REIT Earnings • West Coast Weakness • Cellular Strength

U.S. equity markets finished mostly lower Tuesday as investors analyzed a busy slate of corporate earnings results while benchmark interest rates marched higher despite a disappointing slate of economic data.

Erasing modest gains on Monday, the S&P 500 slipped 0.3% today, but the Dow Jones Industrial Average gained 71 points, advancing for the 16th time in 17 sessions.

Real estate equities were mixed today amid the busiest 48-hour stretch of second-quarter earnings reports. The Equity REIT Index slipped 0.2% today, with 6-of-18 property sectors finishing in positive territory.

After a strong start to office REIT earnings season, results over the past 24 hours have tempered the optimism a bit, particularly for West Coast markets. Paramount Group (PGRE) plunged 8% after reporting very weak results and significantly lowering its full-year outlook.

Midwest-focused apartment REIT CenterSpace (CSR) surged 6% after reporting strong results and significantly raising its full-year outlook. Cell tower REIT SBA Communications (SBAC) rallied 4% after also raising its outlook.

Income Builder Daily Recap

U.S. equity markets finished mostly lower Tuesday as investors analyzed a busy slate of corporate earnings results while benchmark interest rates marched higher despite a disappointing slate of economic data this morning. Erasing modest gains on Monday, the S&P 500 slipped 0.3% today, but the Dow Jones Industrial Average gained 71 points, advancing for the 16th time in 17 sessions. Benchmark yields pushed higher despite a weak JOLTs print - the first major jobs report of the busy week - with job openings falling to the lowest-level since April 2021, while PMI data showed a worsening manufacturing slump. The 10-Year Treasury Yield jumped nine basis points to 4.05%, while the policy-sensitive 2-Year Yield rose three basis points to 4.91%. Real estate equities were mixed today amid the busiest 48-hour stretch of second-quarter earnings reports. The Equity REIT Index slipped 0.2% today, with 6-of-18 property sectors finishing in positive territory, while the Mortgage REIT Index slipped 1.5%.

Office: After a strong start to office REIT earnings season, results over the past 24 hours have tempered the optimism a bit, particularly for West Coast markets. Paramount Group (PGRE) plunged 8% after reporting very weak results and significantly lowering its full-year outlook driven by the bankrupcy of First Republic - its largest tenant - and deepening distress in the San Francisco office market. PGRE leased just 72k square feet of space in Q2 - 70% below its pre-pandemic average from 2017-2019 - with just 12k SF leased in San Francisco Back in June, PGRE slashed its dividend by more than 50%, one of nine office REITs to lower its dividend this year. Kilroy (KRC) slipped 1% after reporting mixed results, noting that its occupancy rate dipped 300 basis points from the prior quarter, driven by several significant lease expirations in its Seattle portfolio. On the upside, KRC still managed to raise its full-year outlook for both same-store NOI and FFO, and was able to secure an 11-year $375M secured loan at a 5.90% fixed interest rate - relatively attractive pricing compared to recent large debt raises in the office sector. Vornado (VNO) finished flat after reporting mixed results as well, recording leasing volume of 279k square feet - down about 10% compared to pre-pandemic-levels, but pricing was relatively firm with cash renewal spreads of 5.7%. We'll hear results this afternoon from Douglas Emmett (DEI), Hudson Pacific (HPP), and Boston Properties (BXP).

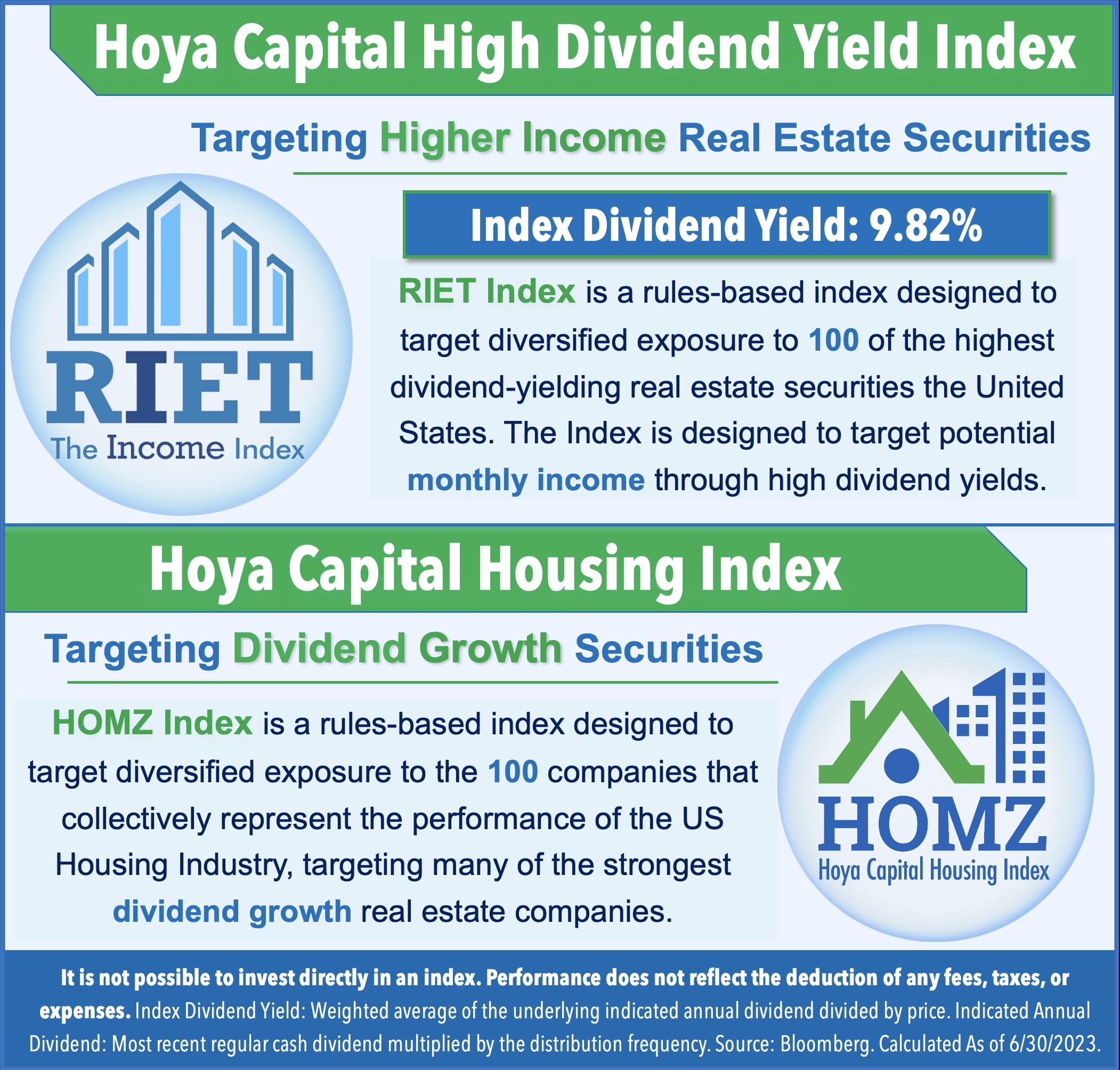

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.