March Madness • Inflation Eases • Fed Ahead

- U.S. equity markets slid Friday while interest rates plunged as traders piled into safe-haven assets ahead of the weekend after a mega-sized rescue package for First Republic failed to settle turmoil.

- On brand with the "March Madness" theme this week, the seesaw action continued with the S&P 500 dipping 1.1% today - but still managed to notch a 1% weekly gain.

- The tech-heavy Nasdaq 100 declined 0.5% today but finished the week higher by nearly 6%, a remarkable divergence from the 3% weekly declines posted by the Mid-Cap 400 and Small-Cap 600.

- Real estate equities slumped despite the retreat in benchmark interest rates, with the Equity REIT Index slipping 2.3% today with 17-of-18 property sectors in negative territory, while the Mortgage REIT Index dipped 3.3%.

- The theme of cooler-than-expected inflation data continued today in the final reading before the FOMC's rate decision next Wednesday. Short-term consumer inflation expectations fell in early March to the lowest level in nearly two years while long-run inflation expectations also eased.

Income Builder Daily Recap

U.S. equity markets slid Friday while interest rates plunged as traders piled into safe-haven assets ahead of the weekend after a mega-sized rescue package for First Republic Bank failed to settle recent turmoil. On brand with the "March Madness" theme this week, the seesaw action continued with the S&P 500 dipping 1.1% today - but still managed to notch a 1% weekly gain. The tech-heavy Nasdaq 100 declined 0.5% today but finished the week higher by nearly 6%, a remarkable divergence from the 3% weekly declines posted by the Mid-Cap 400 and Small-Cap 600. Real estate equities slumped despite the retreat in benchmark interest rates, with the Equity REIT Index slipping 2.3% today with 17-of-18 property sectors in negative territory, while the Mortgage REIT Index dipped 3.3%.

Even more remarkable volatility was seen in Treasury markets this week with benchmark interest rates swinging wildly ahead of next week's FOMC rate decision. The policy-sensitive 2-Year Treasury Yield plunged back to 3.85% today - nearly 125 basis points lower than its highs of 5.07% in the prior week - while the 10-Year Treasury Yield dipped 19 basis points to 3.40%. The Crude Oil benchmark, meanwhile, dipped back to its lowest levels since 2021 while all eleven GICS equity sectors finished lower on the day. Notable individual movers included First Republic (FRC) - which dipped more than 30% today - while logistics giant FedEx (FDX) rallied nearly 8% after reporting strong earnings results and raising its full-year outlook.

The theme of cooler-than-expected inflation data continued today in the final reading before the FOMC's rate decision next Wednesday. The University of Michigan's Survey of Consumers showed that short-term inflation expectations fell in early March to the lowest level in nearly two years while long-run inflation expectations also eased. Respondents said they expect inflation to rise 3.8% over the next year - the lowest reading since April 2021 - and expect inflation to average 2.8% over the next five to ten years, which was the lowest in six months. Earlier this week, we commented that the Fed appears to be fighting the "ghosts of inflation past" which may indeed be the root of recent financial instability. Consumer Price Index data this week showed a sharp cooldown in "real-time" inflation while Producer Price Index data was also significantly cooler-than-expected with the Core PPI Index posting a month-over-month decline for the first time since May 2020.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

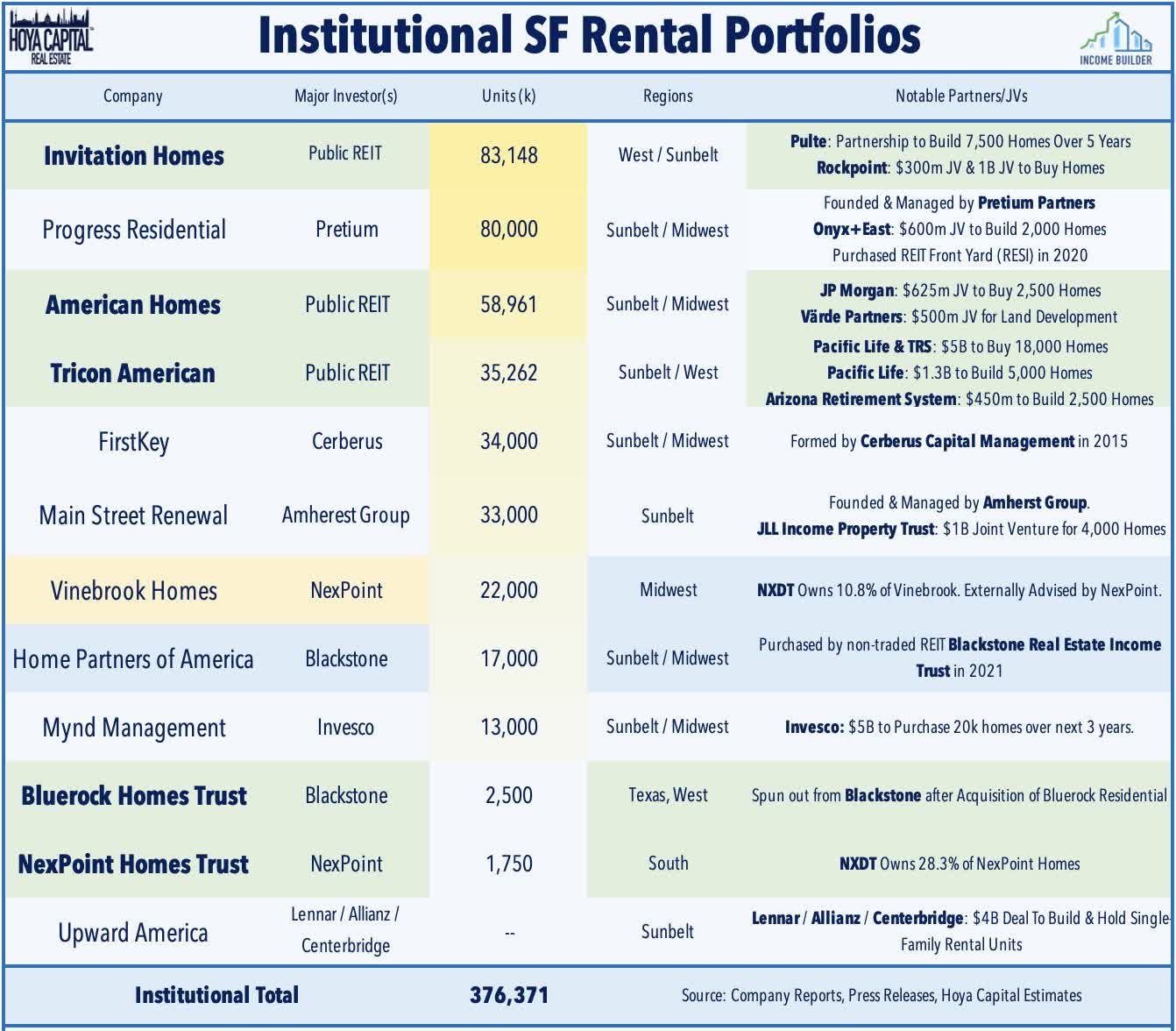

Single-Family Rental: Invitation Homes (INVH) - which we own in the Dividend Growth Portfolio - announced that it received an S&P credit rating upgrade to 'BBB' from 'BBB-' with a stable outlook. S&P cited INVH's "improved capital structure over the past two years along with expectations that positive operating performance will be sustained." After relying on shorter-term mortgage-based debt early in its existence, it has leveraged its strong operational track record - and status as the largest SFR owner in the country - to access longer-term unsecured financing channels over the past several years. INVH has refinanced over $3 billion of secured debt in 2021 and 2022 and has been able to push its nearest-term debt maturity to 2026."

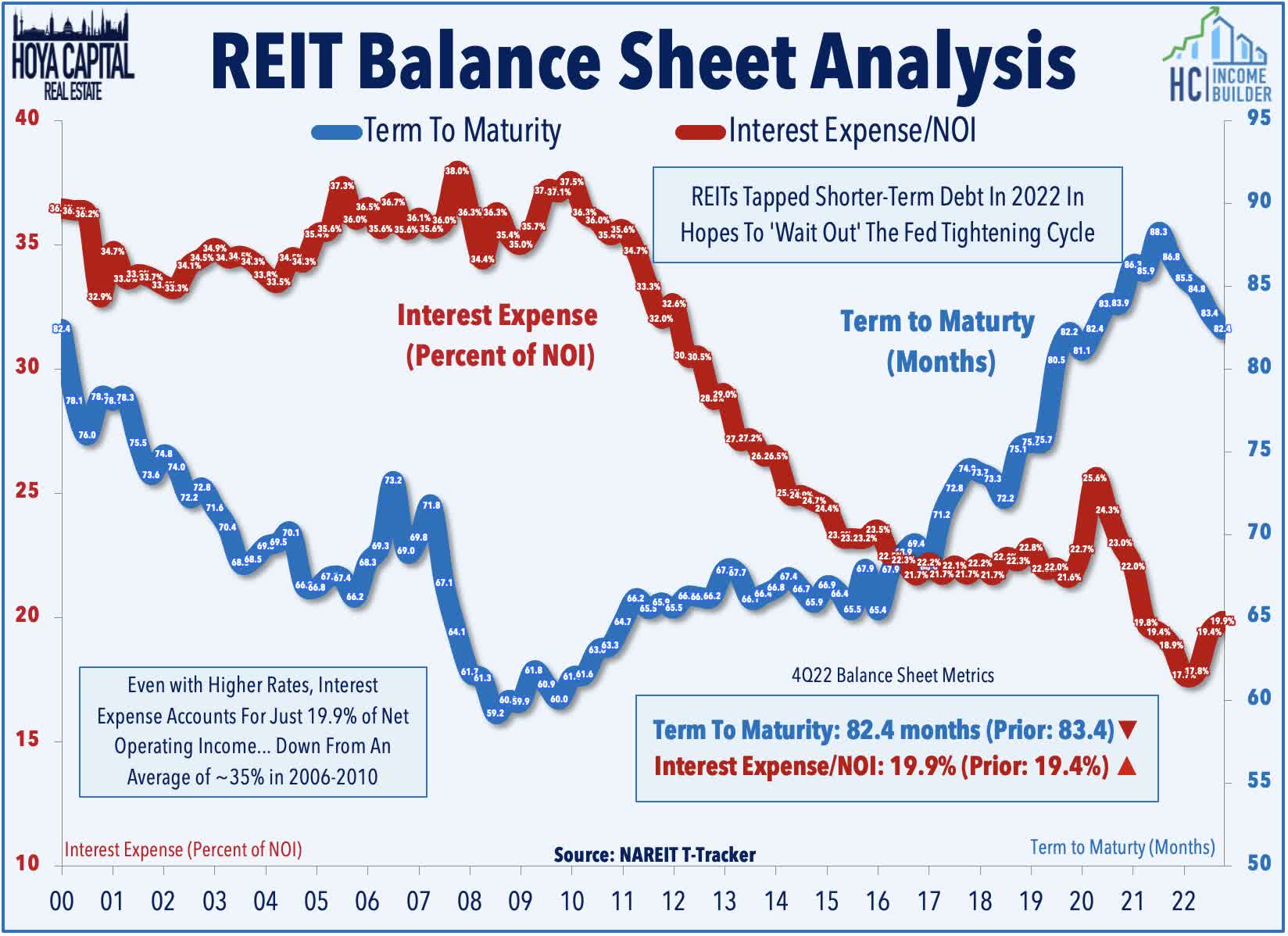

On that note, in our State of the REIT Nation report earlier this week, we examined high-level REIT fundamentals - and REIT balance sheets - to chart the likely path forward for the real estate industry amid the recent turmoil. Owing to the harsh lessons from the Great Financial Crisis, most REITs have been exceedingly conservative with their balance sheet and strategic decisions, ceding ground to higher-levered private-market players. Critically, publicly-traded REITs have had far greater access to longer-term, fixed-rate unsecured debt that has allowed REITs to lock-in fixed rates on nearly 90% of their debt while simultaneously pushing their average debt maturity to nearly 7 years, on average, thus avoiding the need to refinance during these highly unfavorable market conditions.

Additional Headlines from The Daily REITBeat on Income Builder

- Stag Industrial (STAG) announced that CEO Ben Butcher will retire on June 30 but will continue to serve on the Board. The Company appointed Larry Guillemette as independent Chairman of the Board

- Clipper Realty (CLPR) announced 4Q Adjusted FFO of $.11/share

Mortgage REIT Daily Recap

Today we published Mortgage REITs: High-Yield Opportunities & Risk, which discussed our updated outlook on the sector and recent allocations in our Focused Income Portfolio. Mortgage REITs have been slammed by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

On cue, we heard a half-dozen REITs declared their quarterly dividend rates over the past 24 hours, and all six held their payouts steady. Blackstone Mortgage (BXMT) declared a $0.62 dividend (13.8% yield), Brightspire (BRSP) declared a $0.20 dividend (13.1% yield), Starwood Property (STWD) declared a $0.48 dividend (11.1% yield), Cherry Hill (CHMI) declared a $0.27 dividend (20.1% yield), Lument (LFT) declared a $0.06 dividend (12.6% yield), and Granite Point (GPMT) declared a $0.20 dividend (15.6% yield). That didn't stop the selling pressure today, however, as mortgage REITs finished sharply lower today with residential mREITs slipping 3.5% while commercial mREITs dipped by 3.0%. Notably, the underlying MBS benchmarks - (MBB) and (CMBS) each gained about 1% on the day, lifting these indexes to one of their strongest weekly gains of the past decade.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.