Office Distress • Senior Housing Strength • Stocks Rebound

- U.S. equity markets rebounded Thursday despite a continued march higher in interest rates as investors parsed commentary from several Fed officials and stubbornly resilient employment and wage data.

- Rebounding from six-week lows and trimming its week-to-date declines to around 2%, the S&P 500 rebounded by 0.8% today while the Dow gained 342 points.

- Real estate equities rebounded today despite the interest rate headwinds as earnings season wrapped-up. The Equity REIT Index gained 1.2% today with 15-of-18 property sectors in positive territory.

- Diversified Healthcare (DHC) - which plunged nearly 80% last year - soared 60% today after reporting solid fourth-quarter results driven by a recovery in its Senior Housing Operating ("SHOP") portfolio.

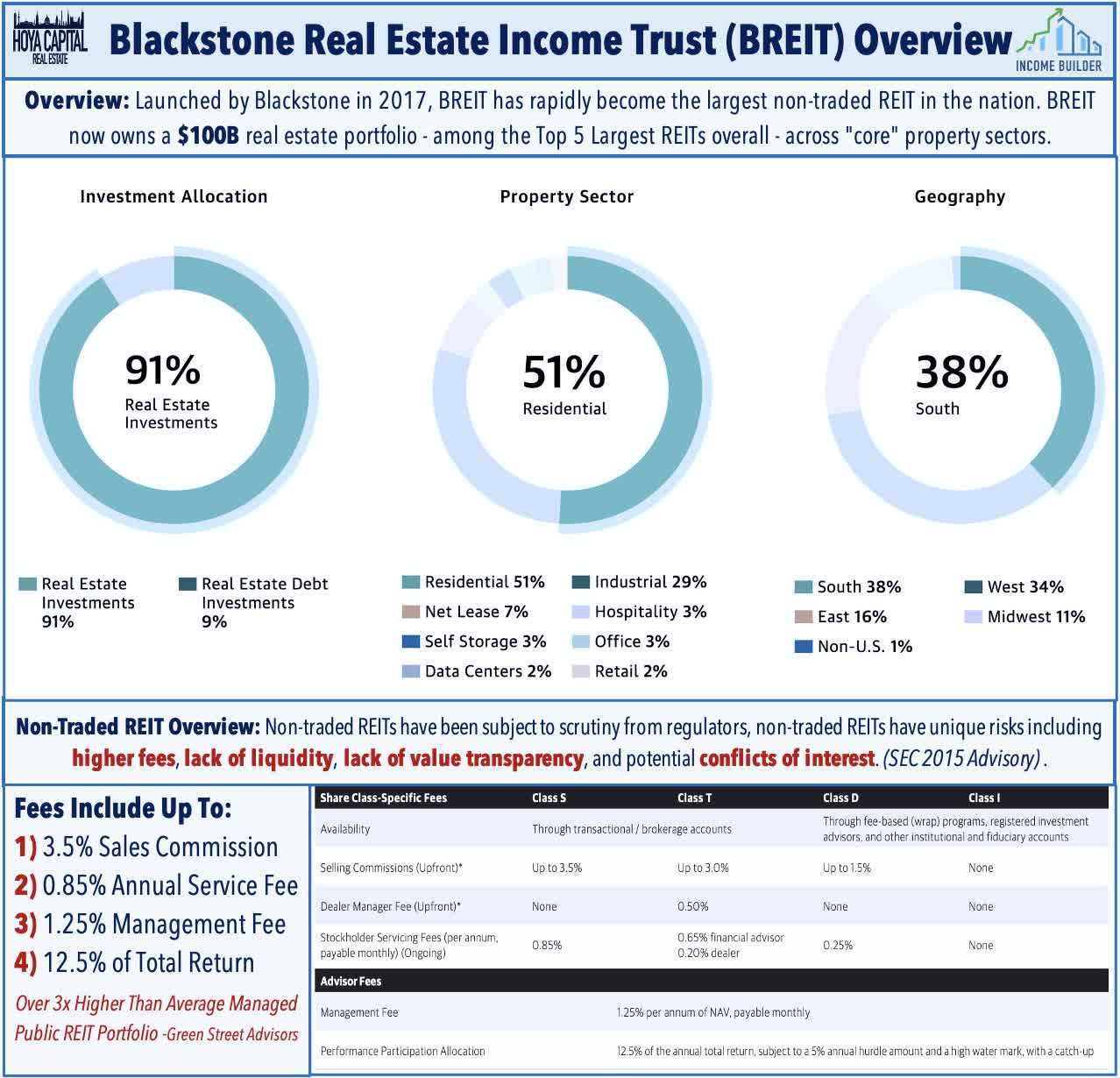

- Asset manager Blackstone (BX) was again in focus on reports that it defaulted on a half-billion-dollar loan on European office properties. The day prior, its flagship privately-traded fund BREIT announced that it limited investor redemptions for a fourth straight month.

Income Builder Daily Recap

U.S. equity markets rebounded Thursday despite a continued march higher in interest rates as investors parsed commentary from several Fed officials and stubbornly resilient employment and wage data. Rebounding from six-week lows and trimming its week-to-date declines to around 2%, the S&P 500 rebounded by 0.8% today while the Dow gained 342 points. Lifted by strong jobless claims data and negative revisions to fourth-quarter productivity data, the 10-Year Treasury Yield climbed another 8 basis points to close at 4.07% today - its highest since November - while the 2-Year Treasury Yield climbed to the highest since 2007. Real estate equities rebounded today despite the interest rate headwinds as earnings season wrapped-up. The Equity REIT Index gained 1.2% today with 15-of-18 property sectors in positive territory while the Mortgage REIT Index declined 0.5%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Today we published Losers of REIT Earnings Season. After covering the Winners of REIT Earnings Season earlier this week, Part 2 of our Earnings Recap focused on the worst-performing property sectors and common threads shared by these laggards. While there were upside standouts and impressive reports within these lagging property sectors, the losers of REIT earnings season included: Office, Technology, Net Lease, Regional Malls, Healthcare, and Specialty REITs. A significant rise in interest rate expense was the common thread seen across many of these sectors - nearly all of which are among the more highly-levered property sectors. International headwinds were also a theme for several property sectors - notably technology REITs - REITs as FX impacts from the rebound in the U.S. dollar and the renewed geopolitical tensions have hit these sectors particularly hard.

Office: These trends were on full display in the office sector, where REIT results weren't particularly awful, but it has been the dismal news flow in the private markets of major loan defaults that have dominated the discussion, including another mega-size loan default on an office property this week from Blackstone (BX), which defaulted on a €531 million ($562 million) bond backed by a portfolio of Finnish offices and retail properties. Over the past two weeks, we've seen a handful of these mega-sized loan defaults in the private markets from Pimco, Brookfield, and RXR - where variable rate mortgage debt - and a lot of it - was the common thread across these defaults. The concerning news from BX comes a day after its flagship privately-traded real estate fund - Real Estate Income Trust - announced that it hit its monthly redemption limit, yet again in February, fulfilling just a third of the funds that were requested by investors. February marked the fourth straight month that BREIT hit its redemption limit, which is capped at 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter.

Healthcare: Diversified Healthcare (DHC) - which plunged nearly 80% last year - soared 60% today after reporting decent fourth-quarter results driven by a recovery in its Senior Housing Operating ("SHOP") portfolio, extending its year-to-date gains to well over 100%. This year's rally for DHC - which is externally advised by RMR Group (RMR) - has been fueled in part by the announced acquisition of DHC's largest tenant - AlerisLife (ALR) - by ABP Acquisition, an affiliate of RMR Group for an 85% premium to its prior close. DHC owns a 32% state in ALR and agreed to tender its shares in a tender offer. Even with this year's surge, however, DHC's stock price remains 50% lower than it was at the start of last year, weighed down by its weak balance sheet and significant rise in interest expense. Property-level fundamentals have improved considerably in recent quarters, however, consistent with results and commentary earlier this earnings season from Welltower (WELL) and Ventas (VTR). DHC noted that it was able to raise monthly rents by nearly 9% over the prior year while simultaneously improving occupancy by 380 basis points, driving a 14.2% increase in revenues.

Single-Family Rental: Tricon Residential (TCN) was little-changed today after reporting mixed results, noting that its full-year FFO increased by 33% in 2022 - consistent with its prior outlook - but provided guidance that calls for a reversal of all of that gain for full-year 2023 due to significantly higher interest rate expenses resulting from its heavy variable rate debt exposure. Consistent with results from Invitation Homes (INVH) and American Homes (AMH), property level fundamentals remained very strong in late 2022 and into early 2023, highlighted by blended rent growth of 7.4% in Q4 and 7.3% in early Q1, which is expected to drive a nearly 7% increase in same-store NOI growth for 2023, well above the 4.5% expected rate of its two larger peers. TCN noted that 29% of its debt is floating-rate - among the highest in the REIT space - driven in large part by its aggressive acquisition strategy that was financed primarily with short-term variable rate debt. Acquisition activity is expected to slow significantly from its 2022 haul of 7,227 home purchases to a range between 2,000-4,000 in 2023.

Hotels: Sotherly Hotels (SOHO) rallied after reporting solid fourth-quarter results driven by "sustained strength for leisure travel, coupled with growing demand for group and business travel" and providing an upbeat outlook for 2023. SOHO reported that its Revenue Per Available Room ("RevPAR") recovered to within 0.5% of pre-pandemic 2019 levels in Q4 despite some weather-related impacts in November, and expects similar relative performance in Q1. One of the best-performing REITs this year, SOHO's rebound was driven by the reinstatement of its preferred dividends, which had been suspended since the pandemic. SOHO noted that it plans to repay the accrued cumulative preferred dividends through "periodic special dividends, as is warranted by market conditions and the company's profitability." SOHO must repay all $23M in accrued preferred dividends before resuming common dividends but noted that it is "looking for opportunities to raise capital that could accelerate the repayment." Recent TSA Checkpoint data shows relatively strong demand trends in early 2023 with both January and February exceeding pre-pandemic throughput levels.

Additional Headlines from The Daily REITBeat on Income Builder

- Simon Property (SPG) priced $650 million of 5.5% notes due 2033 and $650 million of 5.85% notes due 2053 and intends to use net proceeds to pay down variable rate debt.

- Invitation Homes (INVH) announced the promotion of Charles Young to President and Chief Operating Officer (COO) while Dallas Tanner will continue in the role of Chief Executive Officer (CEO)

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today, with residential mREITs slipping 0.2% while commercial mREITs declined 0.1%. BrightSpire (BRSP) rebounded today after dipping sharply earlier this week on news that DigitalBridge (DBRG) -the former external adviser to Brightspire before its internalization - will sell the majority of its ownership - 30,358,213 shares - in BRSP. We still have another week to go in mREIT earnings season, and we'll hear results this afternoon from a trio of mREITs - Western Asset (WMC), Great Ajax (AJX), and ACRES Commercial (ACR).

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.