REIT Earnings • Stocks Rebound • Inflation Data Ahead

- U.S. equity markets rebounded Thursday as benchmark interest rates retreated from their highest levels of the year ahead of a key slate of inflation data on Friday morning.

- Snapping a four-session losing streak, the S&P 500 advanced 0.5% today while the tech-heavy Nasdaq 100 gained 0.9% and the Dow advanced 109 points.

- Real estate equities were mostly-higher as investors parsed a busy slate of earnings reports. The Equity REIT Index advanced 0.8% with 14-of-18 property sectors in positive territory.

- Necessity Retail (RTL) was the upside standout, surging more than 10% after reporting better-than-expected results, noting that its full-year FFO rose 3.9% in 2022 while announcing continued progress in shoring up its balance sheet through asset sales and refinancings.

- Hospital owner Medical Properties Trust (MPW) dipped 8% after reporting ongoing operator issues. Farmland Partners (FPI) dipped 14% after providing downbeat guidance calling for a 30% dip in FFO in 2023.

Income Builder Daily Recap

U.S. equity markets rebounded Thursday as benchmark interest rates retreated from their highest levels of the year ahead of a key slate of inflation data on Friday morning. Snapping a four-session losing streak, the S&P 500 advanced 0.5% today while the tech-heavy Nasdaq 100 gained 0.9% and the Dow advanced 109 points. Bonds caught a bid following a sharp sell-off earlier this week, with the 10-Year Treasury Yield declining by 4 basis points to 3.88%. Real estate equities were mostly-higher as investors parsed a busy slate of earnings reports. The Equity REIT Index advanced 0.8% today with 14-of-18 property sectors in positive territory. The Mortgage REIT Index gained 0.6% while Homebuilders were among the upside leaders.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Net Lease: A half-dozen net lease REITs reported results over the past 24 hours. Necessity Retail (RTL) was the upside standout, surging more than 10% after reporting better-than-expected results, noting that its full-year FFO rose 3.9% in 2022 while announcing continued progress in shoring up its balance sheet through asset sales and refinancings. Getty (GTY) was also an upside standout, advancing about 2% after reporting full-year FFO growth of 8.6% in 2022 - above its prior guidance - and reiterated its outlook for FFO growth of about 3% in 2023, among the stronger growth outlooks in the sector. Broadstone (BNL) and EPR Properties (EPR) each gained about 1% after reporting in-line results. Gladstone Commercial (GOOD) dipped about 5% after reporting that its FFO declined 0.6% in 2022 - one of two net lease REITs that reported negative FFO for the year- as weakness in its office portfolio offset strength in its industrial segment.

Manufactured Housing: Sun Communities (SUI) slumped about 4% after reporting mixed results, noting that its full-year FFO rose 12.9% in 2022 - 120 basis points above its prior guidance - and boosting its dividend by 6% to $0.93/share, but provided a downbeat initial outlook for 2023 with expectations of a 0.4% decline in FFO at the midpoint of its range. Strength from its RV and Marina division - which delivered same-property NOI growth of 10.3% and 7.3%, respectively - offset an uncharacteristically soft year for its core manufactured housing segment, which recorded NOI growth of 3.3%. Expense pressures were the key headwind in late 2022 and its 2023 outlook, offsetting upbeat expectations of 6.3% rental rate growth in its MH division, 7.8% rent increases for RVs, and a 7.5% increase in its marina portfolio.

Cell Tower: American Tower (AMT) - which we own in the REIT Dividend Growth Portfolio - gained after reporting decent results, noting that its full-year FFO rose 1.1% in 2022 - slightly above its prior guidance - but provided initial guidance calling for a 1.6% in FFO at the midpoint of its range. A common theme across the REIT sector, higher interest expense is expected to offset an otherwise strong year of property-level growth. AMT expects 5% organic "same-store" tenant billings growth in the U.S. - an acceleration from the 1% growth in 2022 as the headwinds from the Sprint merger subside. Organic growth was complemented by the construction of nearly 7,000 sites, an American Tower record, including over 2,300 sites built in Q4, its highest level over the past eight quarters.

Industrial: Small-cap Plymouth (PLYM) - which we own in the REIT Focused Income Portfolio - rallied more than 4% after reporting solid results, noting that its full-year FFO rose 7.0% in 2022 and its same-store NOI grew nearly 11% - above its prior guidance range. PLYM confirmed that it achieved 18.1% cash leasing spreads in Q4, commenting that "2022 was a banner year for leasing. We are executing at a higher velocity and rental spreads comparable to prior year." More broadly, PLYM described its outlook for 2023 as "cautiously optimistic," highlighting that it's seeing a large number of announcements on reshoring and nearshoring initiatives that it expects will drive accelerated demand this year in its "Golden Triangle" markets which includes the Sunbelt and Midwest regions.

Storage: ExtraSpace (EXR) rallied nearly 3% after reporting better-than-expected results, noting that its full-year FFO rose 22.1% in 2022 - 130 basis points above its prior outlook - driven by same-store NOI growth of 19.7% - also topping its guidance. EXR's expects its FFO in 2023 to be flat with the prior year as higher interest expenses offset an expected 4% rise in same-store NOI. Earlier this year, EXR raised its quarterly dividend by 8% to $1.62/share. After delivering incredible cumulative rent growth of 30% from mid-2020 to mid-2022, the outlook for the storage sector in 2023 is less certain amid a dip in housing-related demand. We'll hear results this afternoon from CubeSmart (CUBE) and Life Storage (LSI).

Healthcare: Hospital owner Medical Properties Trust (MPW) dipped nearly 8% after reporting mixed results, noting that its full-year FFO rose 4.0% in 2022 - slightly above its prior guidance - but provided a downbeat outlook for 2023 with expectations of a 13.5% dip in its FFO at the midpoint of its range. Tenant concerns were the focus of the report, with MPW noting that its outlook "contemplates a conservative scenario due to the underperformance of Prospect's hospitals, as well as the process by which we expect to recover our investment in Prospect's Pennsylvania and Connecticut hospitals."

Additional Headlines from The Daily REITBeat on Income Builder

- S&P affirmed ADC's “BBB” issuer credit rating on the company and its operating subsidiary with a stable outlook

- AMH, CTO, CUBE, GLPI, LSI, NTST, RHP, and VICI are scheduled to report after the close of trading and LAMR reports tomorrow morning

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly-higher today, with residential mREITs advancing 0.4% while commercial mREITs gained 1.3%. Franklin BSP (FBRT) advanced about 2% after reporting solid results, noting that its BVPS was roughly flat in Q4 at $15.78 while commenting that it's "very happy with where we are today at dividend coverage." New York Mortgage (NYMT) dipped 4% after reporting disappointing results, noting that its Book value Per Share ("BVPS") declined 9% to $3.32 in Q4, but commented that "nearly all book value loss in the quarter were unrealized and expected to be reversed over time." The company also announced a $200M share repurchase program and a one-for-four reverse stock split that is expected to take effect on March 9th. Elsewhere, AG Mortgage (MITT) advanced 2% after reporting a 3% increase in its BVPS in Q4 while MFA Financial (MFA) gained 3% after reporting that its BVPS rose about 2% in Q4 to $15.55.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

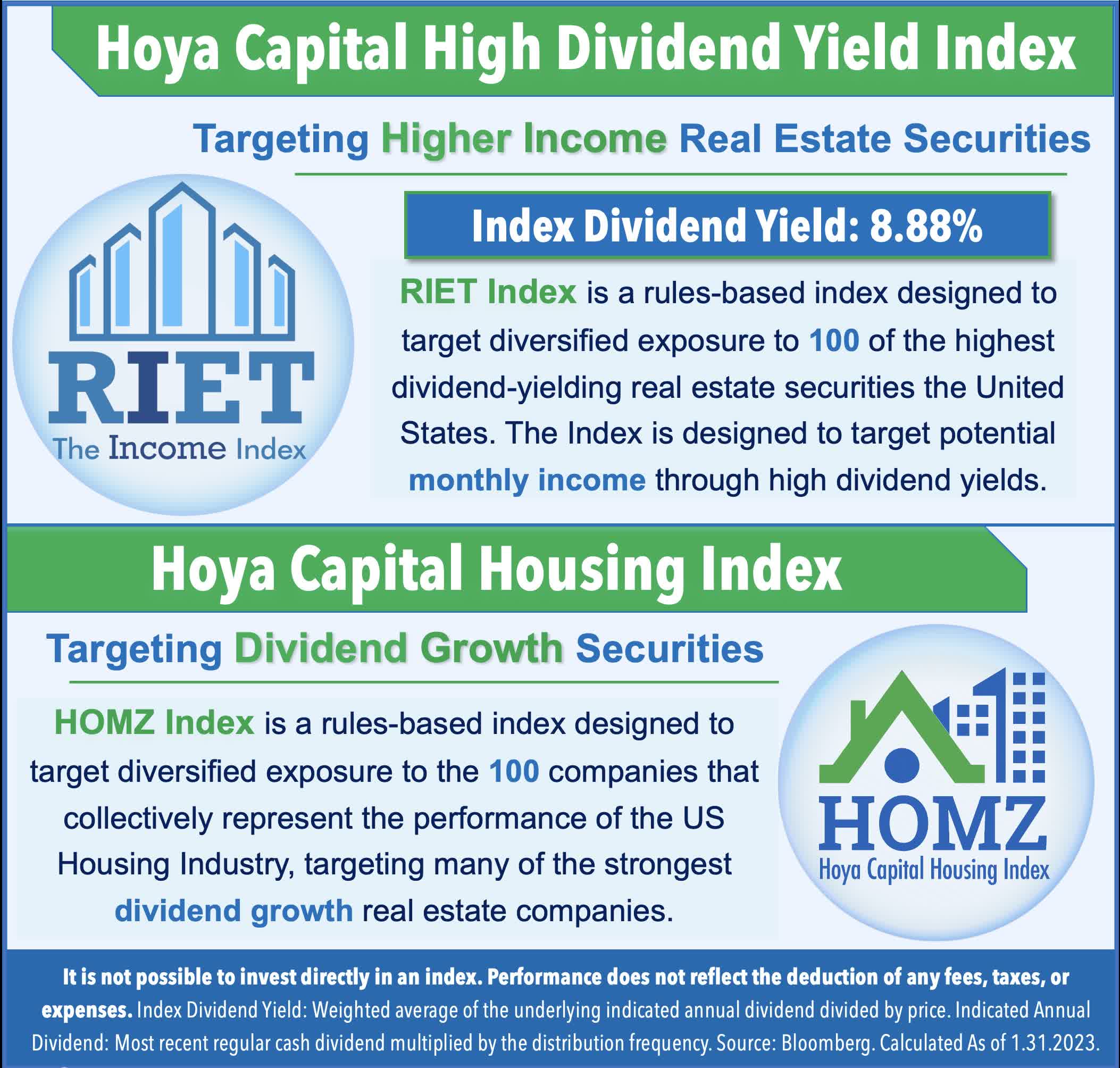

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.