Industrial REITs: We Love Logistics

No slowdown here. After the worst year of performance on record in 2022, Industrial REITs have rebounded this year after earnings results showed a surprising re-strengthening of property-level fundamentals.

Recent earnings results showed that demand continues to substantially outpace available supply. Rent growth reaccelerated in early-2023, with rental spreads averaging over 40%, while occupancy rates climbed to fresh record.

Strengthening rent growth comes despite substantial downward pricing power across other areas of the supply chain. Freight costs are 80% below their 2021 peak, perhaps freeing-up capital for logistics footprints.

The five major industrial REITs raised their full-year guidance, and are on pace to deliver FFO growth that could be double that of the next closest major property sector this year. Supply headwinds remain a near term, but development appetite has chilled given tighter credit conditions.

Sharing similar supply-constrained fundamentals as the single-family housing sector, industrial REITs haven't been "cheap" in a decade, but sector-leading earnings growth justifies their premium multiples and an overweight position in a dividend growth-focused portfolio.

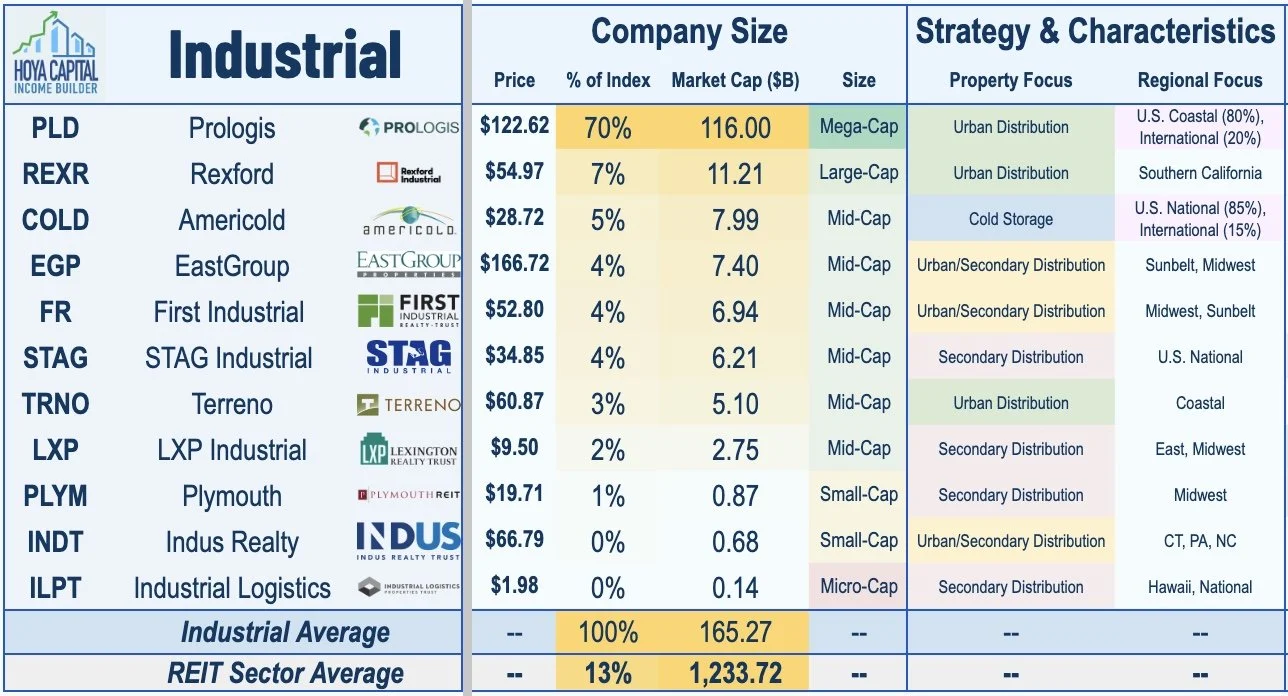

What logistics slowdown? Pressured by global recession concerns and a much-discussed curtailing of logistics spending from e-commerce giant Amazon, Industrial REITs delivered their worst year of performance on record in 2022, but have rebounded this year after earnings results showed a surprising re-strengthening of property-level fundamentals as demand for well-located logistics space continues to substantially outstrip available supply. Led by sector stalwart Prologis (PLD) - one of the five largest publicly-traded REITs in the world - within the Hoya Capital Industrial REIT Index, we track the eleven industrial REITs which total roughly $165 billion in market value.