Hot Inflation Data • Stocks Slump • REIT Dividend Hikes

- U.S. equity markets remained under-pressure Friday - concluding their worst week since December - after hotter-than-expected inflation and spending data lifted benchmark interest rates to three-month highs.

- Pushing its full-week decline to roughly 3%, the S&P 500 slid 1.1% today while the tech-heavy Nasdaq 100 dipped nearly 2%. The Dow dipped 337 points.

- Real estate equities also were lower today as rate pressures offset a generally strong slate of earnings reports and dividend hikes. Equity REITs slipped 1.7% while mortgage REITs declined 1.5%.

- Four more REITs raised their dividends over the past 24 hours - Prologis, Lamar, Essex, and Gaming & Leisure Properties - bringing the full-year total to 32 REIT dividend hikes.

- The strong earnings season for storage and residential REITs continued. CubeSmart (CUBE) rallied 4% after reporting better-than-expected results, noting that its full-year FFO increased by 19.9% in 2022 and sees FFO growth of another 5.7% in 2023.

Income Builder Daily Recap

U.S. equity markets remained under-pressure Friday - concluding their worst week since December - after hotter-than-expected inflation and spending data lifted benchmark interest rates to three-month highs. Pushing its full-week decline to roughly 3%, the S&P 500 slid 1.1% today while the tech-heavy Nasdaq 100 dipped nearly 2%. The Dow dipped 337 points. The 10-Year Treasury Yield climbed 7 basis points to 3.95% today after PCE inflation data - the Fed's preferred inflation gauge - showed an unexpected reacceleration in price pressures in January. Real estate equities were lower as well today as rate pressures offset a generally strong slate of earnings reports and dividend hikes over the past 24 hours. The Equity REIT Index declined 1.7% today with 17-of-18 property sectors in negative territory. The Mortgage REIT Index slipped 1.5% while Homebuilders declined 1%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Storage: The strong earnings season for storage REITs continued with a pair of strong reports. CubeSmart (CUBE) rallied 4% after reporting better-than-expected results, noting that its full-year FFO increased by 19.9% in 2022 and sees FFO growth of another 5.7% in 2023, the highest in the storage sector. CUBE expects same-store NOI growth of 5% for 2023 as sticky pricing trends on renewals are expected to offset a decline in rental rates for new customers. CUBE noted that "street rates" for new customers were down about 10% in Q4 and about 9% in early 2023. Life Storage (LSI) reported sector-leading full-year FFO growth of 28.4% in 2022 and sees another 5.2% growth at the midpoint of its 2023 outlook and provided a preliminary outlook for 2024 as well, noting that it expects "low double-digit FFO per share growth in 2024, with a midpoint of 11%." In its earnings call, LSI outlined its reasons for rejecting the takeover bid from Public Storage (PSA), noting that it believes the proposal "significantly undervalues" the company.

Casino: Both casino REITs reported results yesterday afternoon. Gaming & Leisure Properties (GLPI) gained 0.5% after reporting better-than-expected results and hiking its dividend by 2% to $0.72 alongside a $0.25/share special dividend. GLPI recorded full-year FFO growth of 3.2% in 2022 - 60 basis points above its prior guidance - and sees FFO growth of 2.5% in 2023. VICI Properties (VICI) was also among the better performers today after reporting strong results and an upbeat outlook for 2023, noting that its full-year FFO rose 6.0% in 2022 - 80 basis points above its prior growth outlook - and sees FFO growth of 9.6% in 2023 driven by CPI-linked rent escalations and by several recent large acquisitions, including the remaining 50% stake in the MGM Grand/Mandalay Bay that it acquired from Blackstone in late 2022 and the acquisitions of the PURE Canadian Gaming Casinos in early 2023.

Billboard: Lamar (LAMR) slumped 3% despite reporting solid results and hiking its quarterly dividend by 4% to $1.25/share alongside a new $250M stock buyback program. LAMR noted that its full-year FFO rose 12% in 2022 - above its prior outlook - but provided a relatively muted outlook for 2023 with expectations of 1.3% FFO growth, citing "weakness" in demand from national brands offsetting "resilient" demand from local advertisers. Earlier in the week, Outfront (OUT) - which is more exposed to national brands - reported similarly mixed results, noting that its full-year FFO rose more than 30% in 2022 but sees FFO growth slowing to 5% in 2023 and remaining about 14% below its pre-pandemic level, citing "significantly increased interest expense." OUT held its dividend steady but noted that this "dividend level may ultimately prove to be insufficient to meet our REIT requirements for 2023, and an increase may be required later in the year."

Single-Family Rental: American Homes (AMH) declined 4% after posting mixed results, noting that its full-year FFO rose 13.2% in 2022 - matching its prior guidance - and sees FFO growth of 4.5% for 2023. Cost pressures were in focus as AMH projected same-store expense growth of 9.8% for 2023, citing expectations for a 9% increase in property taxes and a 10% increase in other core property operating expenses. Consistent with results Invitation Homes (INVH) earlier in the week, single-family rent growth remained relatively firm with AMH reporting blended leasing spreads of 8.1% in Q4 - down only slightly from its record-high increase of 9.5% last quarter. Earlier this year, AMH raised its quarterly dividend by 22% to $0.22/share.

In addition to the aforementioned dividend hikes, industrial REIT Prologis (PLD) hiked its quarterly dividend by 10% to $0.87/share, and apartment REIT Essex (ESS) raised its quarterly payout by 5% to $2.31/share, bringing the full-year total across the REIT sector to 32 dividend hikes compared with 4 dividend reductions. This weekend, we'll publish our REIT Earnings Recap on the Income Builder Marketplace. With roughly 95% of the sector having now reported results, REIT earnings season was a bit better than expected with nearly two-thirds of REITs reporting FFO results that exceeded their prior guidance, but the forward outlook was softer than expected across many sectors as headwinds from higher interest rates and operating expenses offsets expectations of relatively strong same-store revenue growth.

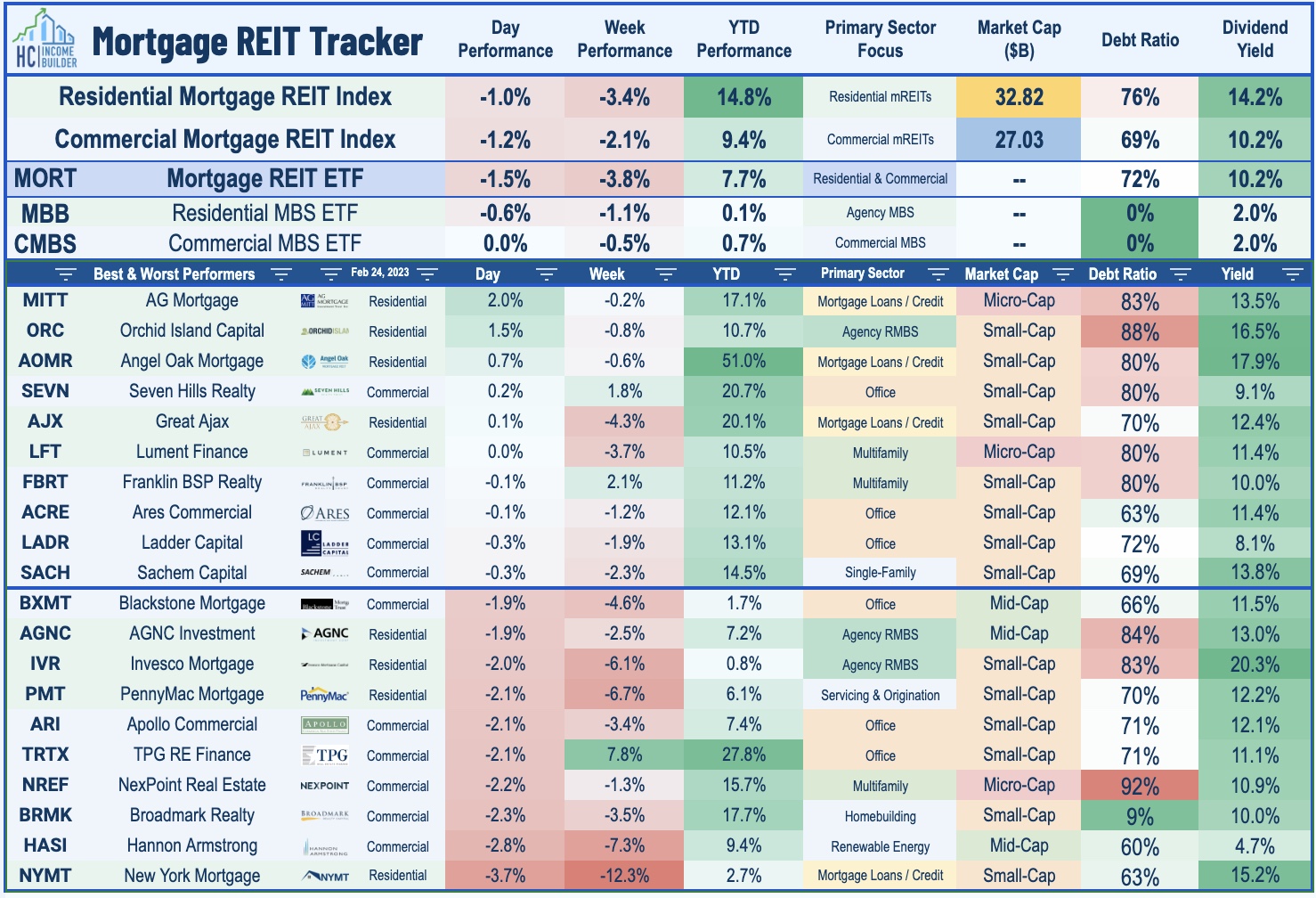

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished mostly-lower today with residential mREITs slipping 1.0% while commercial mREITs declined 1.2%. Orchid Island (ORC) gained 1.5% after reporting that its Book Value Per Share ("BVPS") increased 4.5% to $11.93 in Q4 - among the best in the mREIT space. ORC noted that its hedge-adjusted distributable earnings was $0.40/share - slightly shy of its $0.48 dividend rate, but noted that it sees its current dividend rate as "sustainable." Ellington Financial (EFC) declined 1.5% after it reported that its BVPS declined about 1% in Q4 to $15.05 and posted adjusted earnings of $0.42/share - also slightly shy of its $0.45/share dividend during the period. Granite Point Mortgage (GPMT) also declined 1.5% after reporting that its BVPS declined about 2.5% to $14.48 while posting distributable earnings of $0.17/share - also slightly below its $0.20 dividend rate.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.