Hawkish Powell • Stocks Dip • REIT Earnings

- U.S. equity markets tumbled Tuesday after Fed Chair Powell struck a hawkish tone in Congressional testimony, commenting that the Fed is prepared to "increase the pace of rate hikes" if warranted.

- After finishing roughly flat on Monday, the S&P 500 dipped 1.5% today while the Mid-Cap 400 and Small-Cap 600 depend on their weekly losses to over 2.5%. The Dow dipped 575 points.

- Real estate equities and other yield-sensitive segments were under pressure again with the Equity REIT Index dipping 2.4% today with 17-of-18 property sectors in negative territory.

- The long-end of the yield curve was little changed with the 10-Year Treasury Yield holding steady at 3.98%, but shorter-term rates surged with the 2-Year Treasury Yield closing above 5% for the first time since 2007.

- Cannabis REIT AFC Gamma (AFCG) was among the top-performers today after reporting decent results while noting that it plans to pivot its strategy away from exclusively cannabis-related lending, citing limited opportunities given recent industry headwinds.

Income Builder Daily Recap

U.S. equity markets tumbled Tuesday after Fed Chair Powell struck a hawkish tone in Congressional testimony, commenting that the Fed is prepared to "increase the pace of rate hikes" if warranted. After finishing roughly flat on Monday, the S&P 500 dipped 1.5% today while the Mid-Cap 400 and Small-Cap 600 depend on their weekly losses to over 2.5%. The long-end of the yield curve was little changed, with the 10-Year Treasury Yield holding steady at 3.98%, but shorter-term rates surged, with the 2-Year Treasury Yield closing above 5% for the first time since 2007. Real estate equities and other yield-sensitive segments were under pressure again with the Equity REIT Index dipping 2.4% today with 17-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 1.6%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Cannabis: AFC Gamma (AFCG) was among the top-performers today after reporting stronger-than-expected results, recording distributable EPS of $0.62 in Q4 - covering its $0.56 dividend - and noted that its Book Value Per Share ("BVPS") increased fractionally in Q4 to $16.65, up from $16.61 in Q3. AFCG's existing loan book remains current on payments with the exception of one borrower on non-accrual status - Flower One - which represents about 1% of its portfolio. AFCG did, however, increase its Current Expected Credit Loss reserve ("CECL") reserve from 1.8% as of September 30, 2022, to 4.97% as of December 31, 2022. Citing broader industry headwinds on cannabis operators that we discussed in Cannabis REITs: Smoked Out, AFCG has not originated any new cannabis debt investments over the past nine months and has instead turned its recent focus on non-cannabis commercial real estate lending and anticipates closing its first non-cannabis commercial real estate loan "in the next 90 days." Management indicated that its portfolio could be "more balanced towards 50-50 by the end of this calendar year" between cannabis and non-cannabis loans and specifically cited multifamily construction and industrial as the property sectors it is currently targeting.

Industrial: Indus Realty (INDT) was little-changed today after reporting Q4 results - likely its final report as a public company - as it confirmed that its acquisition by GIC Real Estate at $67.00/share is expected to close in the summer of 2023. Previously known as Griffin Industrial Realty before its REIT conversion back in 2021 - Indus is a small-cap REIT that owns 42 industrial/logistics buildings aggregating 6.1 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina, and Florida. For GIC, the deal is its second major acquisition of the past year following its $14B takeover of net lease REIT Store Capital last September. INDT reported results that were largely in-line with its peers, noting that it achieved same-store NOI growth of 9.5% for full-year 2022 driven by a nearly 30% rental rate spread for the year.

Healthcare: This evening, we'll publish an updated report on the Healthcare REIT sector to the Income Builder Marketplace which will discuss our updated sector outlook and recent portfolio allocations within the sector. We'll discuss the implications of ongoing operator issues in the "public-pay" sub-sectors (skilled nursing and hospitals), which have been pressured by soaring labor costs and by waning government fiscal support. Dividend coverage - which looked very healthy several quarters ago - are beginning to be stretched. Fundamentals appear far stronger for the "private-pay" sub-sectors (senior housing, lab space, and medical office). For senior housing REITs, the long-awaited recovery is finally here, and is being amended by a combination of intersecting tailwinds. Most notably, market rent growth has accelerated significantly in recent quarters, driven in large part by the Cost of Living Adjustment (“COLA”) to Social Security, which increased monthly benefit payments in 2022 by 5.9% and again in 2023 by 8.7%. Historically, SH market rent growth has been closely linked with COLA, and remarkably the combined increase in COLA in 2022 and 2023 (15%) is roughly equal to the combined increase of the previous twelve years combined (16%).

With REIT earnings season winding down, last week we published our REIT Earnings Recap, which we split into two reports: In Winners of REIT Earnings Season, we noted that rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet. Bifurcation is back, however, and after delivering broad-based double-digit earnings growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Our primary focus this earnings season was on 2023 FFO guidance. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit growth. In Losers of REIT Earnings Season, we focused on the worst-performing property sectors and common threads shared by these laggards. A significant rise in interest rate expense was the common thread seen across many of these sectors - nearly all of which are among the more highly-levered property sectors. REITs that 'gambled' with high levels of variable rate debt have been forced to either ride out the volatility and hope for some rate relief, or to fix their interest rate exposure using hedges and/or new bond issuance - usually at a high cost.

Additional Headlines from The Daily REITBeat on Income Builder

- Terreno (TRNO) acquired an industrial property located in Long Island City, Queens, NY on March 6, 2023 for a purchase price of approximately $23.0 million noting that the property consists of one industrial distribution building containing approximately 45,000 sf on 1.1 acres and is 100% leased on a short-term basis where the estimated stabilized cap rate is 5.2%

- Retail Value (OTCPK:RVIC) authorized a liquidating distribution of $0.17 per share, payable on April 5, 2023 to the holders of common shares as of 5:00 p.m. Eastern Time on April 4, 2023 noting that the distribution was funded with cash on hand, collections of accounts receivable and approximately $0.8 million previously held in reserve for potential claims by a purchaser under a property sale agreement which did not materialize prior to the expiration of the general survival period

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs broadly-lower today, with residential mREITs slipping 1.3% while commercial mREITs declined 1.7%. Ellington Residential (EARN) was the top-performer today after reporting that its Book Value Per Share ("BVPS") jumped 8% in Q4 to $8.40 - the second highest increase in the mREIT sector this earnings season behind AGNC Investment (AGNC). EARN reported distributable earnings per share of $0.25, which covered its quarterly dividend of $0.24/share. EARN noted that "January was another month of strong performance. February reversed some of those gains, but we are still solidly up for the year. Year-to-date through the end of February, we estimate that earns book value per share was up close to 4%." We'll hear results from Cherry Hill (CHMI) this afternoon and from Angel Oak (AOMR) later this week.

Economic Data This Week

Employment data highlight a critical week of economic data in the week ahead, headlined by JOLTS and ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in February following the surprisingly strong month of January in which 517k jobs were added. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for February - is expected to show a modest reacceleration in wage growth in February to 4.7% following an encouraging cooldown in January. Speaking of the Fed, investors will also be keenly focused on comments from Fed Chair Powell across two days of congressional testimony next week as part of the central bank's semiannual monetary policy report to the House and Senate.

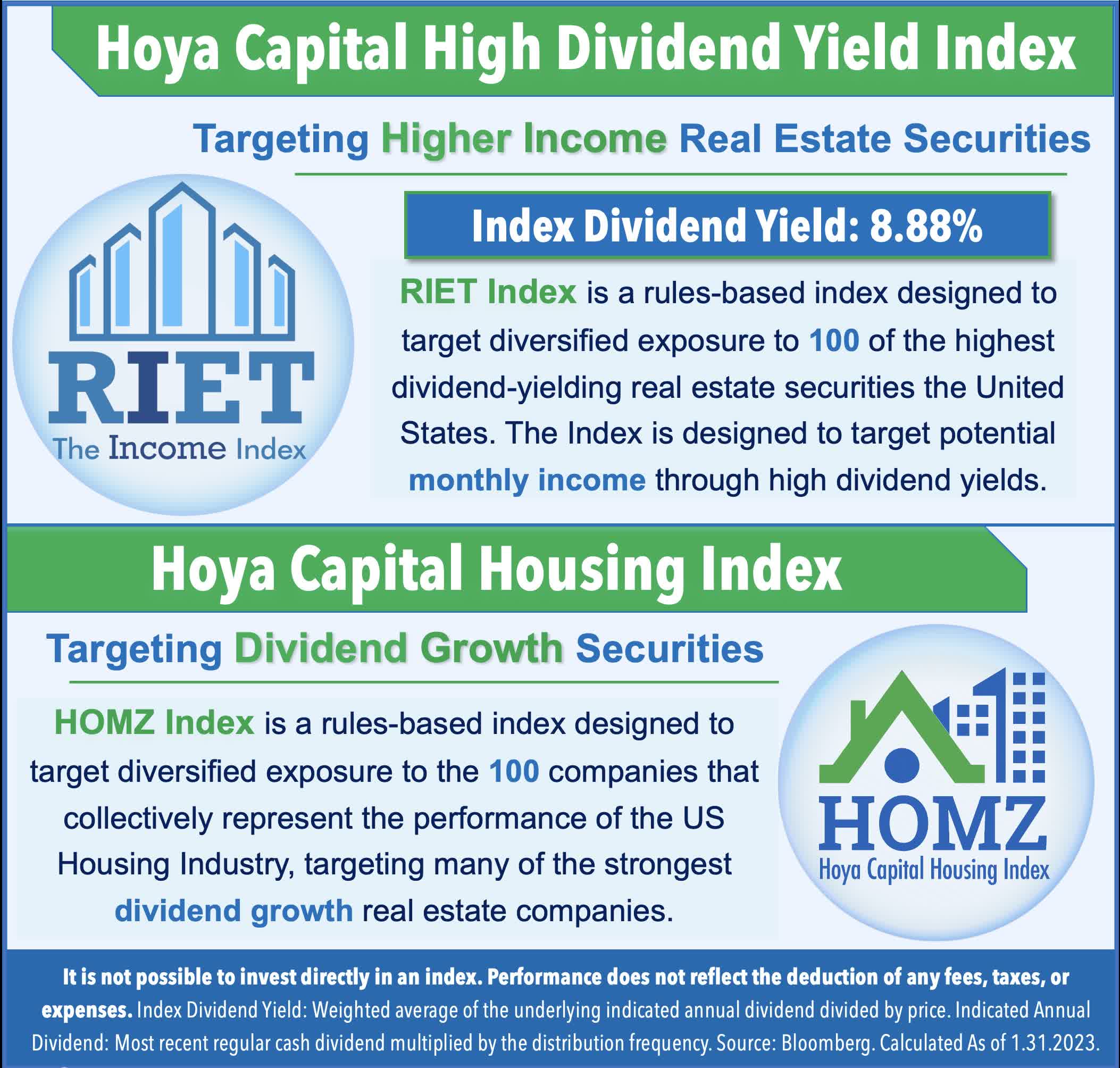

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.