Yields Retreat • Storage Speculation • Mortgage Payout Cut

- U.S. equity markets rallied Friday - helping the benchmarks snap a three-week losing skid- after less-hawkish comments from several Fed officials and PMI data showing encouraging downward trends in price pressures.

- Lifting its weekly gains to around 2%, S&P 500 rallied by 1.6% today while the tech-heavy Nasdaq 100 gained more than 2% and the Dow added 387 points.

- Real estate equities were among the leaders today as benchmark interest rates retreated from four-month highs. The Equity REIT Index gained 1.5% today with 17-of-18 property sectors in positive territory.

- Life Storage (LSI) rallied more than 2% today on speculation that the cancellation of its appearance at Citi's annual property CEO conference next week may indicate that it's getting closer to a deal with Public Storage (PSA) after rejecting its earlier acquisition proposal.

- Mortgage REIT Great Ajax (AJX) dipped more than 7% after it became the fifth REIT to reduce its dividend this year, trimming its distribution by 7% to $0.25/share, representing a dividend yield of roughly 12% at the reduced rate.

Income Builder Daily Recap

U.S. equity markets rallied Friday - helping the benchmarks snap a three-week losing skid - after less-hawkish comments from several Fed officials and PMI data showing encouraging downward trends in price pressures. Lifting its weekly gains to around 2%, S&P 500 rallied by 1.6% today while the tech-heavy Nasdaq 100 gained more than 2%. Real estate equities were among the leaders today as benchmark interest rates retreated from four-month highs. The Equity REIT Index gained 1.5% today with 17-of-18 property sectors in positive territory while the Mortgage REIT Index advanced 1.7%. Homebuilders rebounded on data from Redfin showing encouraging demand trends despite the recent rebound in mortgage rates, with its Homebuyer Demand Index climbing to the highest level since September.

Bonds caught a bid as investors interpreted comments from Fed official Bostic to be somewhat dovish while also seeing some encouraging signs of cooling price pressures in the ISM Services PMI data this morning, which recorded a two-year low in its Prices Paid Index. Retreating from four-month highs yesterday, the 10-Year Treasury Yield dipped 11 basis points today to close at 3.96%, while the 2-Year Treasury Yield retreated from its highest level since 2007. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Storage: Life Storage (LSI) - which we own in the REIT Dividend Growth Portfolio - rallied more than 2% today on speculation that the cancellation of its appearance at Citi's annual property CEO conference next week may indicate that it's getting closer to a deal with Public Storage (PSA), which last month proposed an all-stock $11B acquisition of LSI at an implied valuation of roughly $128/share based on today's closing prices, which was rejected by LSI citing "undervaluation." Earlier this week in Winners of REIT Earnings Season, we noted that storage REITs have been the top-performing sector of earnings season after earnings results quieted critics forecasting a dismal year of declining rents and oversupply headwinds. The largest storage REITs easily topped their prior FFO and NOI guidance and provided an initial 2023 outlook calling for mid-single-digit earnings growth, buoyed by "sticky" rent growth on existing tenants. Life Storage reported sector-leading FFO growth of 28.4% in 2022 and sees another 5.2% growth at the midpoint of its 2023 outlook and provided a preliminary outlook for 2024 as well, noting that it expects "low double-digit FFO per share growth in 2024, with a midpoint of 11%."

Yesterday we published Losers of REIT Earnings Season, Part 2 of our Earnings Recap which focused on the worst-performing property sectors and common threads shared by these laggards. While there were upside standouts and impressive reports within these lagging property sectors, the losers of REIT earnings season included: Office, Technology, Net Lease, Regional Malls, Healthcare, and Specialty REITs. A significant rise in interest rate expense was the common thread seen across many of these sectors - nearly all of which are among the more highly-levered property sectors. International headwinds were also a theme for several property sectors - notably technology REITs - REITs as FX impacts from the rebound in the U.S. dollar and the renewed geopolitical tensions have hit these sectors particularly hard.

Additional Headlines from The Daily REITBeat on Income Builder

- LTC Properties (LTC) sold two skilled nursing centers in New Mexico totaling 235 beds for total proceeds of $20.8M which will be used to pay down variable rate debt.

- In an 8-K filing, Corporate Office (OFC) announced that Todd W. Hartman has resigned from his position as Executive Vice President and Chief Operating Officer

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today, with residential mREITs gaining 0.6% while commercial mREITs rallied 1.8%. Great Ajax (AJX) dipped more than 7% after it became the fifth REIT to reduce its dividend this year, trimming its distribution by 7% to $0.25/share, representing a dividend yield of roughly 12% at the reduced rate. AJX noted that its Book Value Per Share ("BVPS") declined 5.5% for the quarter to $13.00 - among the weakest in the sector this earnings season. Western Asset (WMC) gained about 1% after it reported that its BVPS declined about 3% to $15.70 in Q4 and recorded distributable earnings of $0.33/share - shy of its $0.40/share dividend. ACRES Commercial (ACR) finished lower by 1% after it reported that its BVPS declined about 2% in Q4 to $24.54 on earnings available for distribution of $0.60. ACR is the only mREIT that does not currently pay a dividend.

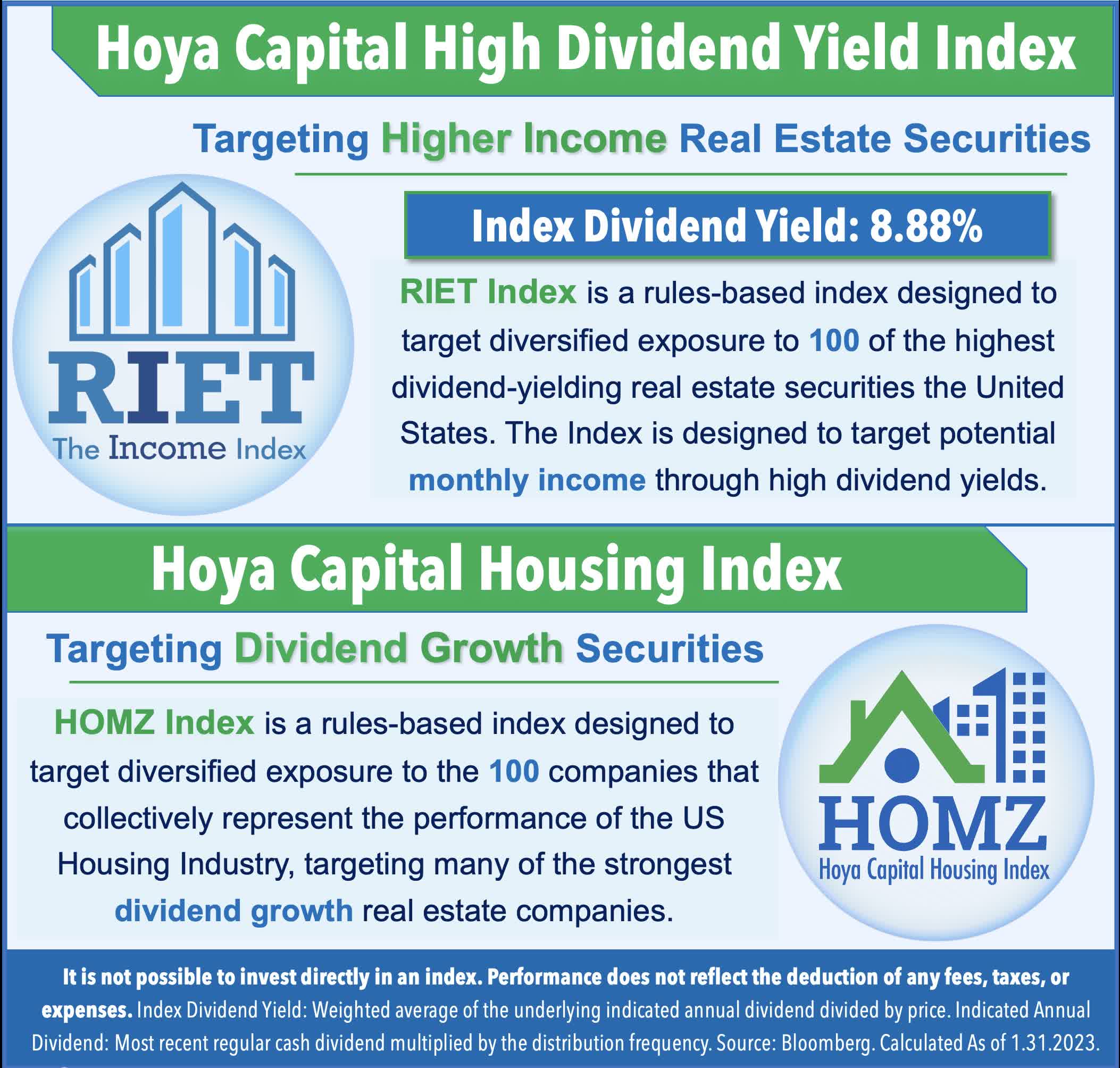

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.