Inflation Soars • REIT Dividend Hikes • Earnings Analysis

- U.S. equity markets finished sharply lower Thursday after a hotter-than-expected CPI inflation report sent interest rates to post-pandemic highs and likely accelerated the Fed's plans for monetary tightening.

- Erasing its week-to-date gains, the S&P 500 slid 1.8% today while the tech-heavy Nasdaq 100 dipped back into "correction territory" with declines of 2.3%.

- Real estate equities slumped today amid rising rate concerns as the Equity REIT Index declined 2.4% today with 18-of-19 property sectors in negative territory while the Mortgage REIT Index declined 1.9%.

- Consumer prices surged at the fastest pace in nearly four decades in January with the CPI index rising by 7.5% year-over-year – hotter than consensus estimates. Food, rent, and energy costs drove the gains with no clear signs of a peak yet.

- A pair of REITs boosted their dividends over the last 24 hours as REIT earnings season continues its positive trend. Even battered mall REIT Macerich gained today after reporting strong foot traffic during the holiday season.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished sharply lower Thursday after a hotter-than-expected CPI inflation report sent interest rates to post-pandemic highs and likely accelerated the Fed's plans for monetary tightening. Erasing its week-to-date gains, the S&P 500 slid 1.8% today while the tech-heavy Nasdaq 100 dipped back into "correction territory" with declines of 2.3%. Mid-Cap and Small-Caps were lower by 1.4%. Real estate equities slumped today amid rising rate concerns as the Equity REIT Index declined 2.4% today with 18-of-19 property sectors in negative territory while the Mortgage REIT Index declined 1.9%.

Hotter-than-expected inflation data pushed the 10-Year Treasury Yield above 2.0% for the first time since late 2019 as investors are now pricing in a full percentage point of hikes by July and as many as seven by the end of 2022. All eleven GICS equity sectors were lower on the day, dragged on the downside by the Real Estate (XLRE) and Technology (XLK) sectors.

The BLS reported this morning that consumer prices surged at the fastest pace in nearly four decades in January as inflation has so far proven to be less "transitory" than many economists projected. The Consumer Price Index rose 7.5% year-over-year – hotter than consensus estimates - and the highest annual increase since February 1982. Core Consumer Prices - which excludes food and energy - rose 6.0% from last year - also hotter than expected. Prices for food, rent, and gasoline were once again the largest contributors to inflation as the energy index rose 27.0% and the food index increased 7.0%.

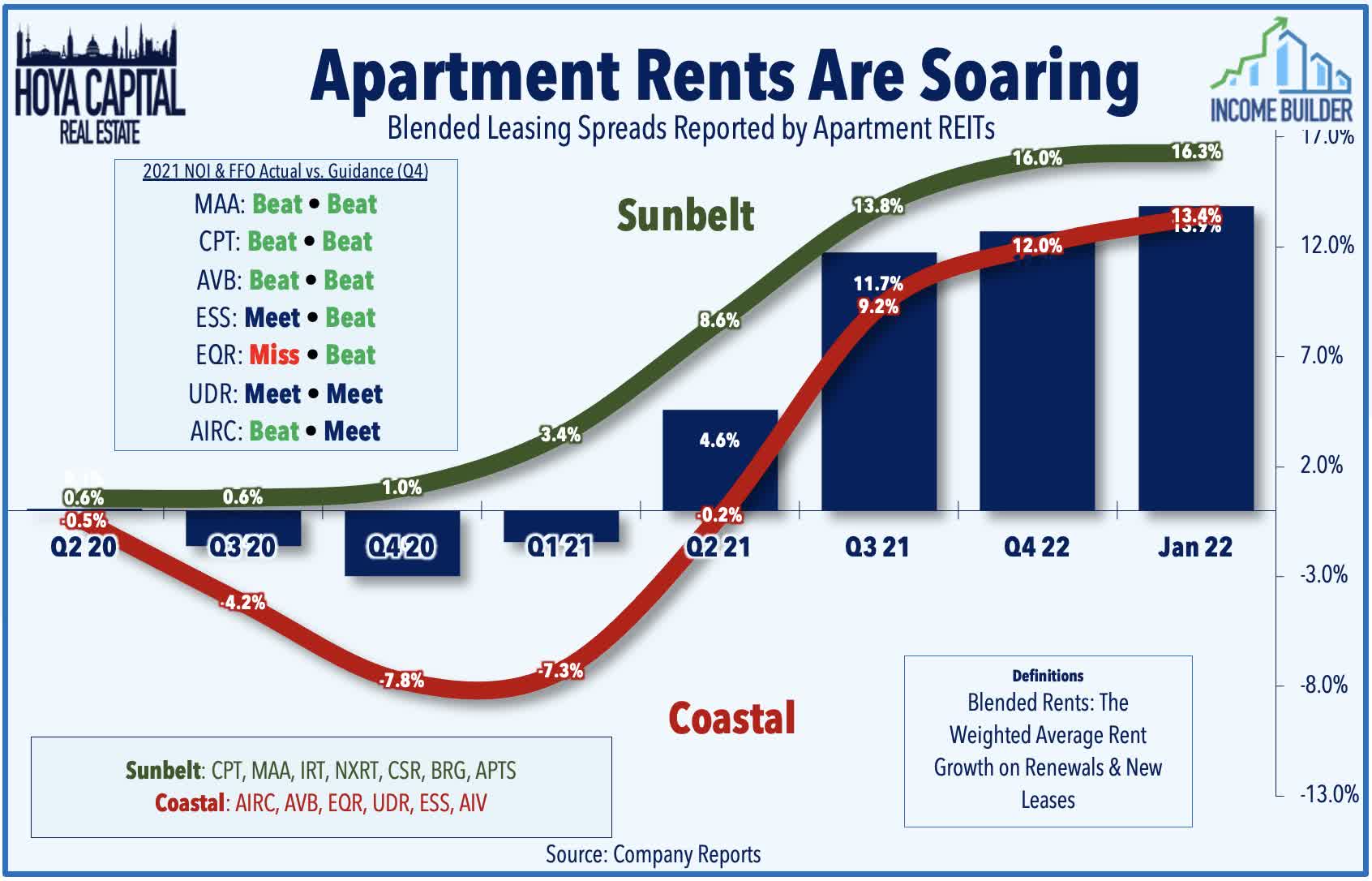

As we've discussed for the last year, we continue to see persistent near-term pressure on inflation metrics due to the delayed impact of soaring rents and home values, which are just beginning to filter in the data. The cost of shelter gained 0.3% in January, while the annual gain rose to 4.4%, the highest in more than 14 years. Private market rent data has shown that national rent inflation has been in the 10-15% range over the past quarter while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

Equity REIT Daily Recap

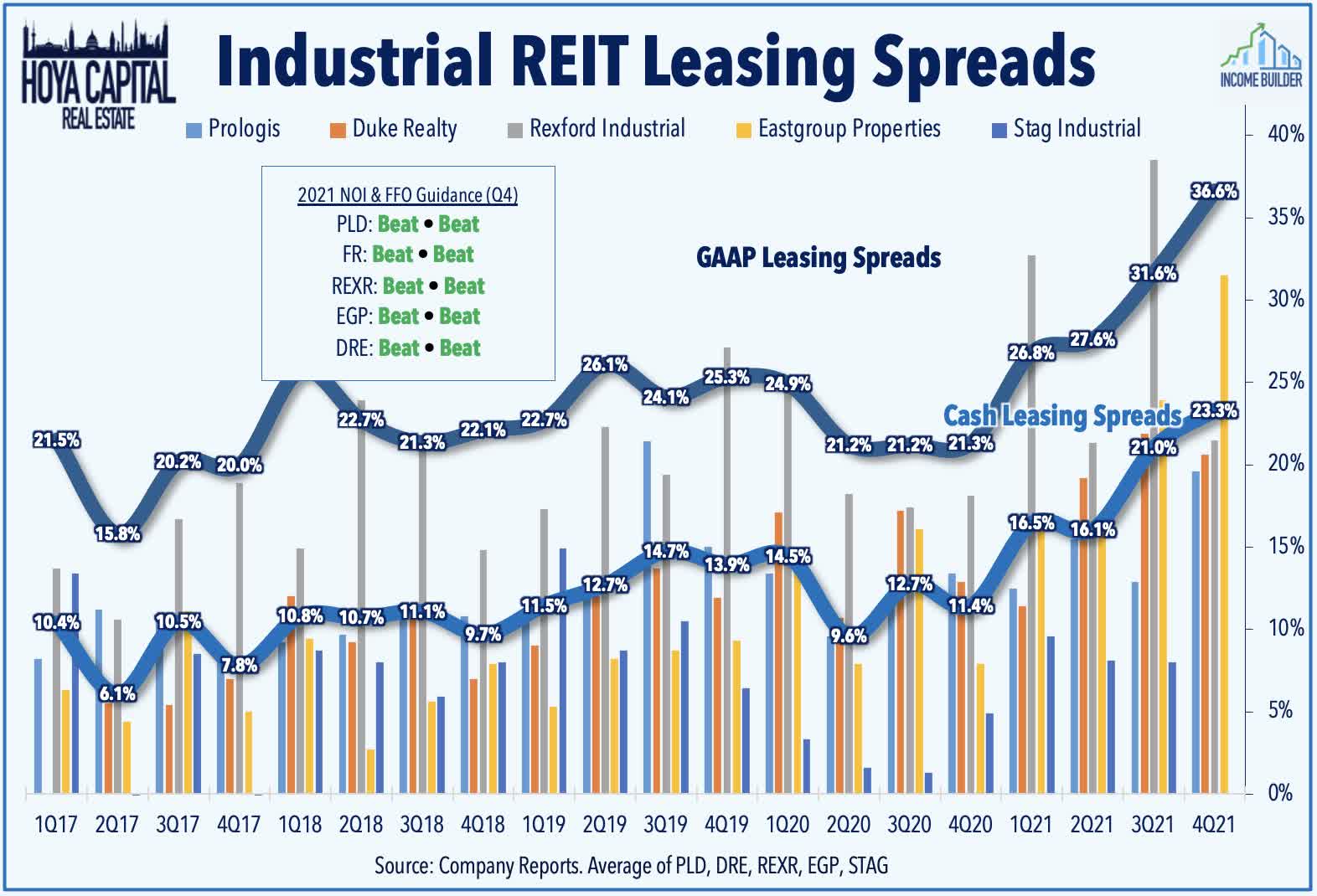

Industrial: First Industrial (FR) reported impressive results yesterday afternoon which included a 9.3% dividend increase. FR recorded full-year FFO growth of 7.1% in 2021 - well above its prior guidance - and sees FFO growth of 8.6% in 2022. Consistent with the reports from the other five industrial REITs, rents continue to soar as FR saw cash rental rates rise 16.2% in 2021, its highest annual increase in company history. Perhaps most impressive, FR recorded same-store NOI growth of 12.3% in 2021 and expects further growth of 5.75% at the midpoint of its guidance range - both of which were the highest in the industrial sector.

Elsewhere in the industrial sector, we heard a similarly strong report from Rexford (REXR), which also included a 31.3% dividend raise. REXR - which focuses exclusively on the Southern California region - reported cash releasing spreads of 21.5%, driving same-store NOI growth of 12.3% in 2021, but REXR does expect to see a slight moderation in growth to 6.5% at the midpoint of its initial guidance range for 2022. With the hikes from FR and REXR, we're now up to 13 equity REIT dividend hikes this year across the real estate sector.

Mall: Macerich (MAC) advanced 2% after reporting decent results this morning which showed signs of stabilizing fundamentals despite headwinds from the Delta and Omicron variants in late 2021. On the upside, MAC noted that foot traffic during the holiday shopping season reached ~95% of pre-pandemic levels while portfolio occupancy increased for the third-straight quarter. Leasing spreads were also decent at +5%, its first positive quarter in two years. Similar to Simon's (SPG) outlook earlier in the week, however, MAC provided relatively downbeat guidance for 2022 calling for muted growth with its 2022 FFO range still 40% below its pre-pandemic level from 2019.

Apartment: Apartment Income (AIRC) - which completed its first full year after spinning off from Aimco (AIV) - reported impressive results yesterday afternoon, recording sector-leading FFO growth of 23% in 2021 and expects another 12.1% growth in 2022 at the midpoint of its guidance range. Continuing the trend of stellar earnings reports from apartment REITs, blended leasing spreads were above its coastal peers with 12.8% growth in Q4, accelerating to 13.3% growth in January. AIRC continues to execute on its portfolio repositioning, completing its exit from the Chicago and New York markets, and reducing its exposure to California while adding to its portfolio in Florida and DC.

Last week, we published REIT Earnings Preview: Dividend Hikes And 2022 Outlook. Highlights of this afternoon's earnings slate include Regency Centers (REG), Federal Realty (FRT), Alpine Income (PINE), and Philips Edison (PECO). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout earnings season.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.