Jobs Week • Net Lease Deal • S&P Index Changes

- U.S. equity markets failed to hold early-session gains Monday on another choppy session as traders took positions ahead of a critical week of employment data and closely-watched Federal Reserve commentary.

- Following gains of roughly 2% last week, the S&P 500 gained 0.1% today, but other major benchmarks were under-pressure, with the Mid-Cap 400 and Small-Cap 600 slipping 1.3% and 2.4%.

- Real estate equities finished mostly-lower, with the Equity REIT Index slipping 0.4% today with 13-of-18 property sectors in negative territory, but the Mortgage REIT Index advanced 0.2%.

- A handful of REITs responded to index composition changes announced by S&P. Starwood Property (STWD) rallied nearly 5% after S&P announced that it will be added to the S&P Mid-Cap 400.

- Realty Income (O) was little-changed today after it announced a $1.5 billion deal to acquire up to 415 single-tenant convenience store properties located in the U.S. from EG Group.

Income Builder Daily Recap

U.S. equity markets failed to hold early-session gains Monday on another choppy session as traders took positions ahead of a critical week of employment data and closely-watched Federal Reserve commentary. Following weekly gains of roughly 2% last week, the S&P 500 eked out a 0.1% gain today, but the other major benchmarks were under pressure, with the Mid-Cap 400 and Small-Cap 600 slipping 1.3% and 2.4%, respectively. Bonds slipped as the 10-Year Treasury Yield climbed 2 basis points to 3.98%. Real estate equities finished mostly-lower, with the Equity REIT Index slipping 0.4% today with 13-of-18 property sectors in negative territory, but the Mortgage REIT Index advanced 0.2%.

Employment data highlight a critical week of economic data in the week ahead, headlined by JOLTS and ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in February following the surprisingly strong month of January in which 517k jobs were added. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for February - is expected to show a modest reacceleration in wage growth in February to 4.7% following an encouraging cooldown in January. Speaking of the Fed, investors will also be keenly focused on comments from Fed Chair Powell across two days of congressional testimony next week as part of the central bank's semiannual monetary policy report to the House and Senate.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

A handful of REITs responded to index composition changes announced by S&P last Friday afternoon, which takes effect on Monday, March 20th. Commercial mREIT Starwood Property (STWD) - which we own in the REIT Focused Income Portfolio - rallied nearly 5% after S&P announced that it will be added to the S&P Mid-Cap 400. Three REITs will change from the S&P 400 to the S&P Small-Cap 600 - JBG Smith (JBGS), Pebblebrook (PEB), and SL Green (SLG). Four REITs that are currently in the S&P 600 will be dropped - Franklin Street (FSP), Hersha Hospitality (HT), Industrial Logistics (ILPT), and Granite Point Mortgage (GPMT) - each of which were lower by at least 3% on the day. REITs comprise only 2.7% of the benchmark S&P 500, but are better-represented in the mid- and small-cap indexes with a 8.0% and 6.9% weighting in the S&P 400 and S&P 600, respectively.

Net Lease: Realty Income (O) was little changed today after it announced a $1.5 billion deal to acquire up to 415 single-tenant convenience store properties located in the U.S. from EG Group - an independent convenience retailer based in the United Kingdom. The portfolio is expected to be acquired at an estimated cap rate of 6.9% and has a 20-year weighted average initial lease term. Realty Income noted that approximately 80% of the total portfolio is in the Northeast U.S., and roughly 80% of properties are operated under the Cumberland Farms brand. The transaction is expected to close in Q2 of 2023 and following the completion, convenience stores will represent about 11% of Realty Income's annual rent. In our Earnings Recap, we noted that most net lease REITs have taken a "business as usual" approach on the acquisitions front in recent months, with cap rates that are only modestly higher from last year despite the significant increase in benchmark interest rates.

With REIT earnings season winding down, last week we published our REIT Earnings Recap, which we split into two reports: In Winners of REIT Earnings Season, we noted that rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet. Bifurcation is back, however, and after delivering broad-based double-digit earnings growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Our primary focus this earnings season was on 2023 FFO guidance. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit growth. Dividend sustainability was also in focus, and we've been scouring through earnings calls to glean insights into the outlook for dividend hikes - and in some cases, dividend cuts - this year. We've seen 37 REITs hike their dividends this year, but have also seen 8 REITs announce or indicate a dividend reduction.

In Losers of REIT Earnings Season, we focused on the worst-performing property sectors and common threads shared by these laggards. While there were upside standouts and impressive reports among some individual names within these lagging property sectors, the losers of REIT earnings season included: Office, Technology, Net Lease, Regional Malls, Public-Pay Healthcare, and Specialty REITs. A significant rise in interest rate expense was the common thread seen across many of these sectors - nearly all of which are among the more highly-levered property sectors. REITs that 'gambled' with high levels of variable rate debt have been forced to either ride out the volatility and hope for some rate relief, or to fix their interest rate exposure using hedges and/or new bond issuance - usually at a high cost. The direct FFO impact from interest rate changes alone amounted to 5-10% across these more-highly-levered sectors, while some REITs at the top of the leverage spectrum expect as much as a 30% hit to 2023 FFO from higher rates.

Additional Headlines from The Daily REITBeat on Income Builder

- Retail Opportunity (ROIC) amended and extended its $600 million unsecured credit facility, extending the maturity date by three years (from February 2024 to March 2027.

- Community Healthcare Trust (CHT) announced that Timothy G. Wallace, Chairman of the Board, Chief Executive Officer and President of the Company, passed away on March 3, 2023

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs slipping 0.2% while commercial mREITs declined 0.1%. As noted above, Starwood Property (STWD) rallied nearly 5% after S&P announced that it will be added to the S&P Mid-Cap 400 while Granite Point Mortgage (GPMT) dipped 3.5% after being removed from the Small-Cap 600. We'll hear results from the Ellington Residential (EARN) this afternoon, and later in the week, we'll see results from Cherry Hill (CHMI) and Angel Oak (AOMR).

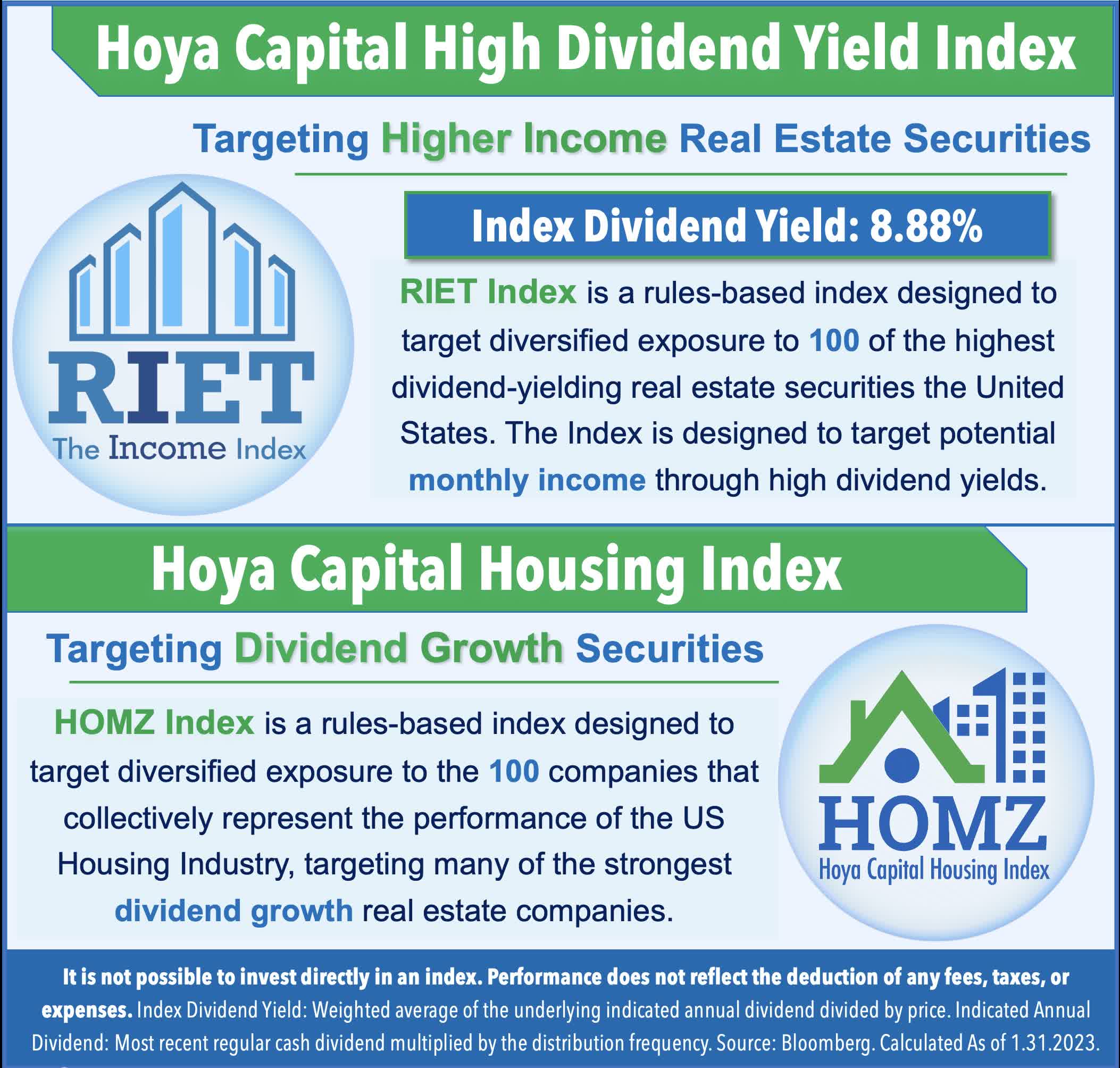

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.