Swiss Bailout • Fed Ahead • REIT Dividend Hikes

- U.S. equity markets rebounded Monday in another volatile session after Swiss regulators engineered a rescue of Credit Suisse by rival UBS, the latest in a series of major bank collapses.

- Continuing its "seesaw" pattern of daily moves for a seventh session, the S&P 500 gained 0.9% today. The Mid-Cap 400 and Small-Cap 600 gained over 1% following declines of 3% last week.

- Real estate equities also finished broadly-higher today as investors weighed potential tailwinds from lower interest rates against increased credit concerns across several property sectors.

- Over the weekend, the Federal Reserve and five other major global central banks announced fresh measures to inject liquidity into US dollar swap arrangements, the latest in a series of emergency policy actions in recent weeks to ease growing strains in the global financial system.

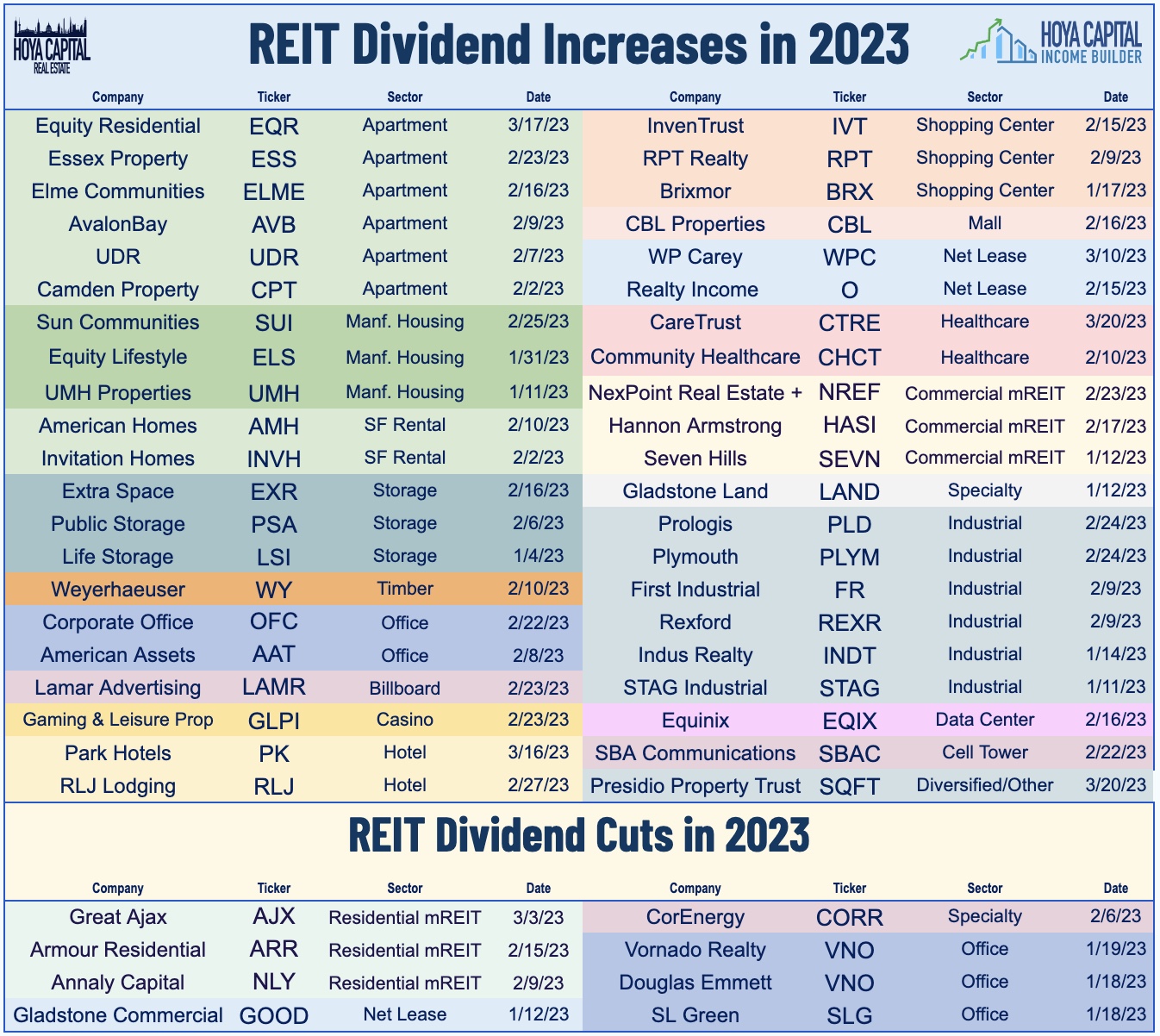

- Another day, another handful of REIT dividend hikes. Micro-cap Presidio Property (SQFT) rallied 2% after it boosted its quarterly dividend by 5% to $0.022/share, representing a forward dividend yield of 8.46%. After the close today, CareTrust REIT (CTRE) hiked its quarterly dividend by 2% to $0.28/share, representing a forward yield of 5.9%.

Income Builder Daily Recap

U.S. equity markets rebounded Monday in another volatile session after Swiss regulators engineered a rescue of Credit Suisse by rival UBS, the latest in a series of major bank collapses. Continuing its "seesaw" pattern of daily moves to a seventh session, the S&P 500 gained 0.9% today following sharp declines last Friday. The Mid-Cap 400 and Small-Cap 600 gained over 1% following declines of 3% last week. The tech-heavy Nasdaq 100 advanced 0.4% today after soaring nearly 6% last week. Real estate equities also finished broadly higher today as investors weighed potential tailwinds from lower interest rates against increased credit concerns across several property sectors. The Equity REIT Index advanced 1.1% today with 17-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.1%.

Over the weekend, the Federal Reserve and five other major global central banks announced fresh measures to inject liquidity into US dollar swap arrangements, the latest in a series of emergency policy actions in recent weeks to ease growing strains in the global financial system. While the engineer rescue of Credit Suisse (CS) appeared to resolve the most immediate crisis, the fate of First Republic Bank (FRC) - which plunged another 50% today - remains uncertain despite attempts at a coordinated rescue by major US banks last week. The volatility across interest rate markets continued today with the policy-sensitive 2-Year Treasury Yield rebounding back towards 4.0% today after dipping to 3.85% last week, a heart-dropping plunge from over 5.0% in the prior week. The Crude Oil benchmark rebounded off its lowest levels since 2021. Led by Energy (XLE) stocks, all eleven GICS equity sectors finished higher on the day.

All eyes will be on the Federal Reserve in the week ahead. The Federal Open Market Committee ("FOMC") begins its two-day policy meeting on Tuesday which concludes with the Fed's Interest Rate Decision on Wednesday afternoon. As of Monday afternoon, swaps markets imply a roughly 75% probability of a 25 basis point rate hike to an upper bound of 5.0% with 25% odds of a pause. Notably, markets now expect this to be the final rate hike of this rate hike cycle and currently reflect expectations of four rate cuts by the end of the year which would bring the upper bound to 4.0%. It'll be another busy week of housing market data as well, with Existing Home Sales data on Tuesday and New Home Sales data on Thursday. Home Sales metrics have closely correlated with changes in mortgage rates, which averaged 6.66% in February, up from 6.26% in January. We'll also be watching weekly Jobless Claims data on Thursday and a busy slate of PMI data throughout the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Another day, another handful of REIT dividend hikes. Micro-cap Presidio Property (SQFT) rallied 2% after it boosted its quarterly dividend by 5% to $0.022/share, representing a forward dividend yield of 8.46%. After the close today, CareTrust REIT (CTRE) hiked its quarterly dividend by 2% to $0.28/share, representing a forward yield of 5.9%. We've now seen 40 REITs hike their dividends this year, while eight REITs have lowered their payouts. Also of note, several closely-watched office REITs held their dividends steady over the past 24 hours including Boston Properties (BXP), SL Green (SLG), and Cousins (CUZ). In our State of the REIT Nation report published last week, we noted that REIT dividend payout ratios remain near historic lows at less than 70% of Funds From Operations ("FFO").

Owing to the harsh lessons from the Great Financial Crisis, most REITs have been exceedingly conservative with their balance sheet and strategic decisions, ceding ground to higher-levered private-market players. Critically, publicly-traded REITs have had far greater access to longer-term, fixed-rate unsecured debt that has allowed REITs to lock-in fixed rates on nearly 90% of their debt while simultaneously pushing their average debt maturity to nearly 7 years, on average. The ability to avoid "forced" capital raising events has been the cornerstone of REIT balance sheet management since the GFC - a time in which many REITs were forced to raise equity through secondary offerings at "firesale" valuations just to keep the lights on, resulting in substantial shareholder dilution which ultimately led to a "lost decade" for REITs. While REITs enter this period on very solid footing with deeper access to capital, the same can't necessarily be said about many private market players that rely on more short-term borrowing and continuous equity inflows.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly higher today with residential mREITs gaining 1.2% while commercial mREITs rallied 2.5%. Arbor Realty (ABR) which we added to the Focused Income Portfolio last week - rallied nearly 6% today after it announced a share repurchase program for up to $50M of its outstanding common stock. The three REITs that declared first-quarter dividend over the past 24 hours each held their payouts steady with prior rates. Rithm Capital (RITM) declared a $0.25/share quarterly dividend (13.0% yield), Franklin BSP Realty (FBRT) declared a $0.355/share quarterly dividend (12.3% yield), and KKR Real Estate (KREF) declared a $0.43/share quarterly dividend (15.6% yield).

Last week, we published Mortgage REITs: High-Yield Opportunities & Risk, which discussed our updated outlook on the sector and recent allocations in our Focused Income Portfolio. Mortgage REITs have been slammed by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.