Inflation Ahead • Strong REIT Earnings • Rents Rising

- U.S. equity markets finished broadly higher Wednesday while Treasury yields declined as investors parsed a busy slate of corporate earnings reports ahead of a closely-watched CPI inflation report tomorrow morning.

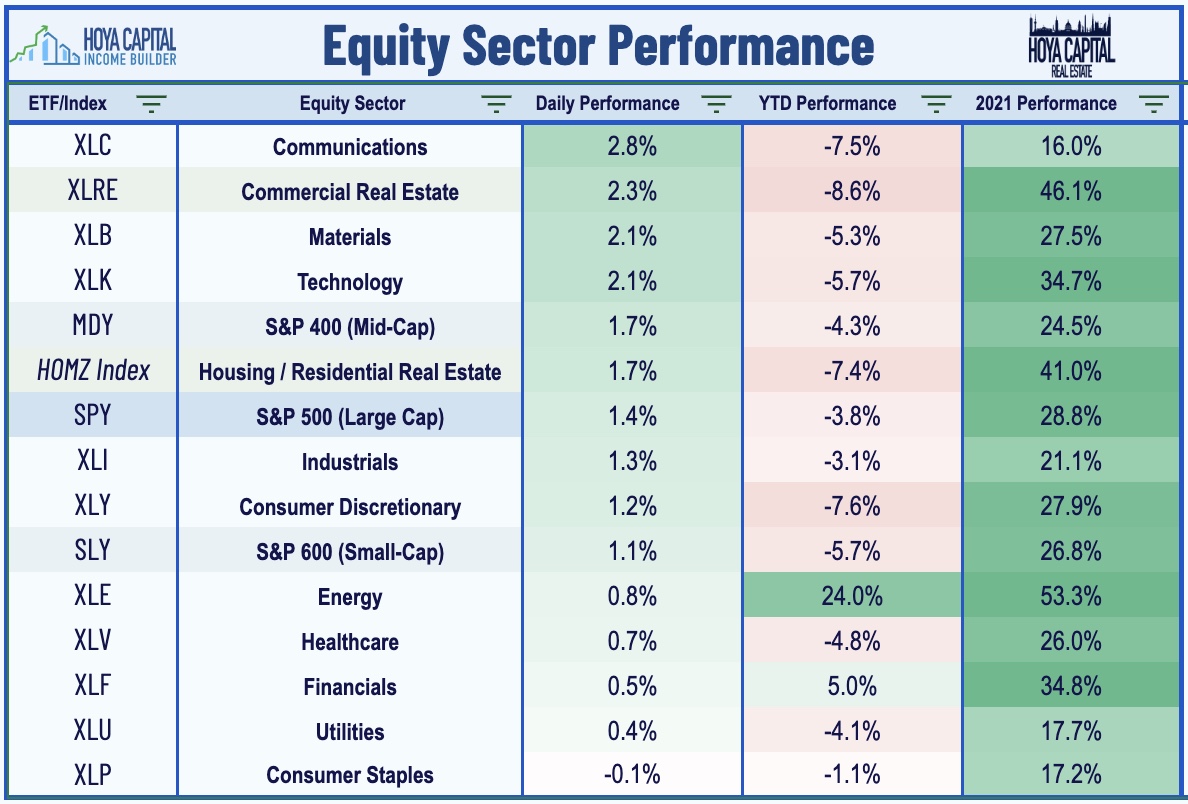

- Pushing its week-to-date gains to nearly 2%, the S&P 500 advanced 1.4% today while the tech-heavy Nasdaq 100 climbed out of "correction territory" with gains of 2.0%.

- Real estate equities were leaders today following strong earnings reports over the last 24 hours as the Equity REIT Index advanced 2.2% with all 19 property sectors in positive territory.

- Coastal apartment REIT UDR rallied 2% after reporting blended leasing spread on new and renewed leases of 11.7% in Q4, which accelerated further to 13.1% in January as rents continue to soar across essentially all segments of the rental markets.

- National Retail (NNN) gained 1% today after it kicked off earnings season for the net lease sector with a strong report this morning in which it beat its 2021 guidance and raised its full-year outlook for 2022.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished broadly higher Wednesday while Treasury yields declined as investors parsed a busy slate of corporate earnings reports ahead of a closely-watched CPI inflation report tomorrow morning. Pushing its week-to-date gains to nearly 2%, the S&P 500 advanced 1.4% today while the tech-heavy Nasdaq 100 climbed out of "correction territory" with gains of 2.0%. Real estate equities were leaders today following strong earnings reports over the last 24 hours as the Equity REIT Index advanced 2.2% with all 19 property sectors in positive territory while the Mortgage REIT Index gained 0.4%.

All eleven GICS equity sectors finished higher on the day, led to the upside by the Communications (XLC) and Real Estate sectors (XLRE) ahead of a busy afternoon of earnings reports which includes index heavyweights Disney (DIS) and Uber (UBER). The 10-Year Treasury Yield remained steady at the highest levels since 2019 at 1.95%. Residential REITs and homebuilders led the Hoya Capital Housing Index to another day of outperformance today as earnings season across the housing industry continues to impress.

Equity REIT Daily Recap

Apartment: UDR (UDR) rallied 2% after continuing the trend of stellar earnings reports from apartment REITs as rents continue to soar across essentially all segments of the rental markets. UDR recorded blended leasing spread on new and renewed leases of 11.7% in Q4, which accelerated further to 13.1% in January. UDR commented, "Our outlook for 2022 guidance signals one of our best years ever." Riding this rental rate momentum, UDR projects 13.2% FFO growth in 2022 at the midpoint of its guidance range and 10.0% same-store NOI growth - which would both be record-highs for the company.

Net Lease: National Retail (NNN) gained 1% today after it kicked off earnings season for the net lease sector with a strong report this morning in which it beat its 2021 guidance and raised its full-year outlook for 2022. NNN recorded Core FFO growth of 10.4% in 2021 - fully recovering its declines from 2020 - and now sees growth of another 3.7% in 2022. NNN remained as active as ever on the acquisition front, buying $550M in properties in 2022 at an initial cash yield of 6.5%, with a weighted average remaining lease term of 18.2 years, and sold 74 properties for $122.0M at a cap rate of 7.4%. The firm sees a continued acceleration in external growth activity, setting its initial 2022 acquisition guidance at $600M.

Healthcare: HealthPeak (PEAK) advanced 2% today after reporting solid results propelled by strength in its life sciences segment. PEAK reported full-year FFO above its prior guidance and sees 7.5% FFO growth in 2022 at the midpoint of its range. For full-year 2021, it recorded 7.2% same-store NOI growth in its life sciences segment and expects 4.5% growth this year. Its medical office segment saw 3.1% NOI growth last year and PEAK is expecting 2.3% growth in 2022 at the midpoint. While a small part of its portfolio, PEAK's senior housing segment saw signs of stabilization in Q4 and PEAK expects to see 10% same-store NOI growth in its CCRC senior housing portfolio in 2022, a positive read-through for senior housing REITs Welltower (WELL) and Ventas (VTR).

Last week, we published REIT Earnings Preview: Dividend Hikes And 2022 Outlook. Highlights of this afternoon's earnings slate include Apartment Income (AIRC), Rexford (REXR), and First Industrial (FR). Tomorrow morning we'll hear from Macerich (MAC) and Kimco (KIM). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs advanced 1.1% while residential mREITs slipped 0.3%. Blackstone Mortgage (BXMT) gained more than 3% today after reporting strong results, highlighted by a 1.1% increase in Book Value Per Share ("BVPS") to $27.22. KKR Real Estate (KREF) finished modestly lower despite reporting a 1.4% increase in its BVPS to $19.37. Apollo Commercial (ARI) was flat today after reporting that its BVPS declined by 2.3% in Q4. We'll hear results this afternoon from Annaly Capital (NLY), Two Harbors (TWO), and Redwood Trust (RWT).

We're excited to announce the launch of our new investment research service on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.