Soft Landing Doubts • Oil Erases Gains • Data Center Deal

- U.S. equity markets declined for a fourth-day Tuesday following decidedly-negative public commentary from Wall Street analysts and executives, who expressed doubt in the likelihood of a "Soft Landing."

- Following declines of nearly 2% on Monday, the S&P 500 declined another 1.4% today while the tech-heavy Nasdaq 100 dipped 2.1%.

- Real estate equities were among the better performers today. Equity REITs declined 0.9% with 4-of-18 property sectors in positive territory. Mortgage REITs fell 1.8% while Homebuilders declined 1.4%.

- The 10-Year Treasury Yield dipped 9 basis points to close at 3.51% - essentially back to its lowest levels since late September. Crude Oil prices dipped 4% today - erasing its 2022 gains.

- DigitalBridge (DBRG) slid more than 7% today after it announced that it completed its previously announced $11B acquisition of data center operator Switch (SWCH) for $34.25 per share in cash.

Income Builder Daily Recap

U.S. equity markets declined for a fourth-day Tuesday following decidedly-negative public commentary from Wall Street analysts and executives, who generally expressed doubt in the likelihood of a "soft landing." Following declines of nearly 2% on Monday, the S&P 500 dipped another 1.4% today while the tech-heavy Nasdaq 100 fell 2.1%. The Mid-Cap 400 and Small-Cap 600 posted more modest declines today of roughly 1% each. Real estate equities were among the better performers today with the Equity REIT Index finishing off by 0.9% with 4-of-18 property sectors in positive territory. The Mortgage REIT Index declined 1.8% while Homebuilders fell 1.4%.

Gloomy commentary from Wall Street analysts and executives commanded the headlines today on an otherwise quiet day of corporate news and economic data, highlighted by warnings from JP Morgan CEO Jamie Dimon that he sees a potential “mild to hard recession” next year. The 10-Year Treasury Yield dipped 9 basis points to close back at 3.51% - essentially back to its lowest levels since late September. Crude Oil prices dipped another 4% today to erase their gains for the year - a dramatic reversal for the commodity that was higher by more than 60% on the year back in June. Ten of the eleven GICS equity sectors were lower on the day with Utilities (XLU) stocks leading on the upside while Communications (XLC) stocks dragged on the downside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

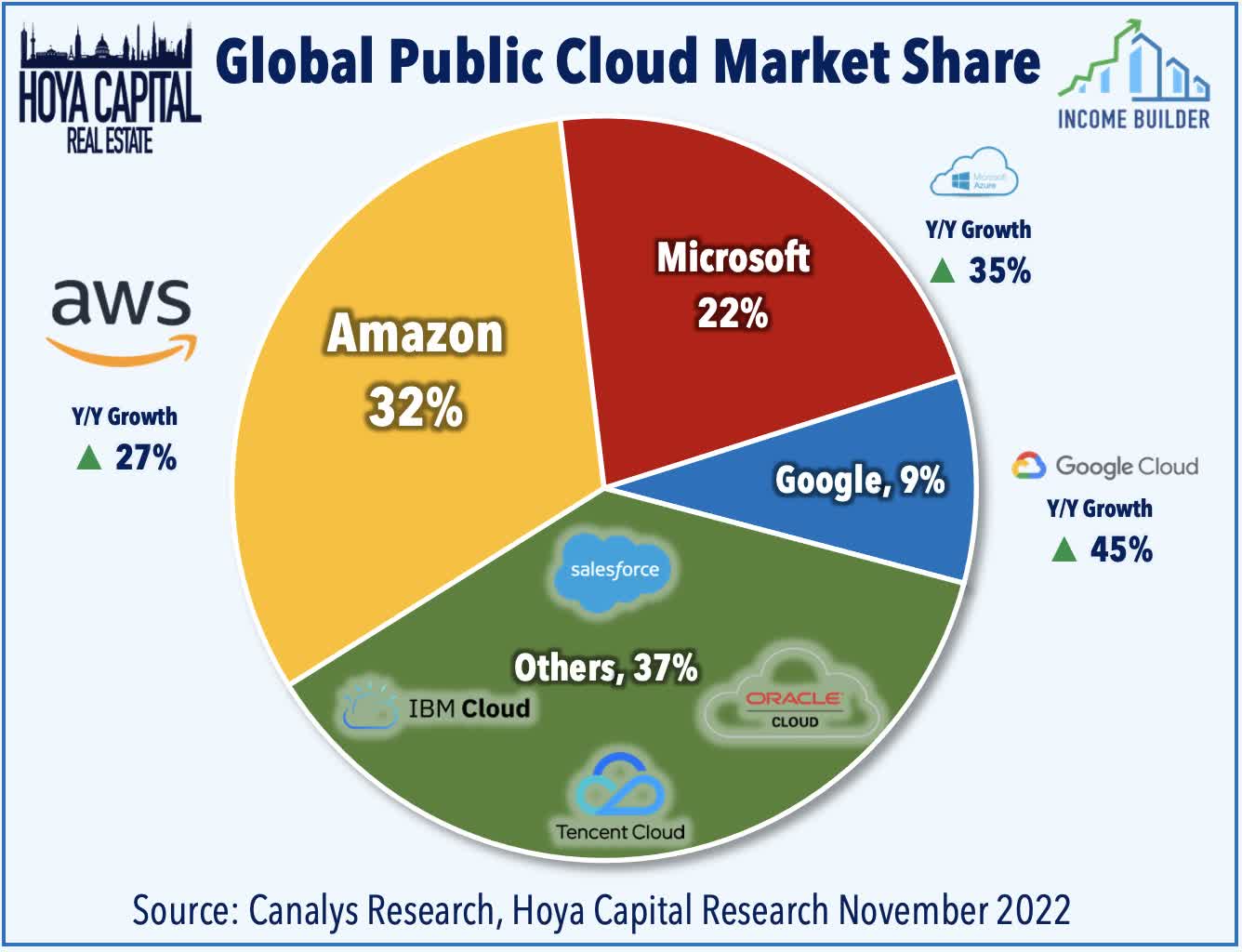

Data Center: DigitalBridge (DBRG) slid more than 7% today after it announced that it completed its previously announced $11B acquisition of data center operator Switch (SWCH) for $34.25 per share in cash. Switch - which had planned to convert to a REIT in 2023 prior to the DBRG acquisition - is no longer listed for trading. On Monday we published Data Center REITs: Patience Pays Off which discussed why Equinix (EQIX) and Digital Realty (DLR) are now positioned to be aggressors in the M&A space as other more-highly-levered private players seek an exit. Ironically, just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from hyperscalers, rental rate trends have meaningfully improved. Competition from the hyperscale giants– Amazon, Microsoft, Google– has been a well-established risk. With negotiating power tilting back towards landlords, there appears to be enough economic value to be shared.

Single-Family Rentals: This evening, we'll publish an updated report on the single-family rental REIT sector on the Income Builder Marketplace which will discuss our updated sector outlook and recent portfolio allocations. SFR REITs have uncharacteristically lagged this year - dipping by more than 30% in 2022 - pressured by stiff headwinds across the housing industry from the historic surge in mortgage rates this year. While residential rent growth has indeed moderated over the past quarter from the record double-digit levels seen earlier this year, we believe that the recently gloomy narrative on SFR REITs is particularly unwarranted given the still-favorable longer-term supply/demand dynamics in the single-family sector. Our newly-developed Own vs. Rent Index shows that the scales have tilted dramatically towards rental markets as the more affordable option as rental rate increases substantially lagged home price appreciation over the pasts several years. Cooling home price appreciation and tightening credit conditions have prompted many smaller SFR investors to pull back, providing a more favorable external growth environment for SFR REITs.

Additional Daily REITBeat Headlines Available on Income Builder

- Moody’s assigned Apartment Income (AIRC) a first-time “Baa2” issuer rating to its operating subsidiary, Apartment Income REIT, L.P. plus assigned shelf ratings of “Baa2” to its senior unsecured debt shelf and “Baa3” to its subordinated debt shelf with a stable outlook

- Americold (COLD) announced that it has entered into an interest rate swap on the remaining $175 million of the $375 million U.S. dollar term loan A-1 facility and based on its current credit ratings, the total fixed interest rate is 4.52% whereby the swap is effective as of November 30, 2022, and it matures July 30, 2027.

- SL Green (SLG) was downgraded by BMO to Market Perform from Outperform (lower price target by $6 to $41)

- SL Green (SLG) was downgraded by Scotiabank to Sector Underperform from Sector Perform (lower price target by $9 to $34)

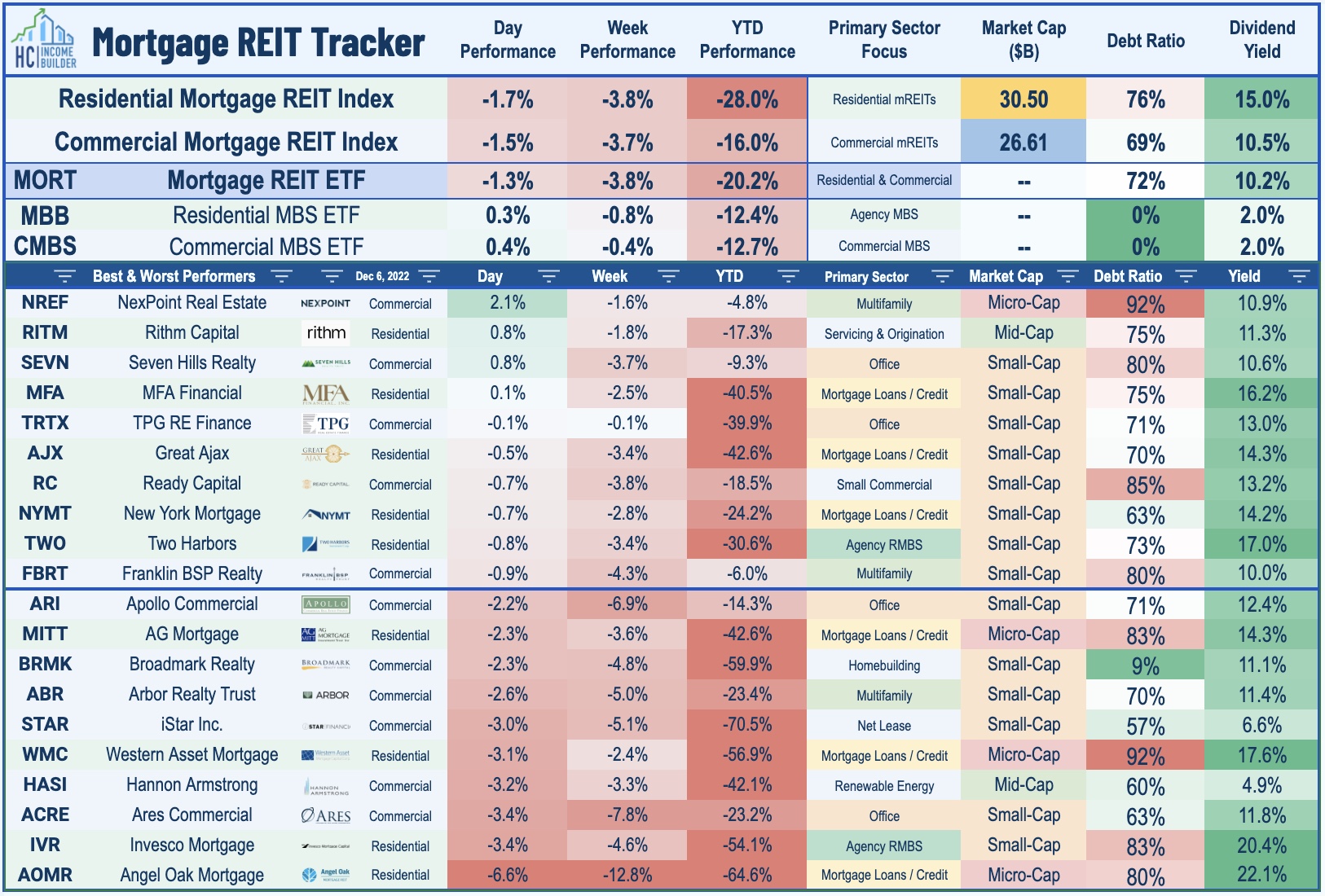

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were also lower today with residential mREITs slipping 1.7% while commercial mREITs declined 1.5%. Last week, we published Mortgage REITs: High Yields Are Fine, For Now. Mortgage REITs - which were left for dead amid a historically brutal year across fixed-income markets - have rebounded in recent weeks as earnings results were not as catastrophic as feared. Mortgage REITs are now outperforming Equity REITs for the year, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio.

Economic Data This Week

The economic calendar slows down a bit in the week, headlined by the Producer Price Index on Friday which investors - and the Fed - are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline PPI is expected to moderate to a 7.2% year-over-year rate while the Core PPI is expected to decelerate slightly to 5.9%. On Friday, we'll also get our first look at Michigan Consumer Sentiment for December. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations. We'll also see a handful of Purchasing Managers Index ("PMI") reports throughout the week from S&P Global and the Institute for Supply Management. Both of these major surveys posted readings below the breakeven-50 level in their preliminary November data.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.