Self-Storage M&A • REIT Earnings • Fed Ahead

U.S. equity markets advanced Monday as investors parsed a soft slate of European economic data ahead of a jam-packed week of newsflow stateside, headline by the Fed's interest rate decision.

The Dow Jones Industrial Average rose for an 11th straight day- its longest winning streak since 2017- while the S&P 500 advanced 0.4% after closing at its highest-levels since April 2022.

Real estate equities were among the leaders today as the busy week of earnings reports began with some M&A developments in the storage space. The Equity REIT Index gained 0.8%.

Public Storage (PSA) gained after it announced a $2.2B deal to acquire Simply Self Storage from Blackstone's (BX) Real Estate Income Trust ("BREIT") for $2.2B - one of a half-dozen portfolio sales by BREIT since late 2022 and the latest example of public REITs capitalizing on Blackstone's struggles to meet withdrawal requests from investors.

Mortgage REIT Dynex Capital (DX) rallied 4% after kicking off mREIT earnings season with a solid report, noting that its Book Value Per Share ("BVPS") increased by 2.9% in Q2 while its comprehensive net income improved to $0.79/share - up from a negative number last quarter and now covering its $0.39/share dividend - driven by hedge gains.

Income Builder Daily Recap

U.S. equity markets advanced Monday as investors parsed a weak slate of PMI data across Europe ahead of a jam-packed week of newsflow stateside, headline by the Federal Reserve's interest rate decision on Wednesday. The Dow Jones Industrial Average rose for an 11th straight day - its longest winning streak since 2017 - while the S&P 500 advanced another 0.4% after closing at its highest-levels since April 2022 last week. Real estate equities were among the leaders today as the busy week of earnings reports began with some M&A developments in the self-storage space. The Equity REIT Index gained 0.8% today, with 13-of-18 property sectors finishing in positive territory, while the Mortgage REIT Index also gained 0.8%. Homebuilders rebounded after a skid last week ahead of earnings results from a half-dozen of the nation's largest builders in the week ahead.

Storage: Public Storage (PSA) gained after it announced a $2.2B deal to acquire Simply Self Storage from Blackstone's (BX) Real Estate Income Trust ("BREIT") for $2.2B - one of a half-dozen portfolio sales by BREIT since late 2022 as it struggles to meet withdrawal requests from investors. The portfolio consists of 127 wholly owned properties and 9M net rentable square feet located across 18 states and in markets, about 65% of which are in Sunbelt markets. We predicted earlier this year that the Simply Storage portfolio - which BREIT acquired in late 2020 - was among the most likely assets that BREIT would sell given its preference to avoid a mark-to-market event by "selling its winners and holding its losers." Four of the six "winners" in BREIT's portfolio are its casino holdings, two of which it has already sold (MGM Grand and Mandalay) and one of which (Bellagio) it is reportedly marketing for sale. The other two "winners" are the Simply Self-Storage portfolio and the GLP Jupier 12 industrial portfolio, which BREIT acquired in 2019.

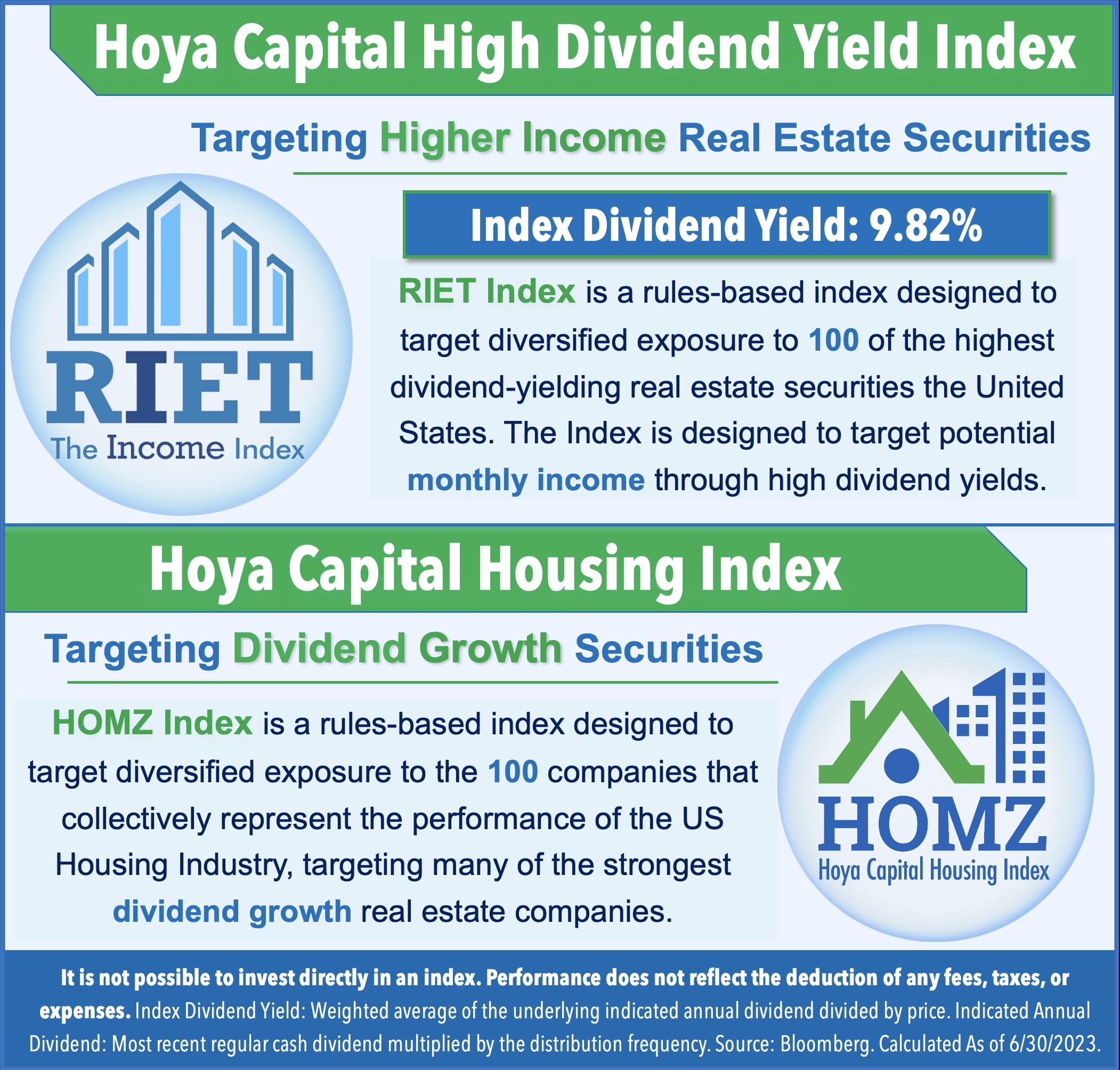

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.