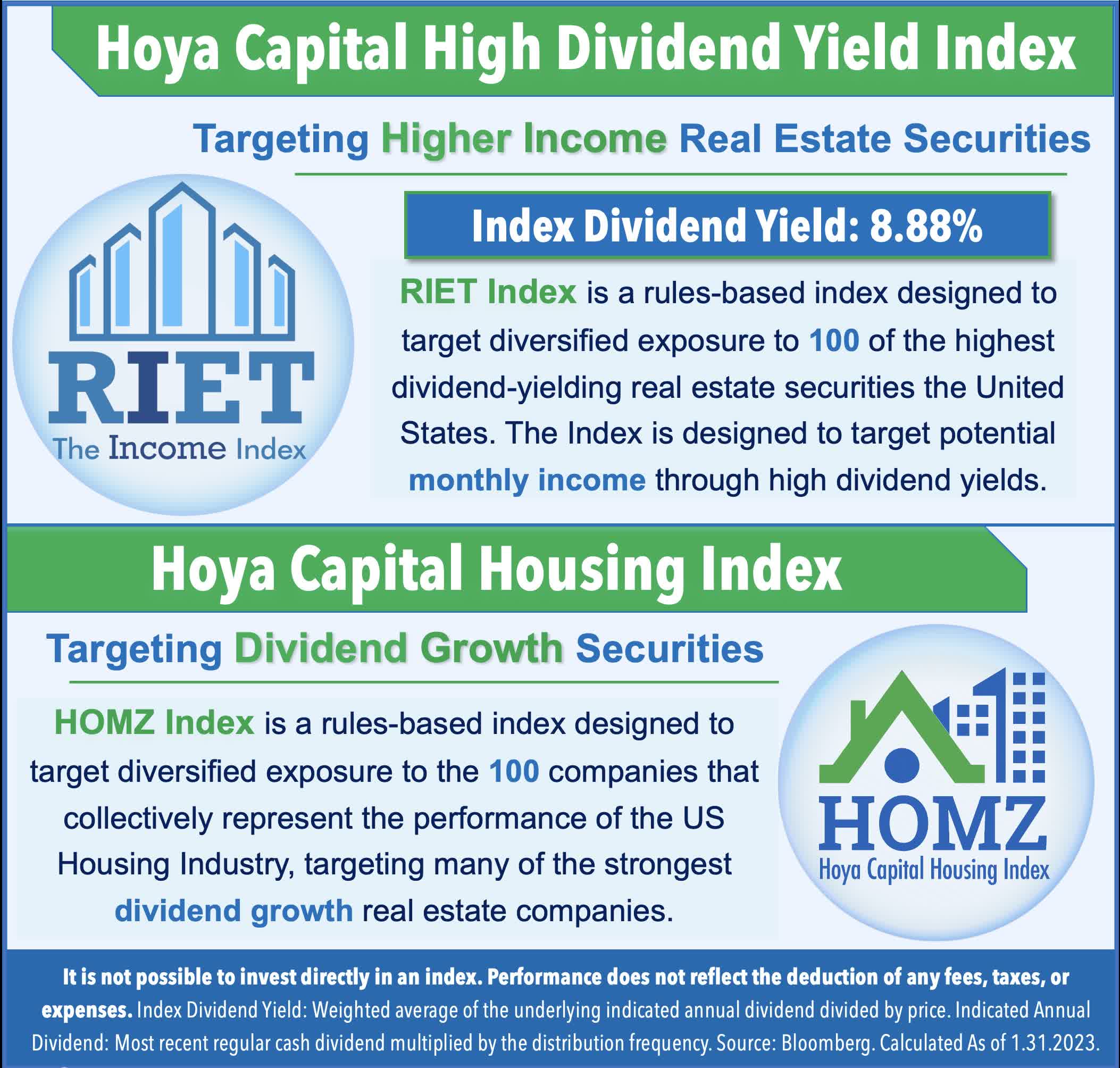

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.